Form CDTFA 106 "VehicleVessel Use Tax Clearance Request 2021

Understanding the CDTFA 106 Vehicle/Vessel Use Tax Clearance Request

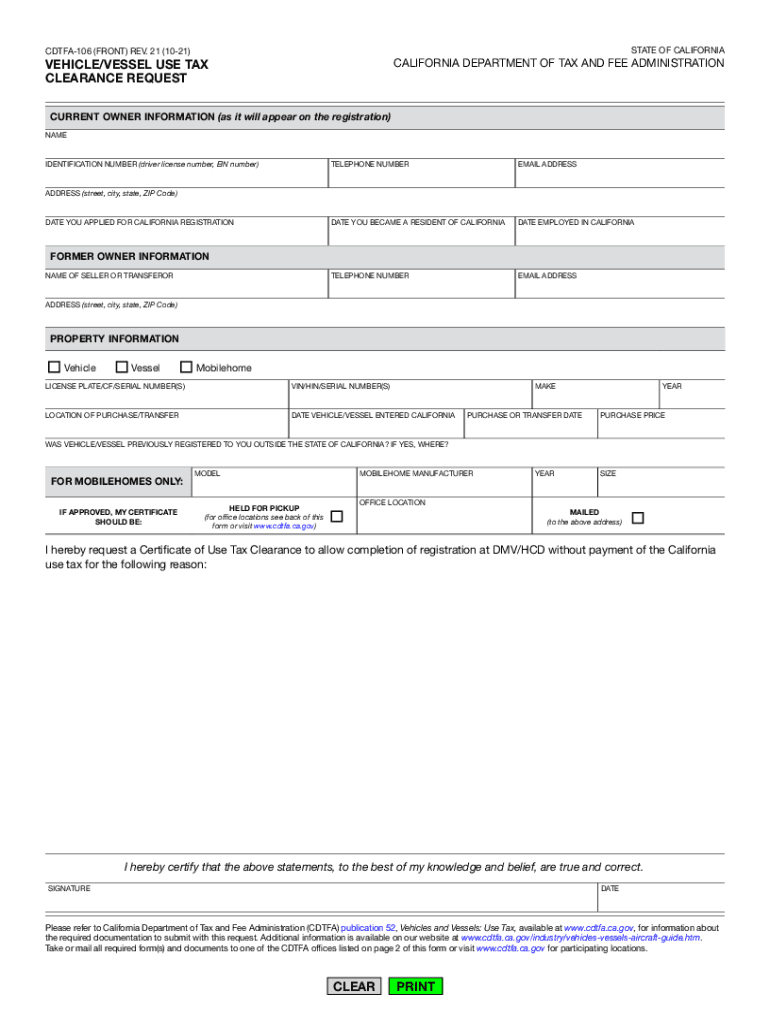

The CDTFA 106 form is essential for individuals or businesses seeking a Vehicle/Vessel Use Tax Clearance in California. This form is required when registering a vehicle or vessel that has been purchased from out of state or when a vehicle is being transferred to a new owner. The clearance request certifies that all applicable use taxes have been paid, ensuring compliance with California tax regulations.

Steps to Complete the CDTFA 106 Form

Filling out the CDTFA 106 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including the vehicle or vessel identification number, purchase date, and details about the seller. Next, complete each section of the form, ensuring that all fields are filled out correctly. After completing the form, review it for any errors before submitting it to the California Department of Tax and Fee Administration (CDTFA).

Obtaining the CDTFA 106 Form

The CDTFA 106 form can be obtained through the California Department of Tax and Fee Administration's official website. It is available for download in PDF format, allowing users to print and fill it out manually. Additionally, forms can be requested at local CDTFA offices or through customer service if needed.

Legal Use of the CDTFA 106 Form

The CDTFA 106 form serves a legal purpose by documenting the payment of use tax on vehicles or vessels. When properly completed and submitted, it provides legal evidence that the necessary taxes have been paid, which is crucial during vehicle registration or ownership transfer. Failure to submit this form may result in penalties or delays in registration.

