Form it 2663 Nonresident Real Property Estimated Income Tax Payment Form Tax Year

What is the IT 2663 Nonresident Real Property Estimated Income Tax Payment Form?

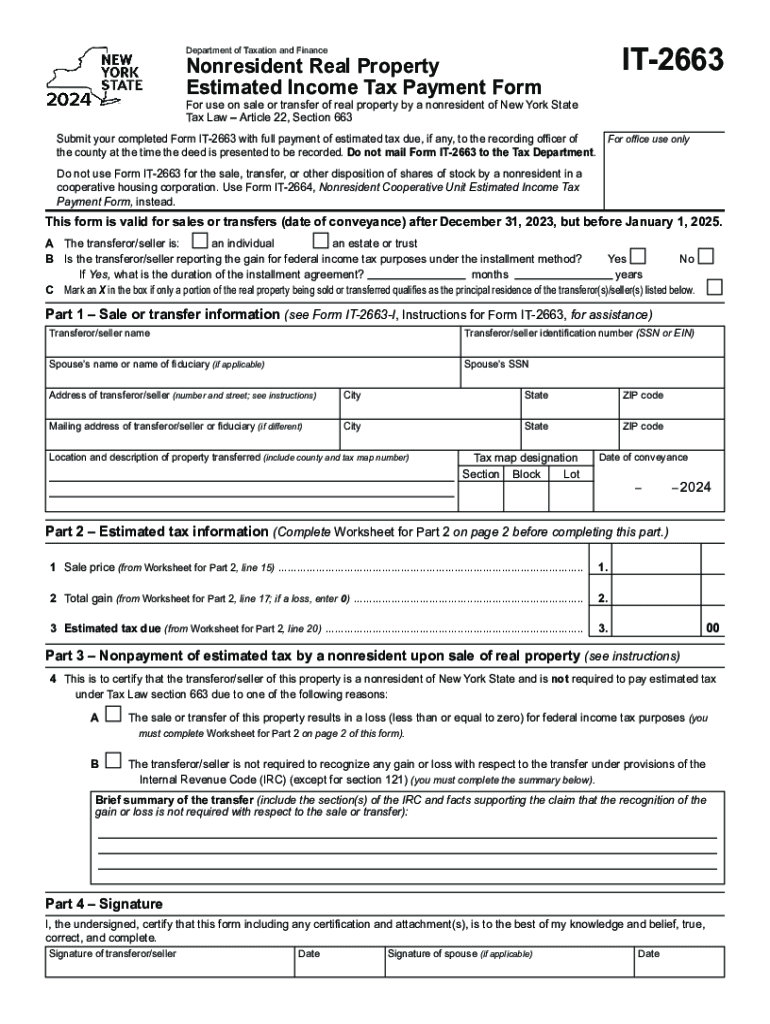

The IT 2663 is a tax form used by nonresidents of New York who are required to make estimated income tax payments on income derived from real property located in New York State. This form is essential for individuals who do not reside in New York but earn income from rental properties or other real estate investments within the state. By filing this form, taxpayers ensure compliance with New York tax regulations and avoid potential penalties for underpayment.

Steps to Complete the IT 2663 Nonresident Real Property Estimated Income Tax Payment Form

Completing the IT 2663 form involves several key steps:

- Gather necessary information, including your Social Security number, property details, and income amounts.

- Calculate your estimated income tax liability based on the income derived from New York real property.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadlines to avoid penalties.

How to Obtain the IT 2663 Nonresident Real Property Estimated Income Tax Payment Form

The IT 2663 form can be obtained from the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing taxpayers to print and complete the form. Additionally, physical copies may be available at local tax offices or through tax professionals who assist with filing.

Filing Deadlines for the IT 2663 Nonresident Real Property Estimated Income Tax Payment Form

It is crucial to be aware of the filing deadlines for the IT 2663 form to avoid penalties. Generally, estimated tax payments are due quarterly, with specific dates set by the New York State Department of Taxation and Finance. Taxpayers should mark their calendars for these deadlines to ensure timely submissions.

Key Elements of the IT 2663 Nonresident Real Property Estimated Income Tax Payment Form

The IT 2663 form includes several key elements that taxpayers must complete:

- Taxpayer identification information, including name and Social Security number.

- Details of the real property, including address and type of income generated.

- Estimated income tax calculation based on the income derived from the property.

- Signature and date to certify the accuracy of the information provided.

Legal Use of the IT 2663 Nonresident Real Property Estimated Income Tax Payment Form

The IT 2663 form serves as an official document for nonresidents to report and pay estimated income taxes on income from New York real estate. Filing this form is a legal requirement for nonresidents earning income in the state, ensuring compliance with New York tax laws. Failure to file or pay estimated taxes can result in penalties and interest charges.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 2663 nonresident real property estimated income tax payment form tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 2663 feature in airSlate SignNow?

The it 2663 feature in airSlate SignNow allows users to streamline their document signing process. This feature ensures that all necessary signatures are collected efficiently, reducing turnaround time. With it 2663, businesses can enhance their workflow and improve productivity.

-

How does pricing work for the it 2663 solution?

Pricing for the it 2663 solution in airSlate SignNow is designed to be cost-effective for businesses of all sizes. We offer various plans that cater to different needs, ensuring you only pay for what you use. Contact our sales team for a detailed quote tailored to your requirements.

-

What are the key benefits of using it 2663?

Using the it 2663 feature in airSlate SignNow provides numerous benefits, including enhanced security and compliance. It simplifies the signing process, making it easier for users to manage documents. Additionally, it helps reduce paper usage, contributing to a more sustainable business practice.

-

Can I integrate it 2663 with other software?

Yes, the it 2663 feature in airSlate SignNow can be seamlessly integrated with various software applications. This includes popular CRM and project management tools, allowing for a more cohesive workflow. Our integration capabilities ensure that you can connect your existing systems effortlessly.

-

Is it 2663 suitable for small businesses?

Absolutely! The it 2663 feature in airSlate SignNow is designed to be user-friendly and accessible for small businesses. It provides an affordable solution for document signing that can scale as your business grows. Small teams can benefit from its efficiency and ease of use.

-

What types of documents can I sign using it 2663?

With the it 2663 feature in airSlate SignNow, you can sign a wide variety of documents, including contracts, agreements, and forms. The platform supports multiple file formats, ensuring flexibility for your signing needs. This versatility makes it an ideal choice for diverse business applications.

-

How secure is the it 2663 signing process?

The it 2663 signing process in airSlate SignNow is highly secure, employing advanced encryption and authentication measures. This ensures that your documents are protected throughout the signing process. We prioritize data security to give you peace of mind when managing sensitive information.

Get more for Form IT 2663 Nonresident Real Property Estimated Income Tax Payment Form Tax Year

Find out other Form IT 2663 Nonresident Real Property Estimated Income Tax Payment Form Tax Year

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent