Local Services TaxRadnor, PA Form

Understanding the Local Services Tax in Radnor, PA

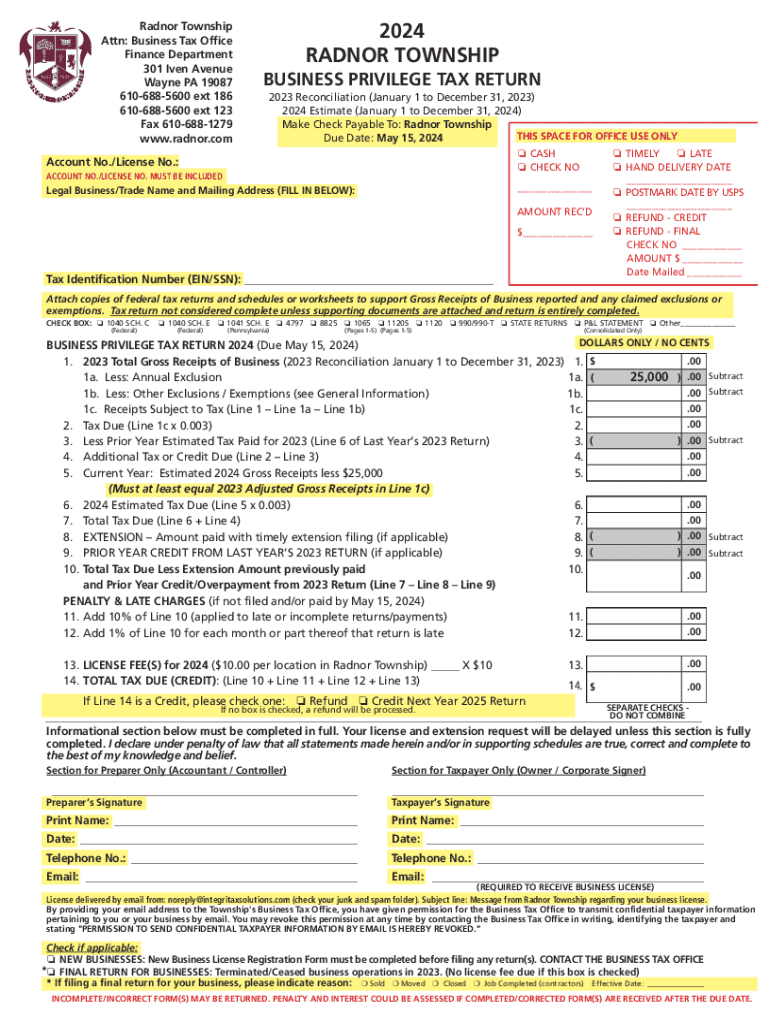

The Local Services Tax (LST) in Radnor, PA, is a tax levied on individuals who work within the municipality. This tax is applicable to residents and non-residents alike, provided they earn income from work performed in Radnor. The primary purpose of the LST is to fund local services, including emergency services, public safety, and infrastructure improvements. The tax is typically assessed at a nominal rate, making it a manageable obligation for most taxpayers.

Steps to Complete the Local Services Tax in Radnor, PA

Completing the Local Services Tax form involves several straightforward steps. First, gather all necessary information, including your personal identification details and income sources. Next, access the appropriate form, which can usually be found on the Radnor municipal website or obtained from the local tax office. Fill out the form accurately, ensuring that all required fields are completed. Once filled, submit the form either online, by mail, or in person, depending on the submission methods available. Finally, keep a copy of the submitted form for your records.

Required Documents for the Local Services Tax in Radnor, PA

To successfully file the Local Services Tax, certain documents are necessary. These typically include proof of residency or employment, such as a driver's license or utility bill, and documentation of income, such as pay stubs or tax returns. Having these documents ready will facilitate a smoother filing process and ensure compliance with local regulations.

Filing Deadlines for the Local Services Tax in Radnor, PA

Filing deadlines for the Local Services Tax are crucial for compliance. Generally, the tax must be filed annually, and the deadline is often set for April 15 of the following year. It is important to check for any specific local announcements or changes to this deadline to avoid penalties. Timely filing ensures that taxpayers remain in good standing with the local government.

Penalties for Non-Compliance with the Local Services Tax in Radnor, PA

Failure to comply with the Local Services Tax requirements can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action for persistent non-compliance. It is essential for taxpayers to understand their obligations and file on time to avoid these consequences.

Who Issues the Local Services Tax in Radnor, PA

The Local Services Tax is administered by the Radnor Township tax office. This office is responsible for collecting the tax, providing necessary forms, and offering guidance to taxpayers. For any questions or clarifications regarding the tax, individuals can contact the tax office directly for assistance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the local services taxradnor pa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Local Services Tax in Radnor, PA?

The Local Services Tax in Radnor, PA, is a tax imposed on individuals working within the municipality. It is designed to fund local services and infrastructure. Understanding this tax is crucial for businesses and employees to ensure compliance and avoid penalties.

-

How can airSlate SignNow help with Local Services Tax documentation?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign documents related to Local Services Tax in Radnor, PA. This streamlines the process of managing tax forms and ensures that all documentation is securely stored and easily accessible. With our solution, you can focus on your business while we handle the paperwork.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans are designed to be cost-effective, especially for those dealing with Local Services Tax in Radnor, PA. You can choose a plan that fits your budget while still accessing all essential features.

-

What features does airSlate SignNow offer for managing Local Services Tax?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning, all of which are beneficial for managing Local Services Tax in Radnor, PA. These tools help simplify the tax documentation process, making it easier for businesses to stay compliant and organized.

-

Is airSlate SignNow compliant with local regulations in Radnor, PA?

Yes, airSlate SignNow is designed to comply with local regulations, including those related to Local Services Tax in Radnor, PA. Our platform ensures that all documents meet legal standards, providing peace of mind for businesses and their employees.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various accounting and tax management software, making it easier to handle Local Services Tax in Radnor, PA. This connectivity allows for seamless data transfer and enhances overall efficiency in managing tax-related tasks.

-

What are the benefits of using airSlate SignNow for Local Services Tax?

Using airSlate SignNow for Local Services Tax in Radnor, PA, offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform simplifies the eSigning process, reduces paperwork, and helps ensure that all tax documents are properly managed and stored.

Get more for Local Services TaxRadnor, PA

Find out other Local Services TaxRadnor, PA

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online