Required Documents for CDTFA 106 Submission

When submitting the CDTFA 106 form, certain documents are required to support the clearance request. These typically include proof of purchase, such as a bill of sale or invoice, and any previous registration documents for the vehicle or vessel. It is important to ensure that all supporting documents are accurate and complete to avoid processing delays.

Form Submission Methods for CDTFA 106

The CDTFA 106 form can be submitted through various methods. Users have the option to submit the form online through the CDTFA's online services, which provides a convenient and efficient way to complete the process. Alternatively, the form can be mailed to the appropriate CDTFA office or delivered in person for processing. Each submission method has its own processing times, so users should choose the one that best suits their needs.

Quick guide on how to complete form cdtfa 106 ampquotvehiclevessel use tax clearance request

Effortlessly Prepare Form CDTFA 106 "VehicleVessel Use Tax Clearance Request on Any Device

Managing documents online has gained popularity among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Handle Form CDTFA 106 "VehicleVessel Use Tax Clearance Request on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

Effortless Modification and eSigning of Form CDTFA 106 "VehicleVessel Use Tax Clearance Request

- Locate Form CDTFA 106 "VehicleVessel Use Tax Clearance Request and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information using the tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which requires seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and click the Done button to preserve your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form CDTFA 106 "VehicleVessel Use Tax Clearance Request to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form cdtfa 106 ampquotvehiclevessel use tax clearance request

Create this form in 5 minutes!

How to create an eSignature for the form cdtfa 106 ampquotvehiclevessel use tax clearance request

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is cdtfa ca, and how does it relate to airSlate SignNow?

CDTFA CA stands for the California Department of Tax and Fee Administration, which requires electronic signatures for many documents. airSlate SignNow simplifies compliance with these requirements by providing an easy-to-use platform for securely eSigning documents related to CDTFA CA.

-

How does airSlate SignNow support businesses in complying with cdtfa ca regulations?

airSlate SignNow helps businesses comply with CDTFA CA regulations by offering secure eSignatures and audit trails that ensure document authenticity. This compliance feature allows businesses to manage their tax documents efficiently while maintaining regulatory standards.

-

What are the pricing plans for airSlate SignNow for users interested in cdtfa ca?

airSlate SignNow offers flexible pricing plans that cater to individual users to large enterprises. Each plan is designed to provide essential features, making it a cost-effective choice for businesses needing to manage their CDTFA CA documentation efficiently.

-

What are the key features of airSlate SignNow relevant to cdtfa ca users?

Key features of airSlate SignNow include secure eSigning, customizable templates, and real-time collaboration tools, which are crucial for handling CDTFA CA documents. These features enhance productivity and ensure that your eSigned documents are legally compliant.

-

Can I integrate airSlate SignNow with other tools I use for cdtfa ca paperwork?

Yes, airSlate SignNow offers seamless integrations with various tools like Google Drive, Salesforce, and other productivity applications. This flexibility allows you to streamline your workflow for handling CDTFA CA documentation alongside your existing tools.

-

How does airSlate SignNow enhance the eSigning experience for cdtfa ca forms?

airSlate SignNow enhances the eSigning experience for CDTFA CA forms by providing a user-friendly interface and quick access to documents on any device. Users can easily sign documents anytime, contributing to faster processing of tax-related paperwork.

-

What benefits does airSlate SignNow provide for businesses handling cdtfa ca documents?

By using airSlate SignNow for CDTFA CA documents, businesses enjoy faster turnaround times and reduced paperwork hassle. This results in greater efficiency and a more organized approach to managing essential tax documentation.

Get more for Form CDTFA 106 "VehicleVessel Use Tax Clearance Request

- Agreement form contract 481379516

- Illinois claim form

- Il judgment form

- Interrogatories 481379520 form

- Illinois mechanics liens form

- 5 day notice 481379523 form

- Illinois notice of default in payment of rent as warning prior to demand to pay or terminate for residential property form

- Breach right cure form

Find out other Form CDTFA 106 "VehicleVessel Use Tax Clearance Request

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form