DR 0145, Colorado Tax Information Authorization or Power of Attorney

Understanding the Colorado DR 0145 Form

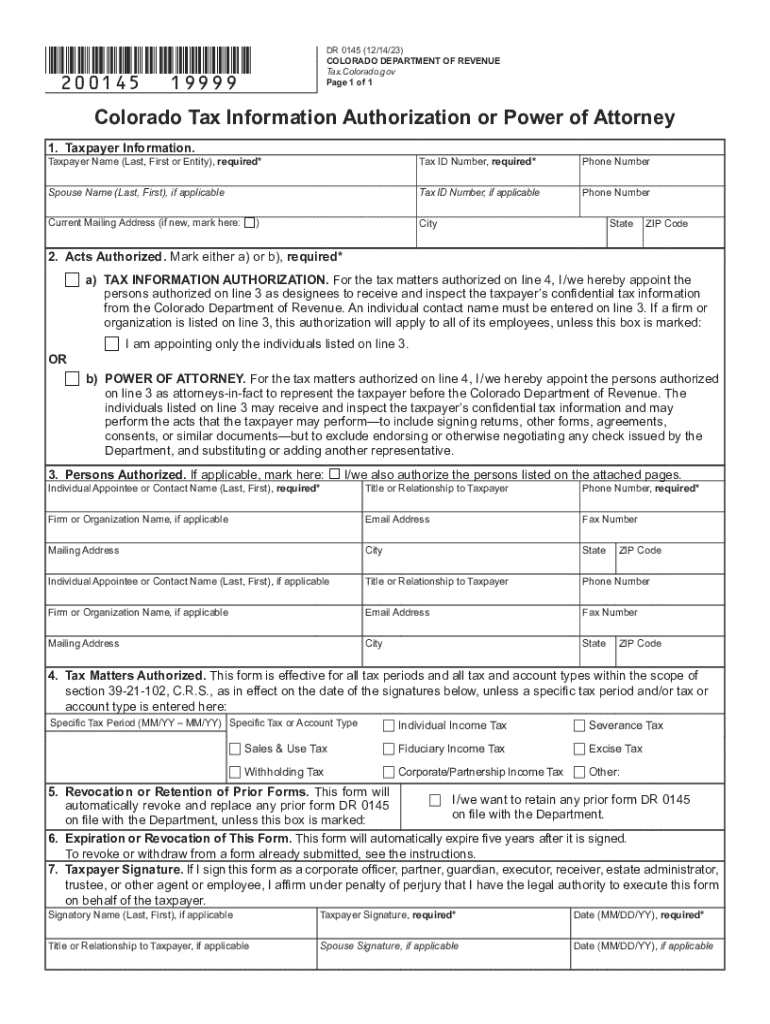

The Colorado DR 0145 form, officially known as the Tax Information Authorization or Power of Attorney, allows individuals to designate someone else to receive confidential tax information from the Colorado Department of Revenue. This form is essential for taxpayers who may need assistance in managing their tax affairs, ensuring that their chosen representative can legally access necessary information on their behalf.

How to Complete the Colorado DR 0145 Form

Filling out the DR 0145 form requires careful attention to detail. The form includes sections where you must provide your personal information, such as your name, address, and Social Security number. You will also need to enter the representative's information, including their name and contact details. Ensure that you specify the type of tax matters for which the authorization is granted. This clarity helps the Colorado Department of Revenue understand the scope of the authorization.

Obtaining the Colorado DR 0145 Form

The DR 0145 form can be obtained directly from the Colorado Department of Revenue's website or by visiting their local office. It is available in a printable format, allowing you to fill it out manually. Additionally, some tax professionals may provide this form as part of their services, ensuring you have the correct documentation for your needs.

Legal Considerations for Using the Colorado DR 0145 Form

Using the DR 0145 form legally empowers your chosen representative to act on your behalf regarding tax matters. It is crucial to understand that this authorization does not grant them the ability to make decisions on your behalf; rather, it allows them to receive information and communicate with the Colorado Department of Revenue. Always ensure that you trust the individual you designate, as they will have access to sensitive information.

Key Elements of the Colorado DR 0145 Form

Several key elements are included in the Colorado DR 0145 form that you should be aware of:

- Taxpayer Information: Personal details of the taxpayer, including Social Security number.

- Representative Information: Details of the individual authorized to act on behalf of the taxpayer.

- Scope of Authorization: Specific tax matters for which the authorization is valid.

- Signature: The taxpayer must sign the form to validate the authorization.

Steps to Submit the Colorado DR 0145 Form

Once you have completed the DR 0145 form, submission can be done through various methods:

- Online: Some submissions may be accepted electronically through the Colorado Department of Revenue's online portal.

- Mail: You can send the completed form to the address specified by the Colorado Department of Revenue.

- In-Person: Alternatively, you may deliver the form directly to a local office of the Colorado Department of Revenue.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 0145 colorado tax information authorization or power of attorney

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the colorado dor dr0145 form?

The colorado dor dr0145 form is a document used for various tax-related purposes in Colorado. It is essential for businesses and individuals to understand its requirements to ensure compliance with state regulations. Using airSlate SignNow, you can easily eSign and send the colorado dor dr0145 form securely.

-

How can airSlate SignNow help with the colorado dor dr0145?

airSlate SignNow streamlines the process of completing and submitting the colorado dor dr0145 form. Our platform allows you to fill out the form electronically, ensuring accuracy and saving time. Additionally, you can eSign the document and send it directly to the appropriate authorities.

-

Is there a cost associated with using airSlate SignNow for the colorado dor dr0145?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution ensures that you can manage documents like the colorado dor dr0145 without breaking the bank. You can choose a plan that fits your budget while enjoying all the features we offer.

-

What features does airSlate SignNow provide for the colorado dor dr0145?

airSlate SignNow provides a range of features for managing the colorado dor dr0145, including customizable templates, secure eSigning, and document tracking. These features enhance your workflow and ensure that your documents are handled efficiently. You can also integrate with other tools to streamline your processes further.

-

Can I integrate airSlate SignNow with other applications for the colorado dor dr0145?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to manage the colorado dor dr0145 seamlessly. Whether you use CRM systems, cloud storage, or other productivity tools, our platform can connect with them to enhance your document management experience.

-

What are the benefits of using airSlate SignNow for the colorado dor dr0145?

Using airSlate SignNow for the colorado dor dr0145 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, allowing you to focus on your core business activities. Additionally, you can access your documents anytime, anywhere.

-

How secure is airSlate SignNow when handling the colorado dor dr0145?

Security is a top priority at airSlate SignNow. When handling the colorado dor dr0145, we utilize advanced encryption and secure storage to protect your sensitive information. You can trust that your documents are safe and compliant with industry standards.

Get more for DR 0145, Colorado Tax Information Authorization Or Power Of Attorney

- Icds monthly progress report form

- A case of exploding mangoes pdf form

- Land contract template ohio form

- Belvedere teachers college form

- Waller county texas assessors office form

- Section 8 application fort walton beach housing authority form

- Young life health form 45185484

- Patient health history form intermountain healthcare intermountainhealthcare

Find out other DR 0145, Colorado Tax Information Authorization Or Power Of Attorney

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors