CA Form 3536 Estimated Fee for LLCs

What is the CA Form 3536 Estimated Fee For LLCs

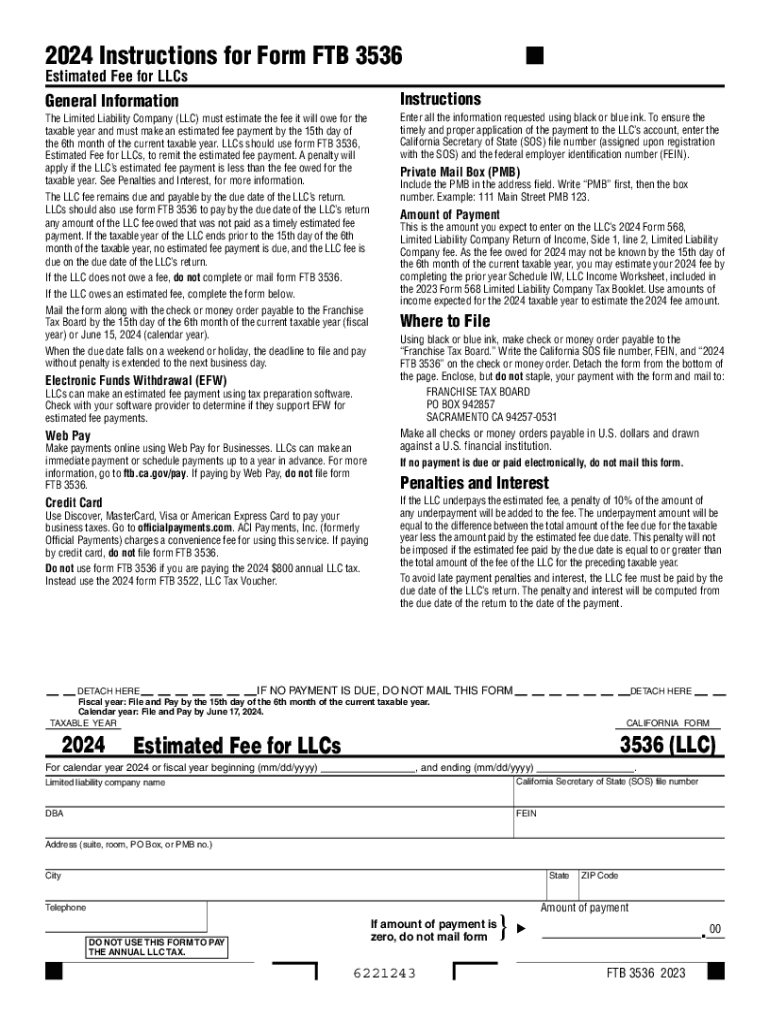

The CA Form 3536 is an essential document used by Limited Liability Companies (LLCs) in California to report and pay their estimated annual fees. This form is specifically designed for LLCs that are subject to California's annual minimum franchise tax. The estimated fee is calculated based on the total income of the LLC, ensuring that the state receives its share of revenue from business activities conducted within its jurisdiction. Understanding this form is crucial for compliance and financial planning for LLCs operating in California.

How to use the CA Form 3536 Estimated Fee For LLCs

Using the CA Form 3536 involves several steps to ensure accurate reporting and payment of the estimated fee. First, LLCs must gather financial information, including total income for the year. Next, they calculate the estimated fee based on the income brackets established by the California Franchise Tax Board. Once the fee is determined, the form can be filled out either electronically or by hand. After completing the form, it should be submitted along with the payment to the appropriate tax authority by the specified deadline to avoid penalties.

Steps to complete the CA Form 3536 Estimated Fee For LLCs

Completing the CA Form 3536 requires careful attention to detail. The following steps outline the process:

- Gather Financial Information: Collect all relevant income statements and financial records for the LLC.

- Calculate Estimated Fee: Determine the estimated fee based on the total income, referring to the income brackets provided by the state.

- Fill Out the Form: Enter the calculated fee and other required information on the form accurately.

- Review for Accuracy: Double-check all entries to ensure there are no mistakes that could lead to penalties.

- Submit the Form: File the form electronically or by mail, along with the payment, before the deadline.

Filing Deadlines / Important Dates

Awareness of filing deadlines is critical for LLCs to avoid penalties. The CA Form 3536 is typically due on the 15th day of the fourth month after the close of the LLC's taxable year. For most LLCs operating on a calendar year, this means the form is due by April 15. It is advisable for businesses to mark this date on their calendars and prepare the necessary documentation in advance to ensure timely submission.

Penalties for Non-Compliance

Failure to file the CA Form 3536 or pay the estimated fee on time can result in significant penalties. These may include late fees and interest on the unpaid amount. Additionally, non-compliance can lead to further legal complications, including the potential suspension of the LLC's business license. It is essential for LLCs to adhere to filing requirements and deadlines to maintain good standing with the state.

Who Issues the Form

The CA Form 3536 is issued by the California Franchise Tax Board (FTB). This state agency is responsible for administering California's tax laws and collecting taxes owed by businesses and individuals. LLCs can find the form and additional guidance directly on the FTB's official website, ensuring they have the most current information and resources available for compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca form 3536 estimated fee for llcs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 ca 3536 form and how does airSlate SignNow help with it?

The 2024 ca 3536 form is essential for businesses to manage their compliance and documentation needs. airSlate SignNow simplifies the process by allowing users to easily send, sign, and store this form electronically, ensuring that all necessary signatures are collected efficiently.

-

How much does airSlate SignNow cost for managing the 2024 ca 3536?

airSlate SignNow offers competitive pricing plans that cater to various business sizes. For managing the 2024 ca 3536, you can choose a plan that fits your budget while enjoying features that streamline document management and eSigning.

-

What features does airSlate SignNow offer for the 2024 ca 3536?

airSlate SignNow provides a range of features for the 2024 ca 3536, including customizable templates, automated workflows, and secure cloud storage. These features enhance productivity and ensure that your documents are handled with the utmost security.

-

Can I integrate airSlate SignNow with other software for the 2024 ca 3536?

Yes, airSlate SignNow seamlessly integrates with various software applications, making it easy to manage the 2024 ca 3536 alongside your existing tools. This integration helps streamline your workflow and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for the 2024 ca 3536?

Using airSlate SignNow for the 2024 ca 3536 offers numerous benefits, including reduced turnaround time for document signing and improved compliance tracking. Additionally, it provides a user-friendly interface that simplifies the entire process for both senders and signers.

-

Is airSlate SignNow secure for handling the 2024 ca 3536?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the 2024 ca 3536. With encryption and secure access controls, you can trust that your sensitive information is safe.

-

How can I get started with airSlate SignNow for the 2024 ca 3536?

Getting started with airSlate SignNow for the 2024 ca 3536 is easy. Simply sign up for an account, choose the appropriate plan, and start creating or uploading your documents. The platform provides intuitive guides to help you through the process.

Get more for CA Form 3536 Estimated Fee For LLCs

Find out other CA Form 3536 Estimated Fee For LLCs

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document