Form 1040 U S Individual Income Tax Return

What is the Form 1040 U.S. Individual Income Tax Return

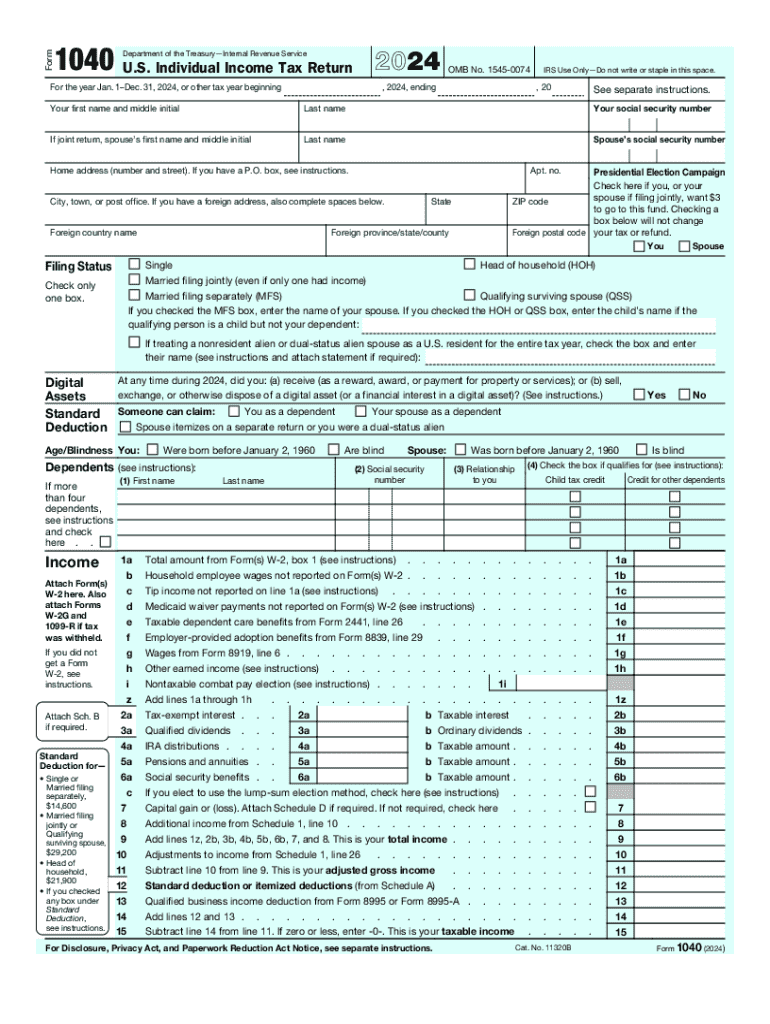

The Form 1040 is the standard federal income tax form used by individuals in the United States to report their income, calculate their tax liability, and determine if they owe additional taxes or are entitled to a refund. This form is essential for filing 2024 taxes and is used to report various types of income, including wages, dividends, and capital gains. The IRS Form 1040 SR is a simplified version designed for seniors aged sixty-five and older, allowing for easier filing.

Steps to Complete the Form 1040 U.S. Individual Income Tax Return

Completing the Form 1040 involves several key steps:

- Gather your documents: Collect all necessary documents, such as W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report your income: Use the appropriate sections to report all sources of income, including wages, interest, and dividends.

- Claim deductions and credits: Identify any deductions or credits you qualify for to reduce your taxable income.

- Calculate your tax: Follow the instructions to determine your tax liability based on your income and deductions.

- Sign and date the form: Ensure you sign the form and include the date before submission.

Filing Deadlines / Important Dates

For 2024 taxes, the deadline to file your Form 1040 is typically April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of estimated tax payment deadlines if they expect to owe taxes. Keeping track of these dates is crucial to avoid penalties and interest on late payments.

Required Documents

To successfully complete the Form 1040, you will need several documents, including:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of other income, such as rental income or dividends

- Documentation for deductions, like mortgage interest statements and medical expenses

- Social Security numbers for yourself and any dependents

Form Submission Methods

You can submit your Form 1040 in several ways:

- Online: Use IRS e-file through approved tax software for a fast and secure submission.

- Mail: Send a paper copy of your completed form to the appropriate IRS address based on your location.

- In-Person: Visit a local IRS office to file your taxes directly with an agent.

IRS Guidelines

The IRS provides detailed guidelines for completing and filing Form 1040. These guidelines cover eligibility criteria, acceptable deductions, and the documentation required for various types of income. Familiarizing yourself with these guidelines ensures compliance and helps maximize your potential refund or minimize your tax liability.

Handy tips for filling out Form 1040 U S Individual Income Tax Return online

Quick steps to complete and e-sign Form 1040 U S Individual Income Tax Return online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a GDPR and HIPAA compliant service for optimum efficiency. Use signNow to electronically sign and send Form 1040 U S Individual Income Tax Return for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040 u s individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can airSlate SignNow help with 2024 taxes?

airSlate SignNow simplifies the process of managing documents related to 2024 taxes by allowing users to eSign and send important tax forms securely. This ensures that all necessary paperwork is completed efficiently, reducing the risk of errors. With our platform, you can easily track the status of your documents, making tax season less stressful.

-

What features does airSlate SignNow offer for 2024 taxes?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage, all designed to streamline your 2024 taxes process. You can create and send tax documents quickly, ensuring compliance and accuracy. Additionally, our user-friendly interface makes it easy for anyone to navigate the eSigning process.

-

Is airSlate SignNow cost-effective for managing 2024 taxes?

Yes, airSlate SignNow offers a cost-effective solution for managing your 2024 taxes. With various pricing plans available, you can choose one that fits your budget while still accessing essential features. This affordability makes it an ideal choice for both individuals and businesses looking to simplify their tax documentation.

-

Can I integrate airSlate SignNow with other tools for 2024 taxes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your workflow for 2024 taxes. This integration allows you to import and export documents easily, ensuring that all your tax-related information is in one place. Streamlining your processes has never been easier.

-

What are the benefits of using airSlate SignNow for 2024 taxes?

Using airSlate SignNow for your 2024 taxes offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your sensitive tax documents are protected while allowing for quick access and easy sharing. This means you can focus more on your financial strategy rather than on document management.

-

How secure is airSlate SignNow for handling 2024 taxes?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive information like 2024 taxes. We utilize advanced encryption and secure cloud storage to protect your documents. Additionally, our compliance with industry standards ensures that your data remains safe throughout the eSigning process.

-

Can I use airSlate SignNow on mobile devices for 2024 taxes?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage your 2024 taxes on the go. Whether you're using a smartphone or tablet, you can easily eSign documents and track their status from anywhere. This flexibility is perfect for busy professionals who need to stay on top of their tax obligations.

Get more for Form 1040 U S Individual Income Tax Return

- Sbi bank loan papper form

- Self declaration for proprietorship in word format fssai

- Doterra enrollment form

- Hospital application form 59699698

- A1 form download

- Developmentally appropriate environment infanttoddler classroom checklist form

- Family therapy treatment plan examples form

- Thank you for your interest in northwestern memorial nmh form

Find out other Form 1040 U S Individual Income Tax Return

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template