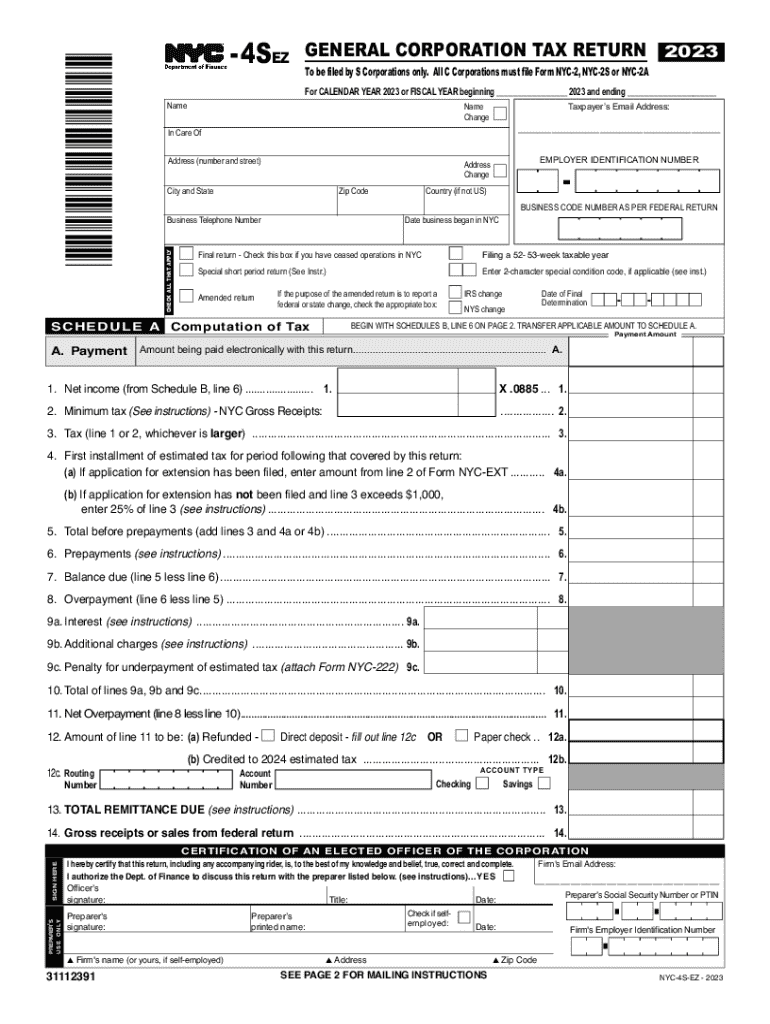

New York City General Corporate Tax Return 1120 2023

Understanding the NYC General Corporate Tax Return 1120

The NYC General Corporate Tax Return 1120 is a tax form that corporations operating in New York City must file annually. This form is essential for reporting income, calculating tax liability, and ensuring compliance with local tax regulations. It is specifically designed for C corporations, which are taxed separately from their owners. Understanding this form is crucial for businesses to maintain their tax obligations and avoid penalties.

Steps to Complete the NYC General Corporate Tax Return 1120

Completing the NYC General Corporate Tax Return 1120 involves several steps. First, gather all necessary financial documents, such as income statements and balance sheets. Next, accurately fill out the form, ensuring that all income, deductions, and credits are reported correctly. After completing the form, review it for accuracy before submission. It is advisable to keep copies of all submitted documents for your records.

Filing Deadlines for the NYC General Corporate Tax Return 1120

Corporations must adhere to specific deadlines when filing the NYC General Corporate Tax Return 1120. Typically, the return is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the return is due on April 15. Late submissions may incur penalties, so it is essential to be aware of these deadlines.

Required Documents for the NYC General Corporate Tax Return 1120

To successfully file the NYC General Corporate Tax Return 1120, several documents are required. These include:

- Income statement detailing revenue and expenses

- Balance sheet showing assets, liabilities, and equity

- Supporting documentation for any deductions or credits claimed

- Previous year’s tax return for reference

Having these documents organized and readily available will facilitate a smoother filing process.

Legal Use of the NYC General Corporate Tax Return 1120

The legal use of the NYC General Corporate Tax Return 1120 is primarily for tax compliance. Corporations are required by law to file this return to report their income and calculate their tax obligations. Failure to file or inaccuracies in the return can lead to legal penalties, including fines and interest on unpaid taxes. Thus, understanding the legal implications of this form is vital for corporate governance.

Form Submission Methods for the NYC General Corporate Tax Return 1120

Corporations have several options for submitting the NYC General Corporate Tax Return 1120. The form can be filed online through the NYC Department of Finance website, mailed directly to the appropriate tax authority, or submitted in person at designated locations. Each method has its own processing times and requirements, so it is important to choose the most suitable option for your business.

Create this form in 5 minutes or less

Find and fill out the correct new york city general corporate tax return 1120

Create this form in 5 minutes!

How to create an eSignature for the new york city general corporate tax return 1120

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nyc 4s ez feature in airSlate SignNow?

The nyc 4s ez feature in airSlate SignNow allows users to streamline their document signing process with ease. This feature is designed to enhance user experience by providing a simple interface for sending and signing documents quickly. With nyc 4s ez, businesses can improve their workflow efficiency.

-

How much does airSlate SignNow cost for the nyc 4s ez plan?

The pricing for the nyc 4s ez plan in airSlate SignNow is competitive and designed to fit various business budgets. Users can choose from different subscription tiers based on their needs, ensuring they only pay for the features they require. This cost-effective solution helps businesses save money while enhancing their document management.

-

What are the key benefits of using airSlate SignNow's nyc 4s ez?

Using airSlate SignNow's nyc 4s ez offers numerous benefits, including increased efficiency and reduced turnaround time for document signing. The intuitive interface makes it easy for users to navigate and manage their documents. Additionally, businesses can enhance their customer experience by providing a seamless signing process.

-

Can I integrate airSlate SignNow with other tools while using nyc 4s ez?

Yes, airSlate SignNow's nyc 4s ez can be integrated with various third-party applications to enhance functionality. This includes popular tools like CRM systems, project management software, and cloud storage services. These integrations help streamline workflows and improve overall productivity.

-

Is the nyc 4s ez feature secure for sensitive documents?

Absolutely! The nyc 4s ez feature in airSlate SignNow prioritizes security, ensuring that all documents are encrypted and stored safely. Users can trust that their sensitive information is protected throughout the signing process. Compliance with industry standards further enhances the security of your documents.

-

How does airSlate SignNow's nyc 4s ez improve collaboration?

The nyc 4s ez feature in airSlate SignNow enhances collaboration by allowing multiple users to sign and comment on documents in real-time. This fosters better communication among team members and stakeholders. With easy access to documents, collaboration becomes more efficient and effective.

-

What types of documents can I send using nyc 4s ez?

With airSlate SignNow's nyc 4s ez, you can send a wide variety of documents, including contracts, agreements, and forms. The platform supports various file formats, making it versatile for different business needs. This flexibility allows users to manage all their document signing requirements in one place.

Get more for New York City General Corporate Tax Return 1120

Find out other New York City General Corporate Tax Return 1120

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed