Employer Tax Forms RI Division of Taxation

What is the Employer Tax Forms RI Division Of Taxation

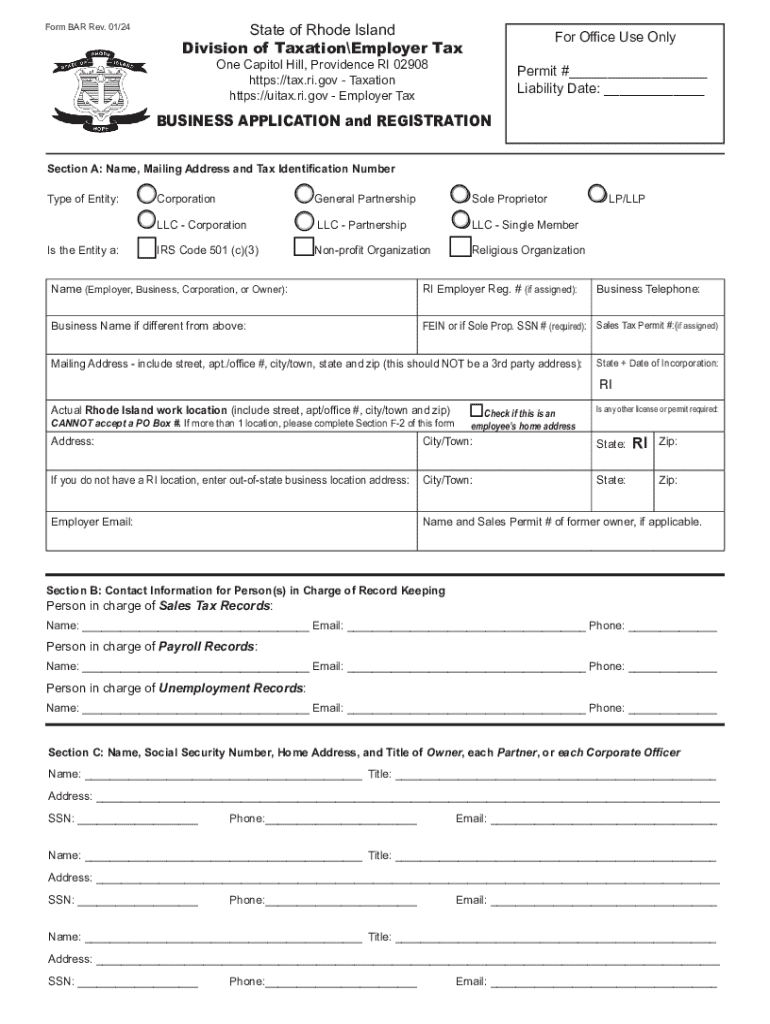

The Employer Tax Forms from the RI Division of Taxation are essential documents that employers in Rhode Island must complete to report and remit various payroll taxes. These forms are used to track employee wages, withholdings, and contributions to state unemployment insurance and other tax obligations. Understanding these forms is crucial for compliance with state tax regulations and ensuring that all required payments are made accurately and on time.

How to use the Employer Tax Forms RI Division Of Taxation

Using the Employer Tax Forms involves several steps to ensure accurate reporting and compliance. Employers should first identify the specific forms required for their business type and payroll structure. Once the appropriate forms are selected, employers can fill them out with the necessary information, including employee details, wages, and tax withholdings. After completing the forms, they must be submitted to the RI Division of Taxation by the specified deadlines to avoid penalties.

Steps to complete the Employer Tax Forms RI Division Of Taxation

Completing the Employer Tax Forms requires careful attention to detail. Follow these steps for accurate completion:

- Gather all necessary employee information, including Social Security numbers and wage details.

- Determine the appropriate forms based on your business structure and payroll requirements.

- Fill out the forms accurately, ensuring all data is correct and complete.

- Review the forms for any errors or omissions before submission.

- Submit the completed forms to the RI Division of Taxation by the designated deadlines.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for employers. The RI Division of Taxation sets specific dates for submitting Employer Tax Forms, which can vary based on the type of tax being reported. Typically, these deadlines align with payroll periods, such as quarterly or annual submissions. Employers should regularly check the RI Division of Taxation website or contact their office for the most current deadlines to ensure compliance and avoid late fees.

Key elements of the Employer Tax Forms RI Division Of Taxation

Key elements of the Employer Tax Forms include essential information that must be accurately reported. This typically encompasses:

- Employer identification details, including name, address, and tax identification number.

- Employee information, such as names, Social Security numbers, and wages.

- Details of tax withholdings and contributions for state unemployment and other applicable taxes.

- Signature and date from an authorized representative of the business.

Legal use of the Employer Tax Forms RI Division Of Taxation

The legal use of Employer Tax Forms is governed by state tax laws and regulations. Employers are required to use these forms to report wages, withholdings, and contributions accurately. Failure to comply with these legal requirements can result in penalties, including fines and interest on unpaid taxes. Therefore, it is vital for employers to understand their obligations and ensure that all forms are completed and submitted correctly.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employer tax forms ri division of taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Employer Tax Forms for RI Division Of Taxation?

Employer Tax Forms for RI Division Of Taxation are official documents that employers must file to report employee wages and withholdings. These forms ensure compliance with state tax regulations and help in calculating the correct amount of taxes owed. Using airSlate SignNow simplifies the process of completing and submitting these forms electronically.

-

How can airSlate SignNow help with Employer Tax Forms for RI Division Of Taxation?

airSlate SignNow provides an easy-to-use platform for businesses to create, send, and eSign Employer Tax Forms for RI Division Of Taxation. The solution streamlines the document management process, ensuring that forms are completed accurately and submitted on time. This reduces the risk of errors and helps maintain compliance with state regulations.

-

What features does airSlate SignNow offer for managing Employer Tax Forms for RI Division Of Taxation?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows specifically for Employer Tax Forms for RI Division Of Taxation. These features enhance efficiency and ensure that all necessary information is captured correctly. Additionally, users can track the status of their forms in real-time.

-

Is there a cost associated with using airSlate SignNow for Employer Tax Forms for RI Division Of Taxation?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options for managing Employer Tax Forms for RI Division Of Taxation. The pricing is competitive and designed to provide value through its comprehensive features. Businesses can choose a plan that best fits their budget and requirements.

-

Can I integrate airSlate SignNow with other software for Employer Tax Forms for RI Division Of Taxation?

Absolutely! airSlate SignNow supports integrations with various software applications, making it easier to manage Employer Tax Forms for RI Division Of Taxation alongside your existing tools. This seamless integration enhances productivity by allowing data to flow between systems without manual entry.

-

What are the benefits of using airSlate SignNow for Employer Tax Forms for RI Division Of Taxation?

Using airSlate SignNow for Employer Tax Forms for RI Division Of Taxation offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform's user-friendly interface allows for quick document preparation and signing, saving time for both employers and employees. Additionally, it helps ensure that all forms are submitted accurately and on schedule.

-

How secure is airSlate SignNow when handling Employer Tax Forms for RI Division Of Taxation?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect Employer Tax Forms for RI Division Of Taxation. The platform ensures that sensitive information is safeguarded throughout the signing process. Users can trust that their data is secure and that they are meeting regulatory requirements.

Get more for Employer Tax Forms RI Division Of Taxation

Find out other Employer Tax Forms RI Division Of Taxation

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy