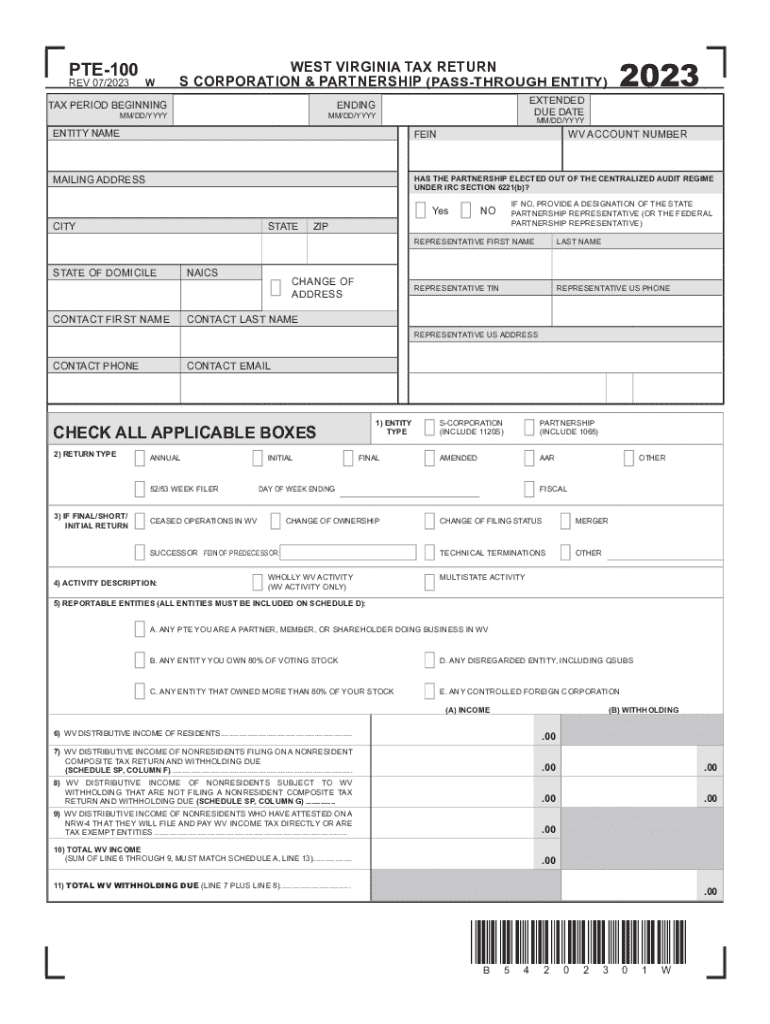

S CORPORATION & PARTNERSHIP PASS through ENTITY Form

What is the S Corporation & Partnership Pass-Through Entity?

The S Corporation and Partnership Pass-Through Entity is a business structure that allows income, deductions, and credits to pass through to individual owners, avoiding double taxation at the corporate level. This structure is particularly beneficial for small businesses, as it simplifies tax reporting and can lead to significant tax savings. In West Virginia, partnerships and S Corporations must adhere to specific state regulations while filing their returns, ensuring compliance with both federal and state tax laws.

Steps to Complete the S Corporation & Partnership Pass-Through Entity

Completing the West Virginia partnership return involves several key steps:

- Gather necessary documentation, including financial statements and previous tax returns.

- Complete the West Virginia Form SPF-100, ensuring all income and deductions are accurately reported.

- Attach any required schedules, such as the West Virginia Schedule SP, to provide additional details on income sources and deductions.

- Review the completed form for accuracy before submission.

- Submit the return electronically or by mail by the designated deadline.

Filing Deadlines / Important Dates

For the 2023 tax year, the filing deadline for the West Virginia partnership return is typically the fifteenth day of the fourth month following the end of the tax year. For partnerships operating on a calendar year, this means the return is due on April 15. It is essential to be aware of any extensions that may apply and to file accordingly to avoid penalties.

Required Documents

When preparing the West Virginia partnership return, several documents are essential:

- Financial statements, including income statements and balance sheets.

- Previous year’s tax returns for reference.

- Supporting documentation for deductions, such as receipts and invoices.

- Any applicable schedules, including the West Virginia Schedule SP.

Form Submission Methods (Online / Mail / In-Person)

Partnerships in West Virginia have several options for submitting their returns. The West Virginia Form SPF-100 can be filed electronically through approved e-filing services, which is often the quickest method. Alternatively, businesses may choose to mail their completed forms to the appropriate state tax office. In-person submissions are also accepted, although this method may require an appointment and is less common.

Penalties for Non-Compliance

Failure to file the West Virginia partnership return on time can result in significant penalties. Late filing penalties may accrue based on the amount of tax owed, while inaccuracies in the return can lead to additional fines. It is crucial for partnerships to ensure timely and accurate submissions to avoid these financial repercussions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the s corporation partnership pass through entity

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the west virginia partnership return instructions 2023?

The west virginia partnership return instructions 2023 provide detailed guidelines on how to complete and file partnership tax returns in West Virginia. These instructions include information on required forms, deadlines, and specific calculations needed for accurate reporting. It's essential for partnerships to follow these instructions to ensure compliance and avoid penalties.

-

How can airSlate SignNow assist with the west virginia partnership return instructions 2023?

airSlate SignNow simplifies the process of managing documents related to the west virginia partnership return instructions 2023. With our eSigning features, you can easily send, sign, and store your partnership tax documents securely. This streamlines your workflow and ensures that all necessary forms are completed and submitted on time.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers a range of features tailored for handling tax documents, including customizable templates, secure eSigning, and document tracking. These features are particularly useful for following the west virginia partnership return instructions 2023, as they help ensure that all required information is accurately captured and submitted. Additionally, our platform is user-friendly, making it accessible for all users.

-

Is airSlate SignNow cost-effective for small businesses managing tax returns?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing tax returns, including the west virginia partnership return instructions 2023. Our pricing plans are designed to fit various budgets, allowing businesses to choose a plan that meets their needs without overspending. This affordability, combined with our robust features, makes it an ideal choice for small business owners.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, which can enhance your ability to manage the west virginia partnership return instructions 2023. By integrating with tools like QuickBooks or Xero, you can streamline your financial processes and ensure that all tax-related documents are easily accessible and organized.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management provides numerous benefits, including increased efficiency, enhanced security, and improved collaboration. These advantages are particularly relevant when dealing with the west virginia partnership return instructions 2023, as they help ensure that all stakeholders can easily access and sign necessary documents. This leads to faster turnaround times and reduced stress during tax season.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes the security of your documents through advanced encryption and secure cloud storage. When managing sensitive information related to the west virginia partnership return instructions 2023, you can trust that your data is protected against unauthorized access. Our platform complies with industry standards to ensure that your documents remain confidential and secure.

Get more for S CORPORATION & PARTNERSHIP PASS THROUGH ENTITY

Find out other S CORPORATION & PARTNERSHIP PASS THROUGH ENTITY

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter