GENERAL CORPORATION TAX RETURN 2024-2026

Understanding the General Corporation Tax Return

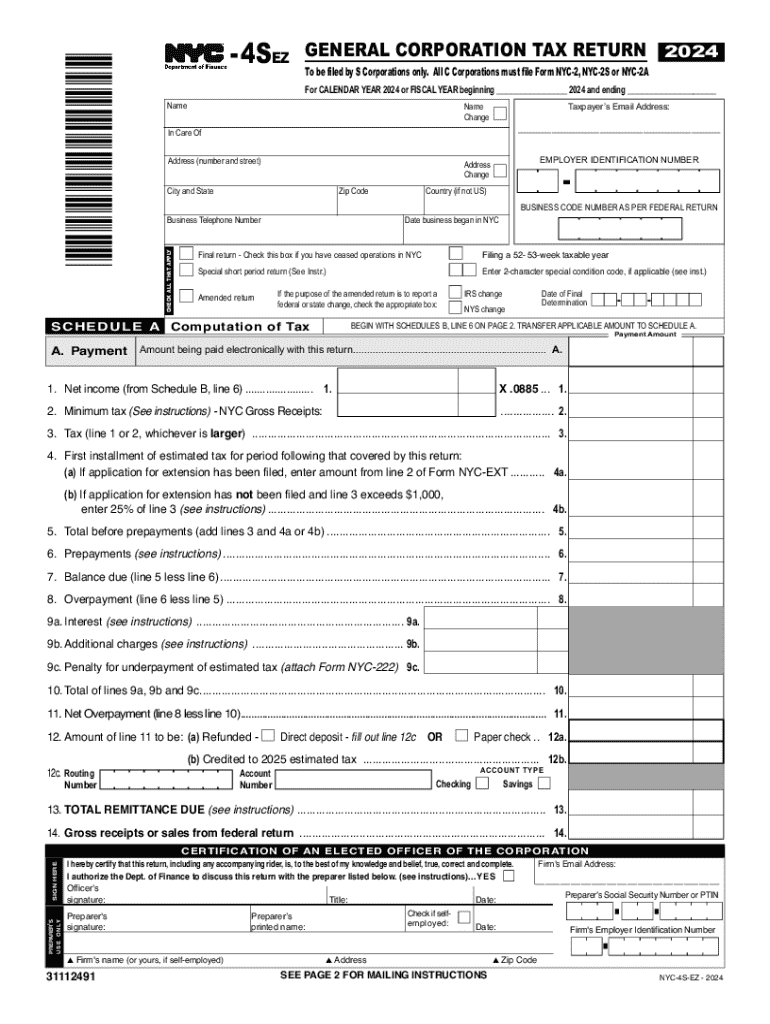

The General Corporation Tax Return is a crucial document for corporations operating in New York City. It is used to report income, calculate tax liability, and ensure compliance with local tax regulations. This form is essential for both newly established and existing corporations, as it provides a comprehensive overview of a corporation's financial activities within the city.

Steps to Complete the General Corporation Tax Return

Completing the General Corporation Tax Return involves several key steps:

- Gather financial records, including income statements and balance sheets.

- Determine the applicable tax rate based on the corporation's income level.

- Fill out the required sections of the form, ensuring accuracy in reported figures.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or by mail.

Filing Deadlines and Important Dates

Corporations must adhere to specific filing deadlines to avoid penalties. The General Corporation Tax Return is typically due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the return is due by April 15. It is advisable to keep track of these dates to ensure timely submission.

Required Documents for Filing

When preparing to file the General Corporation Tax Return, certain documents are essential:

- Financial statements, including profit and loss statements.

- Balance sheets detailing assets and liabilities.

- Records of any tax credits or deductions the corporation intends to claim.

- Prior year tax returns for reference and consistency.

Legal Use of the General Corporation Tax Return

The General Corporation Tax Return serves a legal purpose, ensuring that corporations comply with New York City tax laws. Accurate reporting is not only a requirement but also protects corporations from potential legal issues related to tax evasion or misreporting. Corporations must maintain transparency and adhere to all legal obligations when filing this return.

Form Submission Methods

Corporations can submit the General Corporation Tax Return through various methods:

- Online submission via the New York City Department of Finance website.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if preferred.

Key Elements of the General Corporation Tax Return

The General Corporation Tax Return includes several key elements that must be accurately completed:

- Identification information, including the corporation's name and tax identification number.

- Income details, including gross receipts and deductions.

- Calculation of the tax owed based on reported income.

- Information regarding any applicable credits or adjustments.

Create this form in 5 minutes or less

Find and fill out the correct general corporation tax return

Create this form in 5 minutes!

How to create an eSignature for the general corporation tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the NYC 3L instructions for 2024?

The NYC 3L instructions for 2024 provide detailed guidelines for law students preparing for the New York Bar Exam. These instructions cover eligibility requirements, application procedures, and important deadlines. It's essential to review these instructions thoroughly to ensure compliance and successful application.

-

How can airSlate SignNow assist with the NYC 3L instructions 2024?

airSlate SignNow can streamline the document signing process for students navigating the NYC 3L instructions for 2024. With our easy-to-use platform, you can quickly eSign necessary documents and manage your submissions efficiently. This saves time and reduces the stress of paperwork during your preparation.

-

What features does airSlate SignNow offer for managing NYC 3L documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are ideal for managing NYC 3L documents. These tools help ensure that all your submissions are completed accurately and on time. Additionally, our platform is designed to enhance collaboration among students and advisors.

-

Is airSlate SignNow cost-effective for students following NYC 3L instructions 2024?

Yes, airSlate SignNow is a cost-effective solution for students adhering to the NYC 3L instructions for 2024. Our pricing plans are designed to fit various budgets, making it accessible for law students. By using our service, you can save on printing and mailing costs while ensuring your documents are securely signed.

-

Can I integrate airSlate SignNow with other tools for NYC 3L instructions 2024?

Absolutely! airSlate SignNow integrates seamlessly with various tools that can assist with the NYC 3L instructions for 2024. Whether you use cloud storage services or project management tools, our integrations enhance your workflow and simplify document management.

-

What are the benefits of using airSlate SignNow for NYC 3L instructions 2024?

Using airSlate SignNow for the NYC 3L instructions 2024 offers numerous benefits, including increased efficiency and reduced paperwork. Our platform allows you to eSign documents from anywhere, ensuring you meet all deadlines. Additionally, our user-friendly interface makes it easy for students to navigate their document needs.

-

How secure is airSlate SignNow for handling NYC 3L documents?

Security is a top priority at airSlate SignNow, especially when handling sensitive NYC 3L documents. Our platform employs advanced encryption and security protocols to protect your information. You can trust that your documents are safe while you focus on preparing for your bar exam.

Get more for GENERAL CORPORATION TAX RETURN

- Revenuekygovforms4972 k 2021form 4972 k 2021 from qualified plans of participants kentucky

- Whitley county district court williamsburg ky addresswhitley countywhitley county district court williamsburg ky address form

- Kentucky form 740 np r kentucky income tax return nonresident

- Form 2210 underpayment of estimated tax by individuals estates and trusts

- South carolina partnership return sc1065 taxformfinder

- Attach to sc1040 sc department of revenue form

- Dorscgov forms site forms2022 2024 state of south carolina department of revenue

- 1350 state of south carolina department of revenue application for form

Find out other GENERAL CORPORATION TAX RETURN

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile