Form 540 ES Estimated Tax for Individuals , Form 540 ES, Estimated Tax for Individuals

Understanding Form 540 ES for Estimated Tax Payments

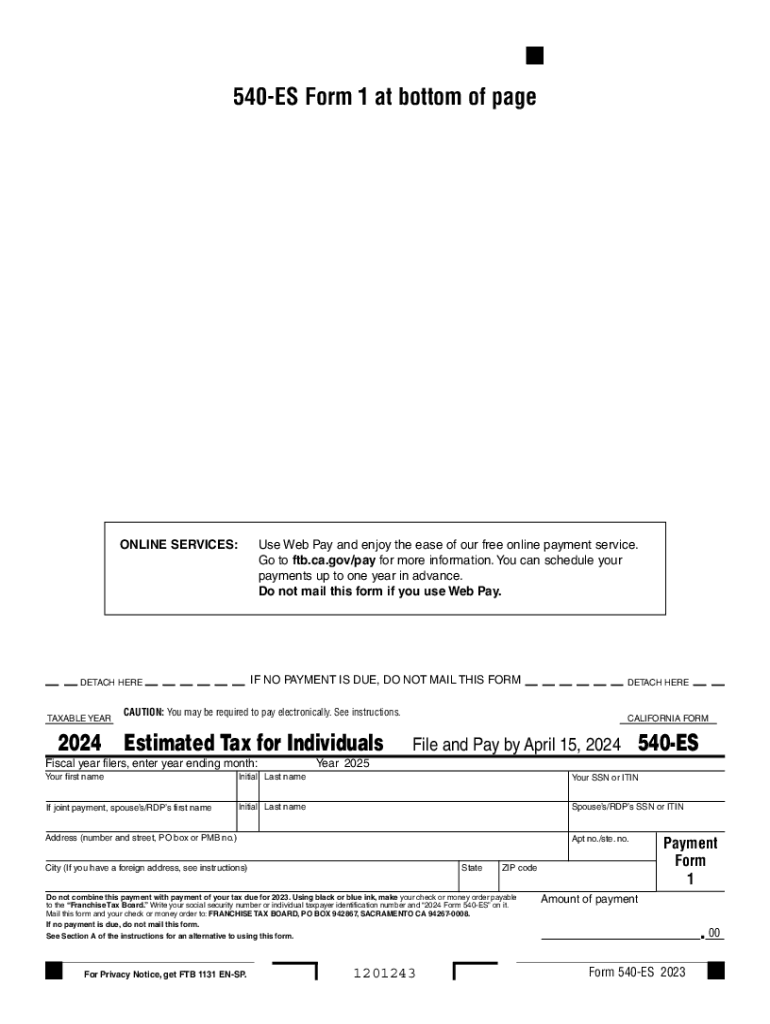

The Form 540 ES is specifically designed for individuals in California who need to make estimated tax payments. This form is essential for taxpayers who expect to owe tax of $500 or more when filing their state income tax return. The estimated tax payments help ensure that individuals meet their tax obligations throughout the year rather than facing a large tax bill at the end of the year. This form is particularly relevant for self-employed individuals, retirees, and those with significant income not subject to withholding.

How to Obtain Form 540 ES

To obtain the Form 540 ES, individuals can visit the California Franchise Tax Board (FTB) website, where the form is available for download. The form can also be requested by contacting the FTB directly. Additionally, many tax preparation offices and financial institutions may provide copies of the form. It is important to ensure that you are using the correct version of the form for the current tax year, as tax laws and forms can change annually.

Steps to Complete Form 540 ES

Completing Form 540 ES involves several steps:

- Gather your financial information, including income, deductions, and any credits you may qualify for.

- Calculate your estimated tax liability using the previous year’s tax return as a guide.

- Divide your estimated tax liability by four to determine your quarterly payment amounts.

- Fill out the form, ensuring all information is accurate and complete.

- Submit the form along with your payment by the due date to avoid penalties.

Filing Deadlines for Form 540 ES

It is crucial to adhere to the filing deadlines for Form 540 ES to avoid penalties. Estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. For the 2024 tax year, the specific due dates are April 15, 2024, June 17, 2024, September 16, 2024, and January 15, 2025. Mark these dates on your calendar to ensure timely submissions.

Legal Use of Form 540 ES

The legal use of Form 540 ES is primarily for individuals who are required to make estimated tax payments to the state of California. This form helps taxpayers comply with state tax laws and avoid underpayment penalties. It is important to accurately estimate your tax liability and make timely payments to maintain compliance with California tax regulations.

Key Elements of Form 540 ES

Form 540 ES includes several key elements that taxpayers must be aware of:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Estimated Tax Calculation: A section for calculating your expected tax liability based on income and deductions.

- Payment Information: Instructions for making payments, including options for online payments or mailing a check.

- Signature: A declaration that the information provided is accurate and complete.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 540 es estimated tax for individuals form 540 es estimated tax for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are franchise tax board forms?

Franchise tax board forms are official documents required by the state for tax reporting and compliance. These forms help businesses report their income, deductions, and other financial information to the tax authorities. Using airSlate SignNow, you can easily fill out and eSign these forms, ensuring timely submission and compliance.

-

How can airSlate SignNow help with franchise tax board forms?

airSlate SignNow streamlines the process of completing and submitting franchise tax board forms. Our platform allows you to fill out forms electronically, add signatures, and send them securely. This not only saves time but also reduces the risk of errors in your submissions.

-

Are there any costs associated with using airSlate SignNow for franchise tax board forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that facilitate the completion and eSigning of franchise tax board forms. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing franchise tax board forms?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure cloud storage for franchise tax board forms. These tools enhance efficiency and ensure that your documents are organized and easily accessible. Additionally, you can track the status of your forms in real-time.

-

Can I integrate airSlate SignNow with other software for franchise tax board forms?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to manage your franchise tax board forms alongside your existing tools. Whether you use accounting software or CRM systems, our platform can seamlessly connect to enhance your workflow.

-

Is airSlate SignNow secure for handling franchise tax board forms?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your franchise tax board forms are protected. We use advanced encryption and secure access protocols to safeguard your sensitive information during the eSigning process.

-

How can I get started with airSlate SignNow for franchise tax board forms?

Getting started with airSlate SignNow is simple. You can sign up for a free trial to explore our features for managing franchise tax board forms. Once you're ready, choose a pricing plan that suits your needs and start eSigning your documents with ease.

Get more for Form 540 ES Estimated Tax For Individuals , Form 540 ES, Estimated Tax For Individuals

Find out other Form 540 ES Estimated Tax For Individuals , Form 540 ES, Estimated Tax For Individuals

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts