Form ST 101 New York State and Local Annual Sales and Use Tax Return Revised 223 2023

Understanding the 2023 ST 101 Tax Form

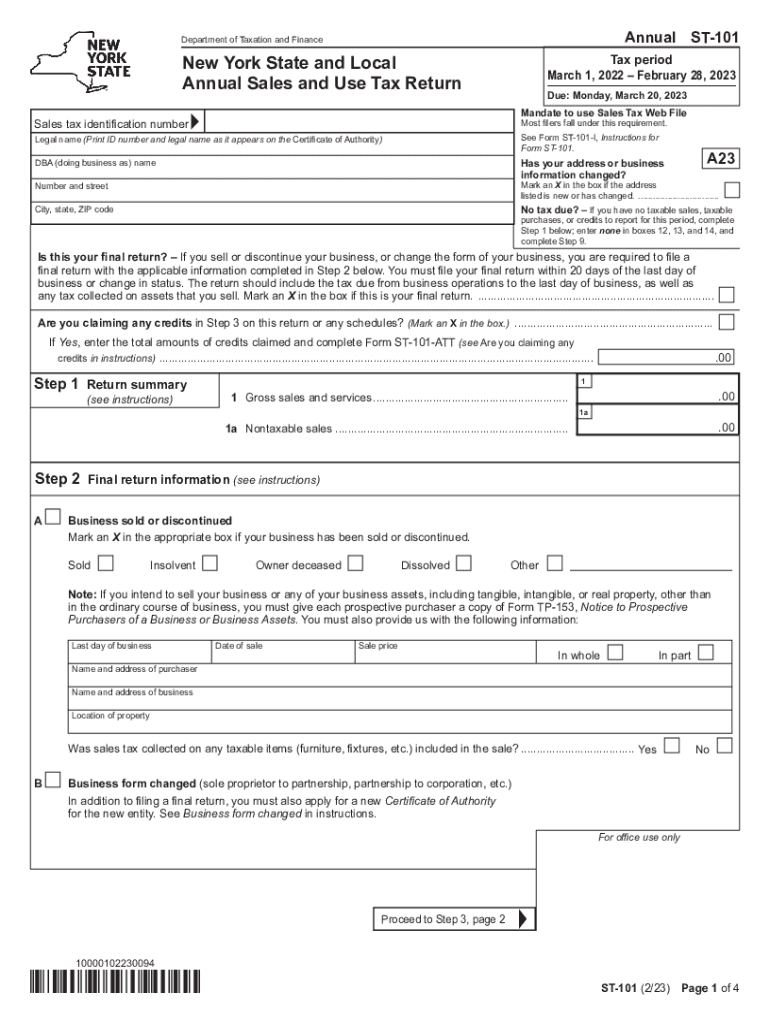

The 2023 ST 101 is a crucial document for businesses operating in New York State, specifically designed for reporting state and local annual sales and use tax. This form is utilized by various entities, including sole proprietors, partnerships, and corporations, to accurately declare their taxable sales and calculate the taxes owed. The ST 101 form helps ensure compliance with New York’s tax regulations and provides a clear record of sales transactions for both the business and tax authorities.

Steps to Complete the 2023 ST 101 Tax Form

Completing the 2023 ST 101 requires careful attention to detail. Here are the essential steps:

- Gather Documentation: Collect all relevant sales records, receipts, and previous tax returns to ensure accurate reporting.

- Fill Out Business Information: Include your business name, address, and identification number at the top of the form.

- Report Sales Figures: Accurately report total sales, exempt sales, and any other applicable figures in the designated sections.

- Calculate Tax Liability: Use the provided tax rates to determine the total amount of sales tax owed based on your reported sales.

- Review and Sign: Double-check all entries for accuracy before signing and dating the form.

Obtaining the 2023 ST 101 Tax Form

The 2023 ST 101 form can be easily obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing businesses to print and fill it out manually. Additionally, businesses may also request a physical copy by contacting the department directly. Ensure you are using the most current version of the form to comply with the latest tax regulations.

Key Elements of the 2023 ST 101 Tax Form

The 2023 ST 101 includes several key sections that are vital for accurate reporting:

- Business Information: This section captures essential details about the business, including its legal structure and contact information.

- Sales Reporting: Businesses must report total sales, exempt sales, and any deductions applicable under New York tax law.

- Tax Calculation: This part outlines how to calculate the total tax due based on reported sales and applicable rates.

- Signature Area: The form requires a signature to certify that the information provided is accurate and complete.

Filing Deadlines for the 2023 ST 101 Tax Form

Timely filing of the 2023 ST 101 is essential to avoid penalties. The due date for submitting this form is typically the last day of the month following the end of the tax year. For most businesses, this means the form is due by January thirty-first of the following year. It is important to stay informed about any changes to deadlines that may occur due to legislative updates.

Penalties for Non-Compliance with the 2023 ST 101

Failure to file the 2023 ST 101 on time or inaccuracies in reporting can lead to significant penalties. These may include fines based on the amount of tax owed and interest on any unpaid taxes. Additionally, repeated non-compliance can result in more severe consequences, including audits and further legal action. To mitigate these risks, businesses should ensure accurate and timely submissions of their tax forms.

Quick guide on how to complete form st 101 new york state and local annual sales and use tax return revised 223

Effortlessly prepare Form ST 101 New York State And Local Annual Sales And Use Tax Return Revised 223 on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Handle Form ST 101 New York State And Local Annual Sales And Use Tax Return Revised 223 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest method to modify and eSign Form ST 101 New York State And Local Annual Sales And Use Tax Return Revised 223 with ease

- Locate Form ST 101 New York State And Local Annual Sales And Use Tax Return Revised 223 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Form ST 101 New York State And Local Annual Sales And Use Tax Return Revised 223 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 101 new york state and local annual sales and use tax return revised 223

Create this form in 5 minutes!

How to create an eSignature for the form st 101 new york state and local annual sales and use tax return revised 223

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 st 101 and how does it relate to airSlate SignNow?

The 2023 st 101 refers to a specific document or form that airSlate SignNow can help you efficiently manage through electronic signatures. With airSlate SignNow, you can easily create, send, and eSign the 2023 st 101, streamlining your document workflow and enhancing compliance.

-

What are the key features of airSlate SignNow for managing the 2023 st 101?

AirSlate SignNow offers several features tailored for the 2023 st 101, such as customizable templates, real-time tracking, and secure eSigning. These features ensure a seamless process for both senders and recipients, allowing for faster and more secure completion of essential documents.

-

How can I integrate airSlate SignNow with other tools for the 2023 st 101?

AirSlate SignNow integrates effortlessly with various applications like Google Drive, Salesforce, and Dropbox, making it easier to manage your 2023 st 101 alongside other tools. This integration allows you to access, send, and store your documents in one unified platform, optimizing your workflow.

-

Is there a cost associated with using airSlate SignNow for the 2023 st 101?

Yes, airSlate SignNow offers pricing plans that cater to different business needs. By choosing the right plan, you can effectively utilize the platform for managing the 2023 st 101 while benefiting from competitive pricing and a cost-effective solution for your eSigning requirements.

-

What are the benefits of using airSlate SignNow for the 2023 st 101?

Using airSlate SignNow for the 2023 st 101 increases efficiency and accelerates the signing process. This platform not only reduces paper usage but also enhances security and compliance, making it a reliable choice for businesses looking to streamline their document workflows.

-

Can airSlate SignNow help with compliance when submitting the 2023 st 101?

Absolutely! AirSlate SignNow provides features that ensure compliance with legal standards when handling the 2023 st 101. The platform's audit trails and secure storage options help maintain the integrity and security of your signed documents.

-

How user-friendly is airSlate SignNow for new users handling the 2023 st 101?

AirSlate SignNow is designed with user experience in mind, making it very accessible even for those new to eSigning or the 2023 st 101. With its intuitive interface and helpful resources, users can quickly learn to navigate the platform and manage their documents efficiently.

Get more for Form ST 101 New York State And Local Annual Sales And Use Tax Return Revised 223

- Fillable bar016 barber shop permit applicationpub form

- Pest control notice sample letter form

- Contractor name change form

- Virginia business license application city form

- City of alexandria 2018 business license application form

- Va va0088676 form sheet pdf

- Virginia department of charitable gaming form 201

- Vt fpr c 101 form

Find out other Form ST 101 New York State And Local Annual Sales And Use Tax Return Revised 223

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney