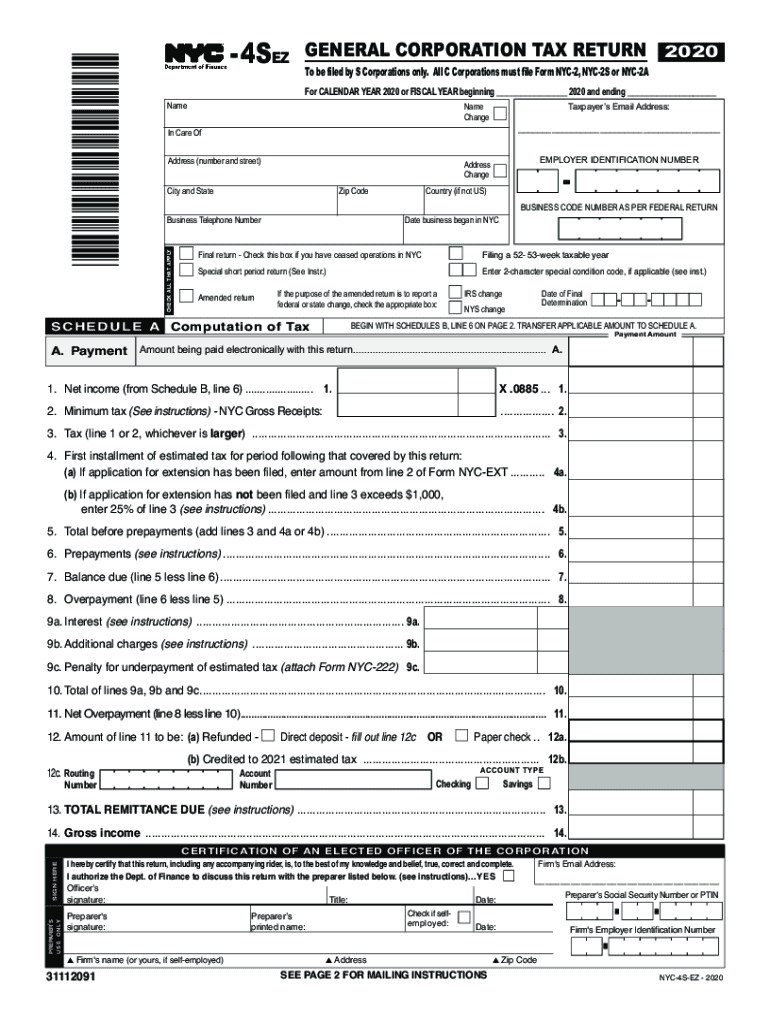

GENERAL CORPORATION TAX RETURN 2020

What is the General Corporation Tax Return?

The General Corporation Tax Return is a crucial document for corporations operating in New York City. It is used to report the income, deductions, and tax liability of corporations doing business within the city. This form is essential for ensuring compliance with local tax laws and regulations. Corporations must accurately complete this return to determine their tax obligations based on their net income.

Steps to Complete the General Corporation Tax Return

Completing the General Corporation Tax Return involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Calculate total income and allowable deductions to determine net income.

- Fill out the General Corporation Tax Return form, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines when filing the General Corporation Tax Return. Typically, the return is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For most corporations operating on a calendar year, this means the return is due on April fifteenth. Late submissions may incur penalties and interest, emphasizing the importance of timely filing.

Required Documents

To complete the General Corporation Tax Return, certain documents are necessary:

- Financial statements, including income statements and balance sheets.

- Records of all income earned and expenses incurred during the tax year.

- Documentation supporting any deductions claimed, such as receipts and invoices.

- Previous year’s tax return for reference and consistency.

Legal Use of the General Corporation Tax Return

The General Corporation Tax Return serves a legal purpose by ensuring that corporations comply with New York City tax laws. Accurate reporting is essential, as failure to file or incorrect filings can lead to significant penalties. This form is also used by the city to assess the overall financial health of corporations operating within its jurisdiction, contributing to local economic planning and development.

Who Issues the Form

The General Corporation Tax Return is issued by the New York City Department of Finance. This department oversees the collection of taxes and ensures compliance with local tax regulations. Corporations can obtain the form directly from the Department of Finance’s website or through their local tax office.

Quick guide on how to complete general corporation tax return 2020

Complete GENERAL CORPORATION TAX RETURN effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Handle GENERAL CORPORATION TAX RETURN on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign GENERAL CORPORATION TAX RETURN with ease

- Obtain GENERAL CORPORATION TAX RETURN and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign GENERAL CORPORATION TAX RETURN and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct general corporation tax return 2020

Create this form in 5 minutes!

How to create an eSignature for the general corporation tax return 2020

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the 'nyc 3l 2019' certification and how can it benefit my business?

The 'nyc 3l 2019' certification pertains to a legal requirement that ensures adherence to local regulations. By utilizing airSlate SignNow, businesses can effectively manage documents that meet the 'nyc 3l 2019' standards, enhancing compliance and trust with clients.

-

How does airSlate SignNow handle document security for 'nyc 3l 2019' submissions?

AirSlate SignNow prioritizes document security by utilizing advanced encryption methods and secure cloud storage. This ensures that all documents associated with 'nyc 3l 2019' submissions are protected from unauthorized access, giving users peace of mind.

-

What pricing plans are available for airSlate SignNow targeting 'nyc 3l 2019' functionalities?

AirSlate SignNow offers flexible pricing plans designed to cater to various business needs, including specific options for users focusing on 'nyc 3l 2019' requirements. You can choose from monthly or annual subscriptions that provide essential features for efficient document management.

-

Can I integrate airSlate SignNow with other software for 'nyc 3l 2019' processes?

Yes, airSlate SignNow seamlessly integrates with multiple software solutions, enhancing its utility for 'nyc 3l 2019' processes. Whether you use CRM, project management, or accounting tools, our platform helps streamline workflows and improve productivity.

-

What features does airSlate SignNow offer that support 'nyc 3l 2019' compliance?

AirSlate SignNow includes features like customizable templates, advanced eSignature options, and workflow automation that directly support 'nyc 3l 2019' compliance. These tools streamline document management and help ensure all required standards are met.

-

How can airSlate SignNow improve the efficiency of handling 'nyc 3l 2019' documents?

By using airSlate SignNow, businesses can reduce the turnaround time for 'nyc 3l 2019' documents through automated workflows and instant eSigning. This boosts overall efficiency, allowing teams to focus on other critical tasks.

-

Is training available for using airSlate SignNow with 'nyc 3l 2019' documents?

Absolutely! AirSlate SignNow provides comprehensive training resources and customer support to help you efficiently manage 'nyc 3l 2019' documents. This ensures that all users can fully leverage the platform's capabilities.

Get more for GENERAL CORPORATION TAX RETURN

Find out other GENERAL CORPORATION TAX RETURN

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF