TM 2 BUSINESS CORPORATION TAX RETURN Department of 2019

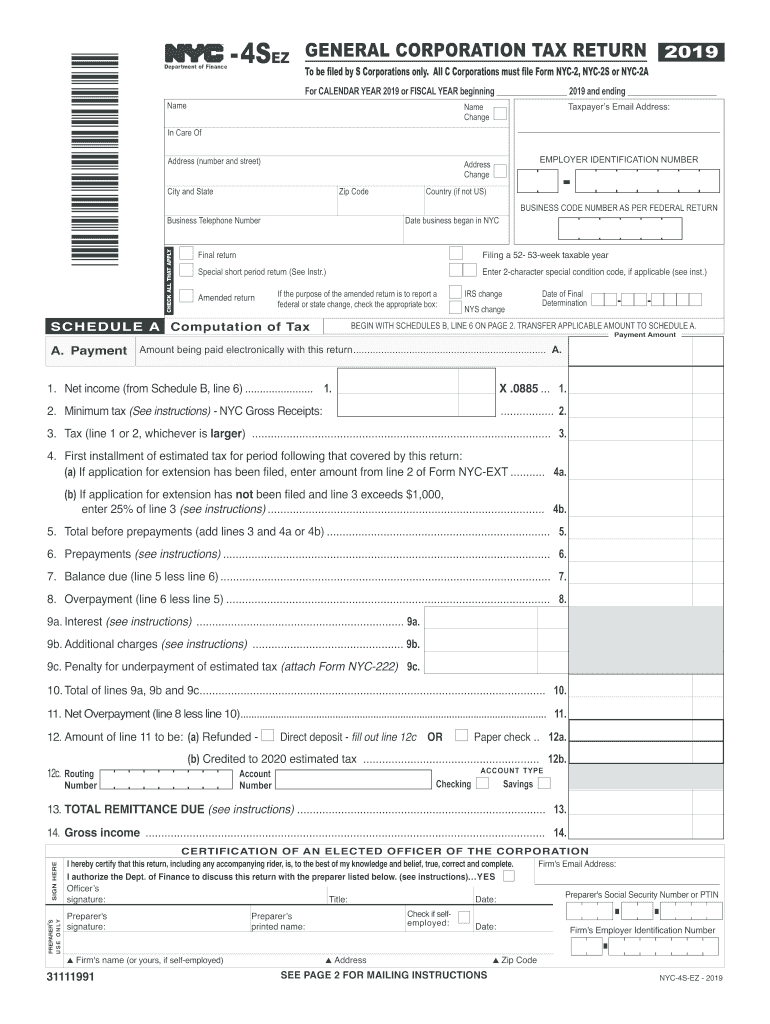

What is the NYC 3L 2019 Form?

The NYC 3L 2019 form is a tax return specifically designed for business corporations operating within New York City. This form is essential for corporations to report their income, calculate their tax liability, and ensure compliance with local tax regulations. The NYC 3L is part of the broader New York City tax system and is crucial for maintaining transparency and accountability in corporate financial practices.

Key Elements of the NYC 3L 2019 Form

The NYC 3L 2019 form includes several key elements that businesses must accurately complete. These elements typically encompass:

- Business Information: This section requires the corporation's name, address, and Employer Identification Number (EIN).

- Income Reporting: Corporations must report their total income, including gross receipts and other income sources.

- Deductions: The form allows businesses to list allowable deductions, which can reduce taxable income.

- Tax Calculation: This section computes the total tax owed based on the reported income and deductions.

- Signature: An authorized representative must sign the form to validate the information provided.

Steps to Complete the NYC 3L 2019 Form

Completing the NYC 3L 2019 form involves several important steps:

- Gather all necessary financial documents, including income statements and expense records.

- Fill in the business information section accurately, ensuring all details match official records.

- Report total income and list any deductions that apply to your business.

- Calculate your total tax liability based on the provided information.

- Review the completed form for accuracy and ensure it is signed by an authorized individual.

- Submit the form by the designated filing deadline to avoid penalties.

Filing Deadlines for the NYC 3L 2019 Form

It is crucial for businesses to adhere to the filing deadlines associated with the NYC 3L 2019 form. Typically, the form must be filed by the 15th day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due on April 15. Missing this deadline can result in penalties and interest on any unpaid tax liabilities.

Penalties for Non-Compliance with the NYC 3L 2019 Form

Failure to file the NYC 3L 2019 form on time or providing inaccurate information can lead to significant penalties. These may include:

- Late Filing Penalties: A percentage of the unpaid tax may be assessed for each month the return is late.

- Accuracy-Related Penalties: Additional charges may apply if the information reported is found to be misleading or incorrect.

- Interest Charges: Interest may accrue on any unpaid tax from the due date until the tax is paid in full.

Form Submission Methods for the NYC 3L 2019 Form

Businesses have several options for submitting the NYC 3L 2019 form. These methods include:

- Online Submission: Corporations can file electronically through the New York City Department of Finance's online portal.

- Mail: The completed form can be sent via postal service to the appropriate tax office.

- In-Person Filing: Businesses may also deliver the form directly to designated tax offices within New York City.

Quick guide on how to complete tm 2 business corporation tax return department of

Complete TM 2 BUSINESS CORPORATION TAX RETURN Department Of effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to locate the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without interruptions. Manage TM 2 BUSINESS CORPORATION TAX RETURN Department Of on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign TM 2 BUSINESS CORPORATION TAX RETURN Department Of effortlessly

- Locate TM 2 BUSINESS CORPORATION TAX RETURN Department Of and then click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign TM 2 BUSINESS CORPORATION TAX RETURN Department Of to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tm 2 business corporation tax return department of

Create this form in 5 minutes!

How to create an eSignature for the tm 2 business corporation tax return department of

How to make an eSignature for your Tm 2 Business Corporation Tax Return Department Of online

How to make an electronic signature for your Tm 2 Business Corporation Tax Return Department Of in Chrome

How to generate an electronic signature for signing the Tm 2 Business Corporation Tax Return Department Of in Gmail

How to make an electronic signature for the Tm 2 Business Corporation Tax Return Department Of from your mobile device

How to make an eSignature for the Tm 2 Business Corporation Tax Return Department Of on iOS devices

How to create an electronic signature for the Tm 2 Business Corporation Tax Return Department Of on Android

People also ask

-

What is airSlate SignNow and how is it related to nyc 3l 2019?

airSlate SignNow is an eSignature solution that allows businesses to send and electronically sign documents efficiently. If you're looking for a reliable solution connected to nyc 3l 2019 regulations, airSlate SignNow is designed to meet these compliance needs while ensuring ease of use.

-

How does airSlate SignNow improve document management for nyc 3l 2019?

With airSlate SignNow, businesses can streamline their document management processes related to nyc 3l 2019. The platform allows for automated workflows, making it easy to track document status and manage approvals, which is essential for compliance and efficiency.

-

What are the pricing options for airSlate SignNow regarding nyc 3l 2019?

airSlate SignNow offers competitive pricing that aligns well with businesses navigating the needs of nyc 3l 2019. It includes various plans to cater to different sizes and requirements, making it a cost-effective choice for companies looking to comply with these regulations.

-

What features of airSlate SignNow support compliance with nyc 3l 2019?

The features of airSlate SignNow, such as secure signing, audit trails, and compliance with eSignature laws, are crucial for businesses dealing with requirements of nyc 3l 2019. These functionalities ensure that all documents are not only secure but also legally binding.

-

Can airSlate SignNow be integrated with other tools for nyc 3l 2019 compliance?

Yes, airSlate SignNow can seamlessly integrate with various software applications to enhance its functionality for nyc 3l 2019 compliance. This includes CRM systems and document management tools, allowing businesses to create a unified workflow that meets their legal needs.

-

What benefits can I expect from using airSlate SignNow for nyc 3l 2019 requirements?

Using airSlate SignNow for your nyc 3l 2019 requirements can lead to increased efficiency, reduced document turnaround times, and enhanced security. These benefits help businesses stay compliant while focusing on their core operations.

-

Is airSlate SignNow user-friendly for teams dealing with nyc 3l 2019?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it ideal for teams needing to manage nyc 3l 2019 documentation. Its intuitive interface allows team members to quickly adapt and manage their tasks without extensive training.

Get more for TM 2 BUSINESS CORPORATION TAX RETURN Department Of

- Usj service academy recommendation form us

- State of michigan official immunization record mcir record state of michigan official immunization record mcir record michigan form

- Orgcode vi spdat form 2015

- Letter of instruction to the guardian and trustee for myour children form

- Dr 3 form calrecycle ca

- Booty ful beginnings workout a weeks 1 4 training log form

- Ars 11 1605 review option form mcdot maricopa

- Room rental agreement doc form

Find out other TM 2 BUSINESS CORPORATION TAX RETURN Department Of

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement