500518KANSASK4EMPLOYEES WITHHOLDING ALLOWANCE CERT Form

Understanding the Kansas K-4 Employee's Withholding Allowance Certificate

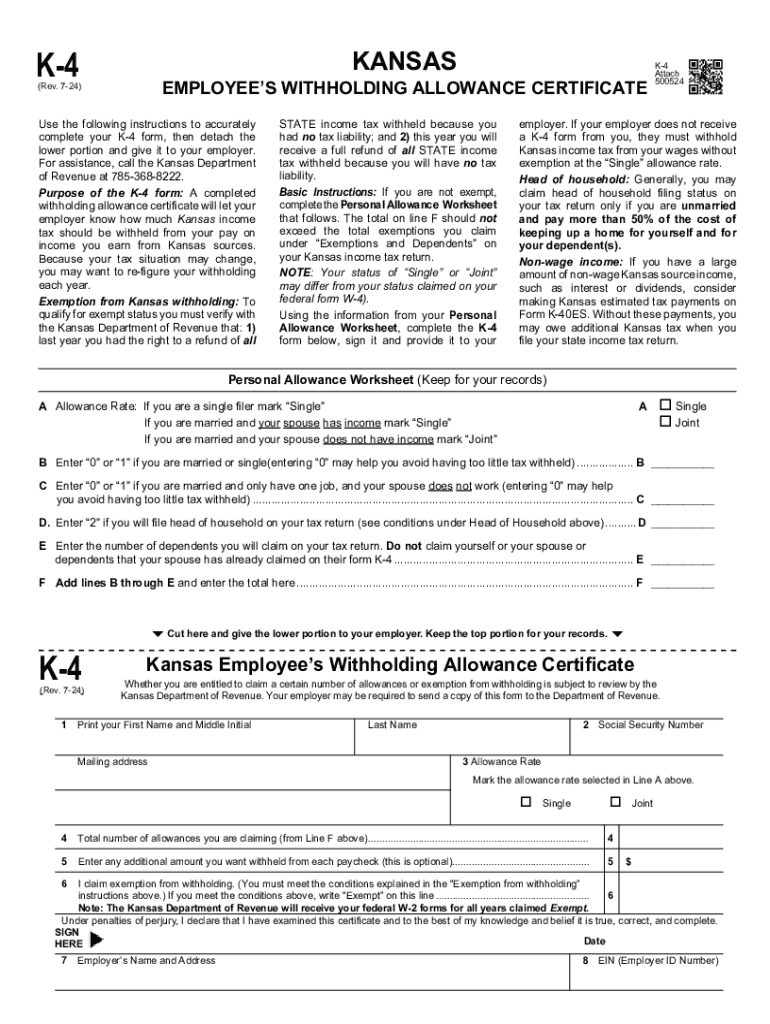

The Kansas K-4 form, officially known as the Kansas Employee's Withholding Allowance Certificate, is a crucial document for employees working in Kansas. This form allows employees to indicate the number of withholding allowances they are claiming, which directly affects the amount of state income tax withheld from their paychecks. Proper completion of the K-4 form ensures that the correct amount of taxes is withheld, helping to avoid underpayment or overpayment of state taxes.

Steps to Complete the Kansas K-4 Form

Completing the Kansas K-4 form involves several straightforward steps:

- Obtain the Form: You can download the K-4 form from the Kansas Department of Revenue website or request a physical copy from your employer.

- Fill in Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Claim Allowances: Indicate the number of allowances you are claiming based on your personal and financial situation. The more allowances you claim, the less tax will be withheld.

- Sign and Date: Ensure you sign and date the form to validate it.

Legal Use of the Kansas K-4 Form

The Kansas K-4 form is legally required for all employees in Kansas who wish to have state income tax withheld from their pay. Employers must keep this form on file for each employee and use it to determine the appropriate amount of state tax to withhold. Failure to submit a K-4 form may result in the employer withholding taxes at the highest rate, which could lead to an unexpected tax burden for the employee at the end of the year.

Eligibility Criteria for the Kansas K-4 Form

To be eligible to complete the Kansas K-4 form, you must be an employee working in Kansas. This includes full-time, part-time, and temporary employees. Additionally, you should have a valid Social Security number and be subject to Kansas state income tax withholding. If you are self-employed or a contractor, you will not use the K-4 form for withholding purposes.

Filing Deadlines for the Kansas K-4 Form

While the K-4 form itself does not have a specific filing deadline, it is important to submit it to your employer as soon as you start a new job or experience a change in your tax situation. This ensures that the correct amount of state income tax is withheld from your first paycheck. Additionally, if you wish to change your withholding allowances, you should submit a new K-4 form promptly to reflect those changes.

Examples of Using the Kansas K-4 Form

Consider a situation where an employee, Jane, starts a new job in Kansas. She completes the K-4 form, claiming two allowances based on her marital status and number of dependents. This results in a lower amount of state tax withheld from her paychecks. Conversely, if another employee, John, claims zero allowances due to his financial circumstances, more tax will be withheld, potentially leading to a tax refund when he files his annual return.

Handy tips for filling out 500518KANSASK4EMPLOYEES WITHHOLDING ALLOWANCE CERT online

Quick steps to complete and e-sign 500518KANSASK4EMPLOYEES WITHHOLDING ALLOWANCE CERT online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a GDPR and HIPAA compliant platform for maximum simplicity. Use signNow to electronically sign and send 500518KANSASK4EMPLOYEES WITHHOLDING ALLOWANCE CERT for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 500518kansask4employees withholding allowance cert

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a K 4 form and why is it important?

The K 4 form is a crucial document used for tax purposes in certain states. It helps individuals and businesses report their income accurately, ensuring compliance with state tax regulations. Understanding the K 4 form is essential for proper financial management and avoiding potential penalties.

-

How can airSlate SignNow help with K 4 form management?

airSlate SignNow simplifies the process of managing K 4 forms by allowing users to create, send, and eSign documents securely. Our platform ensures that all your K 4 forms are stored safely and can be accessed anytime, streamlining your workflow. This efficiency saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for K 4 forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual subscriptions, with options that include features specifically designed for managing K 4 forms. Our cost-effective solution ensures you get the best value for your investment.

-

Are there any integrations available for K 4 form processing?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your K 4 form processing. You can connect with popular tools like Google Drive, Salesforce, and more, allowing for a smooth workflow. These integrations help you manage your documents more efficiently and keep everything organized.

-

What features does airSlate SignNow offer for K 4 forms?

airSlate SignNow provides a range of features designed to facilitate K 4 form management, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your documents are handled efficiently and securely. Additionally, our user-friendly interface makes it easy for anyone to navigate the platform.

-

Can I access my K 4 forms on mobile devices?

Absolutely! airSlate SignNow is optimized for mobile use, allowing you to access and manage your K 4 forms from anywhere. Whether you're in the office or on the go, you can easily send, sign, and store your documents securely. This flexibility enhances productivity and ensures you never miss a deadline.

-

Is airSlate SignNow secure for handling K 4 forms?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your K 4 forms and sensitive information. Our platform is compliant with industry standards, ensuring that your documents are safe from unauthorized access.

Get more for 500518KANSASK4EMPLOYEES WITHHOLDING ALLOWANCE CERT

- Ekurhuleni pensioners rebate form

- Criminal thinking worksheets form

- Motion for early termination of probation template form

- Ncjosi study guide pdf form

- Vaps full form in special education

- How to fill nomination form

- Contoh medical form

- Long term volunteer form the church of jesus christ of latter lds

Find out other 500518KANSASK4EMPLOYEES WITHHOLDING ALLOWANCE CERT

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy