Colorado Trust Form

What is the Colorado Trust

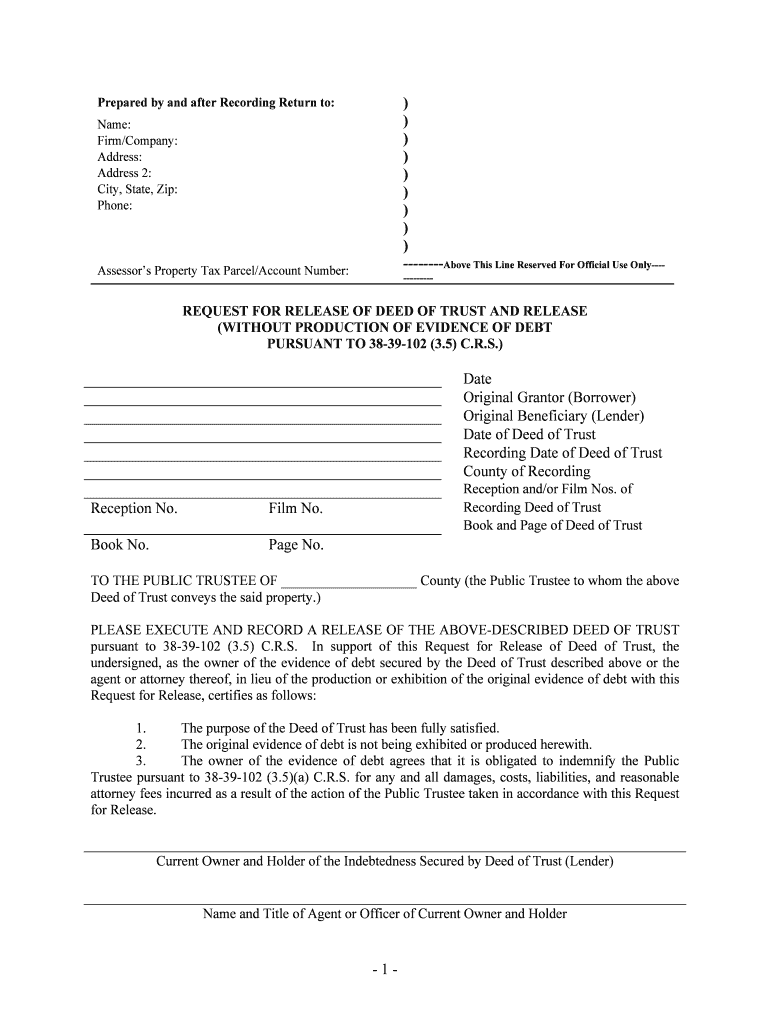

The Colorado Trust is a legal arrangement that allows individuals to manage their assets and property. This form of trust can be used for various purposes, including estate planning, asset protection, and tax benefits. The trust is established by a grantor who transfers assets into the trust, which are then managed by a trustee for the benefit of the beneficiaries. Understanding the Colorado Trust is essential for anyone looking to ensure their assets are handled according to their wishes.

How to use the Colorado Trust

Using the Colorado Trust involves several key steps. First, the grantor must decide on the type of trust that best meets their needs, whether revocable or irrevocable. Next, the grantor needs to draft the trust document, outlining the terms and conditions, including the roles of the trustee and beneficiaries. Once established, the grantor transfers assets into the trust. It is crucial to keep the trust document updated to reflect any changes in circumstances or intentions.

Steps to complete the Colorado Trust

Completing the Colorado Trust requires careful attention to detail. The following steps are typically involved:

- Determine the purpose of the trust and select the appropriate type.

- Draft the trust document, ensuring all legal requirements are met.

- Designate a trustee who will manage the trust assets.

- Transfer ownership of assets into the trust, which may include real estate, bank accounts, and investments.

- Review and sign the trust document in the presence of a notary public.

Legal use of the Colorado Trust

The legal use of the Colorado Trust is governed by state laws, which outline the requirements for creating and maintaining a trust. It is essential to comply with these regulations to ensure that the trust is valid and enforceable. This includes adhering to the formalities of execution, such as having the trust document signed and notarized. Additionally, the trustee must act in the best interests of the beneficiaries and manage the trust assets prudently.

