Form 4923H Highway Use Motor Fuel Refund Claim for Rate

Overview of Missouri Form 4923

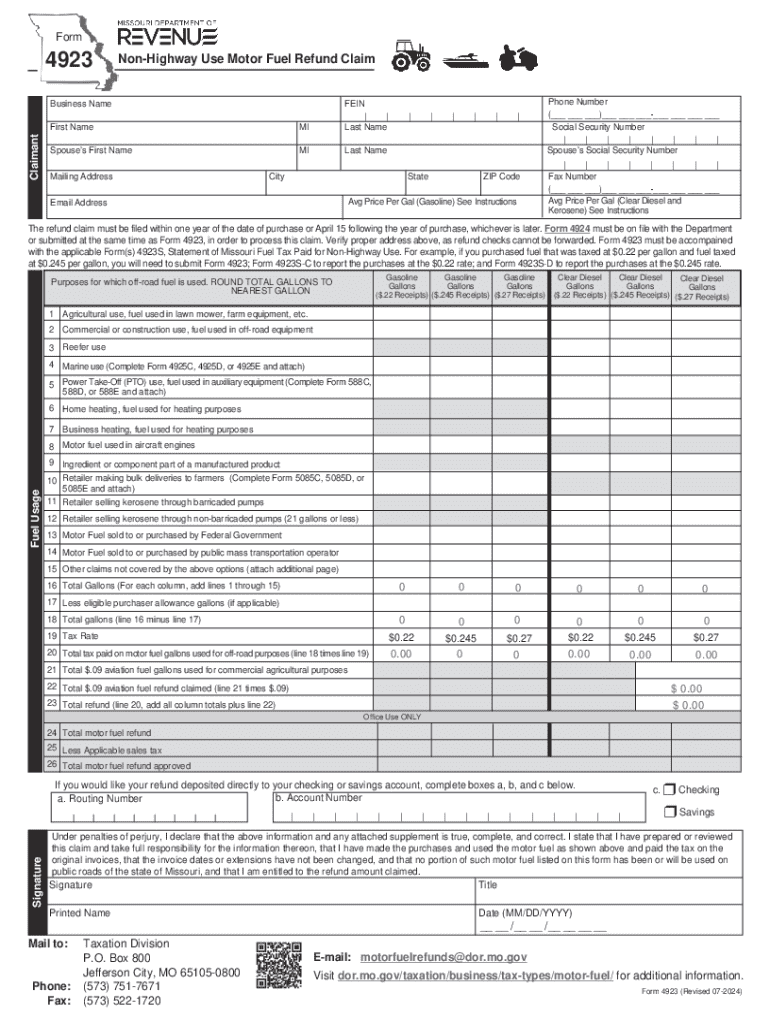

The Missouri Form 4923, officially known as the Highway Use Motor Fuel Refund Claim, is designed for individuals and businesses seeking a refund on motor fuel taxes paid. This form is particularly relevant for those who use fuel for non-highway purposes, such as agricultural or off-road activities. Understanding the purpose and eligibility criteria for this form is essential for anyone looking to reclaim these taxes.

Steps to Complete Missouri Form 4923

Completing the Missouri Form 4923 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including receipts for fuel purchases and records of fuel usage. Next, fill out the form by providing your personal or business information, detailing the amount of fuel used, and specifying the reasons for the refund claim. Double-check all entries for accuracy before submitting the form to avoid delays in processing.

Eligibility Criteria for Form 4923

To qualify for a refund using the Missouri Form 4923, applicants must meet specific eligibility criteria. This includes being a registered user of motor fuel for non-highway purposes. Additionally, the fuel must have been purchased within the specified timeframe, and the applicant must provide proof of purchase and usage. Understanding these criteria is crucial to ensure that your claim is valid and can be processed without issues.

Required Documents for Submission

When submitting Missouri Form 4923, certain documents must accompany the claim to support the refund request. These typically include receipts for fuel purchases, documentation of the fuel's use, and any relevant tax identification numbers. Ensuring that all required documents are included will help facilitate a smoother review process by the Missouri Department of Revenue.

Form Submission Methods

Missouri Form 4923 can be submitted through various methods, providing flexibility for applicants. The form can be mailed directly to the Missouri Department of Revenue, or in some cases, it may be submitted electronically if the option is available. It is important to check the latest guidelines from the Department to determine the most efficient submission method for your situation.

Filing Deadlines for Form 4923

Timely submission of Missouri Form 4923 is crucial for receiving a refund. The filing deadlines are typically set by the Missouri Department of Revenue and may vary each year. It is advisable to check the official announcements or the department's website for the most current deadlines to ensure your claim is filed on time and considered for processing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4923h highway use motor fuel refund claim for rate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Missouri Form 4923?

The Missouri Form 4923 is a document used for specific tax purposes in the state of Missouri. It is essential for businesses to understand its requirements to ensure compliance. Using airSlate SignNow, you can easily eSign and send this form securely.

-

How can airSlate SignNow help with the Missouri Form 4923?

airSlate SignNow streamlines the process of completing and eSigning the Missouri Form 4923. Our platform allows you to fill out the form digitally, ensuring accuracy and saving time. Plus, you can track the document's status in real-time.

-

Is there a cost associated with using airSlate SignNow for the Missouri Form 4923?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are cost-effective and designed to provide value, especially for businesses frequently handling documents like the Missouri Form 4923. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Missouri Form 4923?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the Missouri Form 4923. These tools enhance efficiency and ensure that your documents are handled securely and professionally.

-

Can I integrate airSlate SignNow with other applications for the Missouri Form 4923?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage the Missouri Form 4923 alongside your existing workflows. This integration helps streamline processes and enhances productivity.

-

What are the benefits of using airSlate SignNow for the Missouri Form 4923?

Using airSlate SignNow for the Missouri Form 4923 offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform simplifies the eSigning process, making it easier for businesses to stay compliant and organized.

-

Is airSlate SignNow user-friendly for completing the Missouri Form 4923?

Yes, airSlate SignNow is designed with user-friendliness in mind. The intuitive interface allows users to easily navigate through the process of completing and eSigning the Missouri Form 4923, regardless of their technical expertise.

Get more for Form 4923H Highway Use Motor Fuel Refund Claim For Rate

Find out other Form 4923H Highway Use Motor Fuel Refund Claim For Rate

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe