Form MT 160 Authorized Combative Sports Tax Return Revised 1224

What is the NY 160 Form?

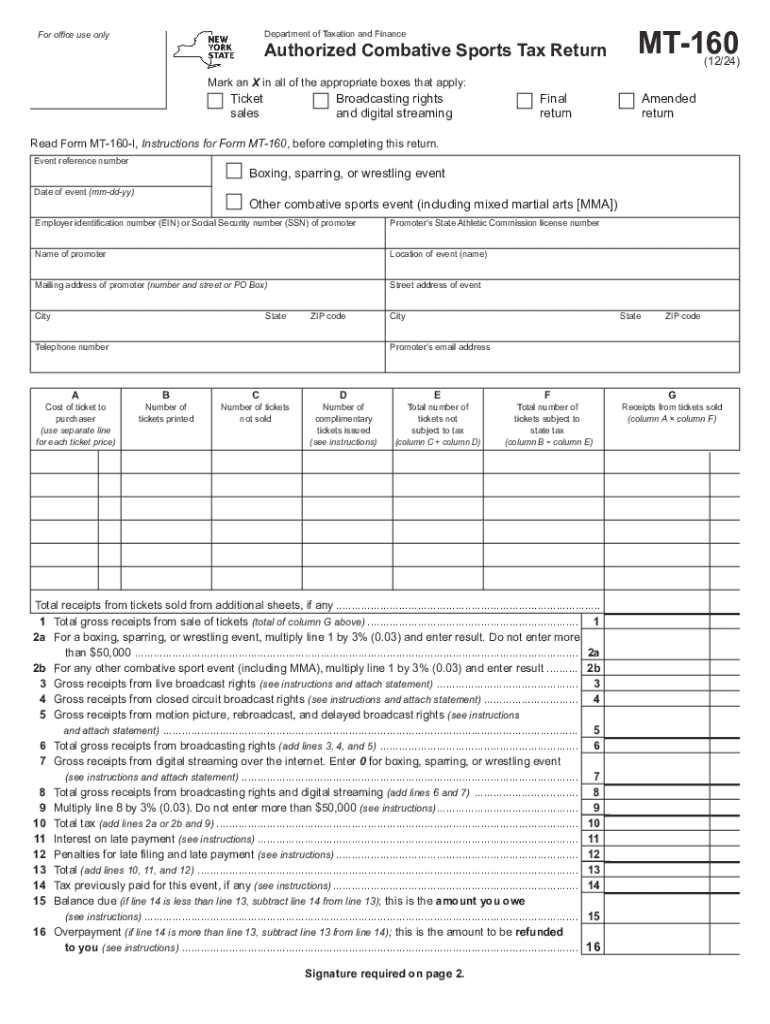

The NY 160 form, officially known as the NY 160 Authorized Combative Sports Tax Return, is a tax document used in New York State for reporting and paying taxes related to combative sports. This form is specifically designed for individuals and organizations involved in promoting or conducting combative sports events, such as boxing or mixed martial arts. The tax collected is aimed at supporting state regulations and oversight of these activities.

How to Use the NY 160 Form

To effectively use the NY 160 form, individuals or businesses must accurately report their earnings from combative sports events. This includes gross receipts from ticket sales, sponsorships, and any other income generated from such events. The completed form must be submitted to the New York State Department of Taxation and Finance, along with the appropriate tax payment. It is crucial to keep detailed records of all income and expenses related to the events to ensure compliance and accuracy on the form.

Steps to Complete the NY 160 Form

Completing the NY 160 form involves several key steps:

- Gather all necessary financial information, including total revenue from combative sports events.

- Fill out the form with accurate figures, ensuring that all income sources are included.

- Calculate the tax owed based on the applicable rates for your earnings.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with the payment to the New York State Department of Taxation and Finance by the specified deadline.

Filing Deadlines / Important Dates

Filing deadlines for the NY 160 form are typically aligned with the state's tax calendar. It is important to be aware of these dates to avoid penalties. Generally, the form must be filed quarterly, and specific deadlines are set for each quarter's earnings. Keeping track of these dates ensures timely compliance and helps avoid any late fees associated with the submission.

Penalties for Non-Compliance

Failure to file the NY 160 form on time or inaccuracies in reporting can result in significant penalties. These may include fines based on the amount of tax owed, interest on unpaid taxes, and potential legal actions for repeated non-compliance. It is essential for individuals and businesses to understand these consequences and ensure that they adhere to all filing requirements to avoid financial repercussions.

Eligibility Criteria

Eligibility to use the NY 160 form is primarily based on involvement in the promotion or conduct of combative sports events in New York State. This includes promoters, event organizers, and any entities that derive income from such activities. It is important to assess your role and revenue streams to determine if you are required to file this form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mt 160 authorized combative sports tax return revised 1224

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NY 160 form?

The NY 160 form is a tax form used by businesses in New York to report their income and calculate their tax obligations. It is essential for ensuring compliance with state tax laws. Understanding how to fill out the NY 160 form correctly can help businesses avoid penalties.

-

How can airSlate SignNow help with the NY 160 form?

airSlate SignNow provides an efficient platform for electronically signing and sending the NY 160 form. With its user-friendly interface, businesses can streamline their document management process, ensuring that the NY 160 form is completed and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the NY 160 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that simplify the process of managing the NY 160 form, making it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for the NY 160 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are beneficial for handling the NY 160 form. These features enhance efficiency and ensure that all necessary steps are taken for compliance.

-

Can I integrate airSlate SignNow with other software for the NY 160 form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the NY 160 form alongside your existing tools. This integration capability enhances workflow efficiency and data accuracy.

-

What are the benefits of using airSlate SignNow for the NY 160 form?

Using airSlate SignNow for the NY 160 form provides numerous benefits, including time savings, reduced paperwork, and improved accuracy. The platform's ease of use ensures that businesses can focus on their core operations while efficiently managing their tax documentation.

-

Is airSlate SignNow secure for handling the NY 160 form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like the NY 160 form. The platform employs advanced encryption and security measures to protect your data throughout the signing process.

Get more for Form MT 160 Authorized Combative Sports Tax Return Revised 1224

- Qasfloridarevenuecomformslibrarycurrentgeneral information and instructions for the display of dr

- Taxpayer bill of rightsinternal revenue service irs tax forms

- Colliertaxcollectorcomtourist development taxtourist development taxcollier county tax collector form

- Floridarevenuecomformslibrarycurrentinstructions for f 1120n corporate incomefranchise tax return

- Taxcoloradogov sites tax2022 colorado employee withholding certificate dr 0004 form

- 2021 income tax formsindividuals ampamp families colorado

- Dr 1002 colorado salesuse tax rates form

- Bmv 4856 form

Find out other Form MT 160 Authorized Combative Sports Tax Return Revised 1224

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document