Key elements of the Colorado Trust

Several key elements define the Colorado Trust. These include:

- Grantor: The individual who creates the trust.

- Trustee: The person or entity responsible for managing the trust.

- Beneficiaries: The individuals or organizations that benefit from the trust.

- Trust Document: The legal document that outlines the terms of the trust.

- Assets: The property and funds placed into the trust.

State-specific rules for the Colorado Trust

Each state has its own regulations regarding trusts, and the Colorado Trust is no exception. In Colorado, specific rules govern the creation, administration, and termination of trusts. For instance, the trust must be in writing and signed by the grantor. Additionally, Colorado law provides guidelines on how trustees should manage trust assets and the rights of beneficiaries. Familiarity with these state-specific rules is vital for anyone establishing a trust in Colorado.

Quick guide on how to complete colorado trust

Complete Colorado Trust effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Colorado Trust on any device using the airSlate SignNow mobile applications for Android or iOS, and simplify any document-centric task today.

The simplest way to edit and eSign Colorado Trust effortlessly

- Obtain Colorado Trust and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you prefer. Edit and eSign Colorado Trust and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Colorado trust and how does it benefit me?

A Colorado trust is a legal arrangement that allows you to manage your assets for the benefit of your beneficiaries. It provides numerous benefits, including avoiding probate, minimizing estate taxes, and ensuring your wishes are carried out. By utilizing a Colorado trust, you can have peace of mind knowing your assets are safeguarded and distributed according to your desires.

-

How does airSlate SignNow facilitate the creation of a Colorado trust?

AirSlate SignNow streamlines the process of creating a Colorado trust by allowing you to easily eSign important documents online. This digital solution ensures that your trust-related documents are executed quickly and securely. With airSlate SignNow, you can confidently manage your Colorado trust paperwork from anywhere, enhancing convenience and efficiency.

-

What are the costs associated with setting up a Colorado trust?

The costs to set up a Colorado trust can vary based on factors like the complexity of your assets and legal fees. However, airSlate SignNow provides cost-effective solutions that help reduce overhead expenses associated with managing your Colorado trust documents. By digitalizing the process, you save both time and money while ensuring compliance with legal requirements.

-

Can I integrate airSlate SignNow with my existing Colorado trust management tools?

Yes, airSlate SignNow offers seamless integrations with a range of tools that can help manage your Colorado trust. This capability allows for smooth data flow between platforms, ensuring that your trust administration is efficient and organized. Whether using CRM systems or document storage solutions, airSlate SignNow can enhance your existing processes.

-

What features does airSlate SignNow offer for managing a Colorado trust?

AirSlate SignNow provides essential features for managing a Colorado trust, including document automation, secure eSigning, and easy access to templates. These features simplify the management of your trust documents, ensuring that you can efficiently update or modify your trust whenever necessary. Plus, you can track document status and ensure they are signed promptly.

-

What benefits will I receive from using airSlate SignNow for my Colorado trust?

Using airSlate SignNow for your Colorado trust offers quick and secure document handling, leading to improved efficiency in estate planning. The platform allows you to eSign documents from anywhere, making it easier to update your trust as needed. Additionally, you can rest assured knowing that your sensitive information is handled with top-notch security.

-

Is airSlate SignNow user-friendly for creating a Colorado trust?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, making it straightforward for anyone to create and manage a Colorado trust. The intuitive interface guides you through the steps of document preparation and eSigning, ensuring that you have a smooth experience without needing extensive technical skills.

Get more for Colorado Trust

- Control number id p019 pkg form

- Idaho option to purchase forms and faqus legal forms

- Power of attorney poa form and instructions idaho state tax

- Control number id p025 pkg form

- Contractor formsconstruction contract formsus legal forms

- Control number id p051 pkg form

- Siding contractors form

- Caregiver essentials 5 legal documents you should check on first form

Find out other Colorado Trust

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe