If Line 3 is over $233,750, See Exemption Worksheet Form

Understanding the Exemption Worksheet for Line 3

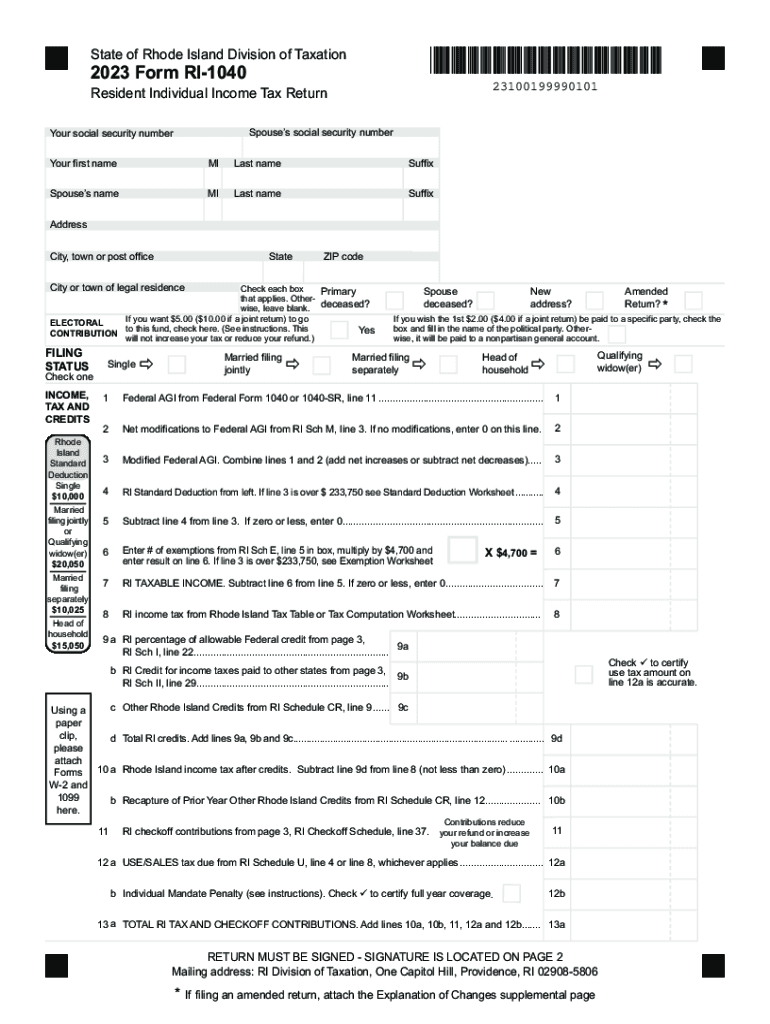

The exemption worksheet for Line 3 is a crucial component in the Rhode Island tax forms process, particularly for those whose income exceeds $233,750. This worksheet helps taxpayers determine their eligibility for specific exemptions that can significantly affect their overall tax liability. By accurately completing this worksheet, individuals can ensure they are not overpaying their taxes and are taking advantage of any exemptions available to them.

Steps to Complete the Exemption Worksheet

Completing the exemption worksheet requires careful attention to detail. Here are the essential steps:

- Begin by gathering all necessary financial documents, including your income statements and previous tax returns.

- Locate Line 3 on your Rhode Island tax form, which will direct you to the exemption worksheet.

- Fill in your total income as reported on your tax return.

- Follow the instructions provided on the worksheet to calculate your exemptions based on your income level.

- Double-check your calculations to ensure accuracy before submitting your tax forms.

Legal Use of the Exemption Worksheet

The exemption worksheet for Line 3 is legally mandated for taxpayers in Rhode Island whose income exceeds the specified threshold. Using this worksheet correctly is essential to comply with state tax laws. Failure to complete it accurately can lead to penalties or an audit, making it vital to understand its legal implications and ensure all entries are truthful and precise.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is critical for Rhode Island taxpayers. Typically, the deadline for submitting your state tax forms, including the exemption worksheet, aligns with federal tax deadlines. For the 2023 tax year, the due date is generally April 15. However, if this date falls on a weekend or holiday, the deadline may shift. Always verify the current year's dates to avoid late penalties.

Required Documents for the Exemption Worksheet

To complete the exemption worksheet accurately, certain documents are necessary. These include:

- Your Rhode Island tax return from the previous year.

- W-2 forms or other income statements.

- Documentation of any additional income sources.

- Records of deductions or credits you plan to claim.

Having these documents on hand will streamline the process and help ensure that you provide accurate information.

Examples of Using the Exemption Worksheet

Understanding how to apply the exemption worksheet can clarify its importance. For instance, if a taxpayer has a total income of $250,000, they would use the worksheet to determine if they qualify for any exemptions that could lower their taxable income. This could result in significant tax savings. Another example is a married couple filing jointly with a combined income of $300,000; they must carefully assess their eligibility for exemptions to optimize their tax outcome.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the if line 3 is over 233750 see exemption worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Rhode Island tax forms and why are they important?

Rhode Island tax forms are official documents required for filing state taxes in Rhode Island. They are essential for individuals and businesses to report income, claim deductions, and ensure compliance with state tax laws. Using the correct Rhode Island tax forms helps avoid penalties and ensures accurate tax reporting.

-

How can airSlate SignNow help with Rhode Island tax forms?

airSlate SignNow simplifies the process of completing and submitting Rhode Island tax forms by allowing users to eSign documents securely and efficiently. Our platform streamlines document management, making it easy to fill out, sign, and send tax forms without the hassle of printing or mailing. This saves time and reduces the risk of errors.

-

Are there any costs associated with using airSlate SignNow for Rhode Island tax forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Each plan provides access to features that facilitate the completion and eSigning of Rhode Island tax forms. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Rhode Island tax forms?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically designed for managing Rhode Island tax forms. Users can easily create, edit, and share tax documents while ensuring compliance with state regulations. These features enhance productivity and streamline the filing process.

-

Can I integrate airSlate SignNow with other software for Rhode Island tax forms?

Absolutely! airSlate SignNow offers integrations with various software applications, including accounting and tax preparation tools. This allows users to seamlessly manage their Rhode Island tax forms alongside their existing workflows, enhancing efficiency and reducing the need for manual data entry.

-

Is airSlate SignNow secure for handling Rhode Island tax forms?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all Rhode Island tax forms are handled with the utmost care. Our platform uses advanced encryption and security protocols to protect sensitive information. You can trust that your tax documents are safe and secure while using our services.

-

What benefits does airSlate SignNow provide for filing Rhode Island tax forms?

Using airSlate SignNow for filing Rhode Island tax forms offers numerous benefits, including time savings, increased accuracy, and enhanced convenience. The ability to eSign documents eliminates the need for physical signatures, while our user-friendly interface makes it easy to navigate the filing process. This leads to a more efficient tax preparation experience.

Get more for If Line 3 Is Over $233,750, See Exemption Worksheet

- Waiver and release from liability for minor child for sorority function form

- Waiver and release from liability for adult for fraternity event form

- Release liability event form

- Waiver release liability form 497427219

- Babysitting form 497427220

- Waiver liability house form

- Waiver and release from liability for minor child for house sitting form

- Waiver liability school form

Find out other If Line 3 Is Over $233,750, See Exemption Worksheet

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free