Form 590 Withholding Exemption Certificate Form 590, Withholding Exemption Certificate

Understanding the Form 590 Withholding Exemption Certificate

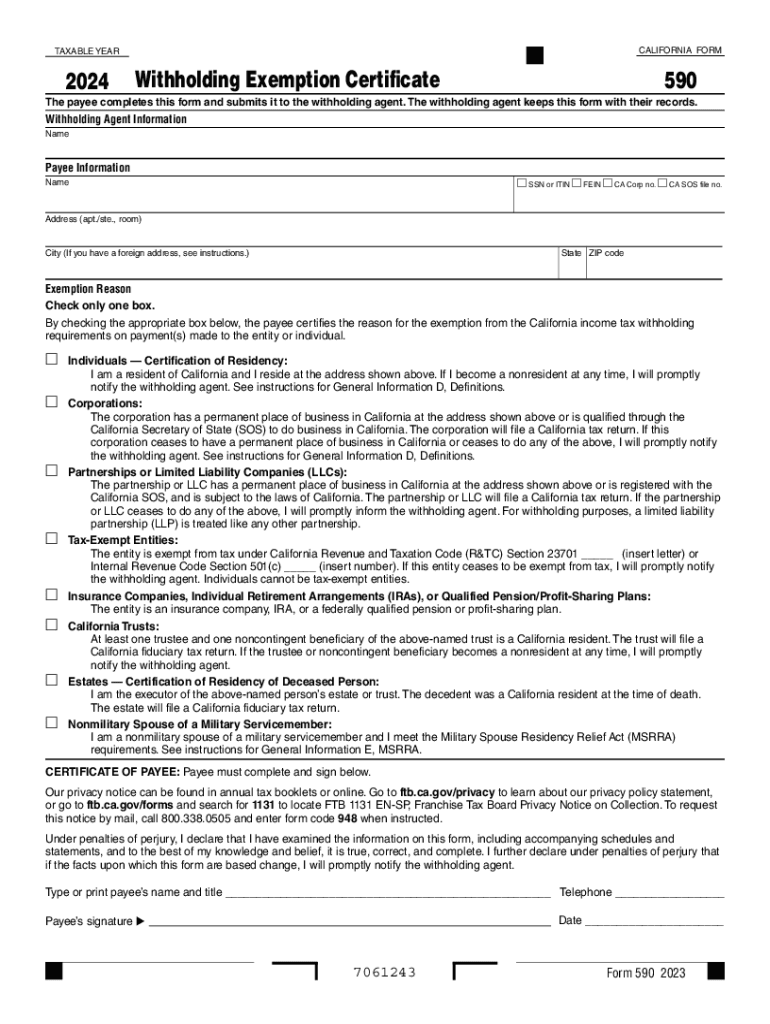

The Form 590, also known as the California Withholding Exemption Certificate, is a crucial document for individuals and businesses in California. It allows taxpayers to claim an exemption from California state income tax withholding on certain types of income. This form is particularly relevant for non-residents and residents who qualify under specific criteria, such as those who are not subject to withholding due to their income level or tax status.

Steps to Complete the Form 590 Withholding Exemption Certificate

Filling out the Form 590 involves several straightforward steps:

- Begin by providing your personal information, including your name, address, and taxpayer identification number.

- Indicate the type of income for which you are requesting an exemption, such as rental income or certain types of investment income.

- Review the eligibility criteria carefully to ensure you meet the requirements for exemption.

- Sign and date the form to certify that the information provided is accurate and complete.

Legal Use of the Form 590 Withholding Exemption Certificate

The Form 590 is legally recognized by the California Franchise Tax Board (FTB) and is essential for compliance with state tax laws. Using this form correctly helps prevent unnecessary withholding of taxes on income that may not be subject to such deductions. It is important to ensure that the form is completed accurately to avoid penalties or issues with tax compliance.

Key Elements of the Form 590 Withholding Exemption Certificate

Several key elements must be included when completing the Form 590:

- Personal identification details, including name and address.

- The specific income type for which the exemption is being claimed.

- Signature and date to affirm the accuracy of the information.

- Any applicable supporting documentation that may be required to substantiate the claim.

How to Obtain the Form 590 Withholding Exemption Certificate

The Form 590 can be easily obtained through the California Franchise Tax Board's official website. It is available in a downloadable PDF format, which can be printed and filled out manually. Additionally, taxpayers may request a physical copy through mail or in-person visits to designated tax offices.

Eligibility Criteria for the Form 590 Withholding Exemption Certificate

To qualify for the exemption using the Form 590, individuals must meet specific eligibility criteria. Common qualifications include:

- Being a non-resident of California receiving income from California sources.

- Having a total income that falls below the threshold for state income tax withholding.

- Meeting other specific conditions outlined by the California Franchise Tax Board.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 590 withholding exemption certificate form 590 withholding exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FTB Form 590 and why is it important?

The FTB Form 590 is a crucial document used for withholding on payments made to non-residents in California. It ensures that the correct amount of tax is withheld and reported to the Franchise Tax Board. Understanding how to properly complete the FTB Form 590 can help businesses avoid penalties and ensure compliance with state tax laws.

-

How can airSlate SignNow help with the FTB Form 590?

airSlate SignNow simplifies the process of completing and eSigning the FTB Form 590. With our user-friendly platform, you can easily fill out the form, gather necessary signatures, and securely send it to the relevant parties. This streamlines your workflow and ensures that your documents are processed efficiently.

-

Is there a cost associated with using airSlate SignNow for the FTB Form 590?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage documents like the FTB Form 590 without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the FTB Form 590?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for forms like the FTB Form 590. These features enhance your document management process, making it easier to ensure that all necessary steps are completed accurately and on time.

-

Can I integrate airSlate SignNow with other applications for the FTB Form 590?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the FTB Form 590. Whether you use CRM systems, cloud storage, or other business tools, our platform can connect seamlessly to enhance your document management experience.

-

What are the benefits of using airSlate SignNow for the FTB Form 590?

Using airSlate SignNow for the FTB Form 590 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and send documents quickly, ensuring that you meet deadlines and maintain compliance with tax regulations.

-

Is airSlate SignNow secure for handling sensitive documents like the FTB Form 590?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents such as the FTB Form 590. We utilize advanced encryption and security protocols to protect your data, ensuring that your information remains confidential and secure throughout the signing process.

Get more for Form 590 Withholding Exemption Certificate Form 590, Withholding Exemption Certificate

- Corpiq formulaire demande de location

- Pharmacology viva questions with answers pdf form

- Apgvb account opening form

- Gluometer maintenance and quality control record form

- Essential med chronic application form

- Crucial conversations cheat sheet form

- Fccla planning process example form

- Fouo cover sheet form

Find out other Form 590 Withholding Exemption Certificate Form 590, Withholding Exemption Certificate

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement