LT11C Sample Form

What is the LT11C Sample

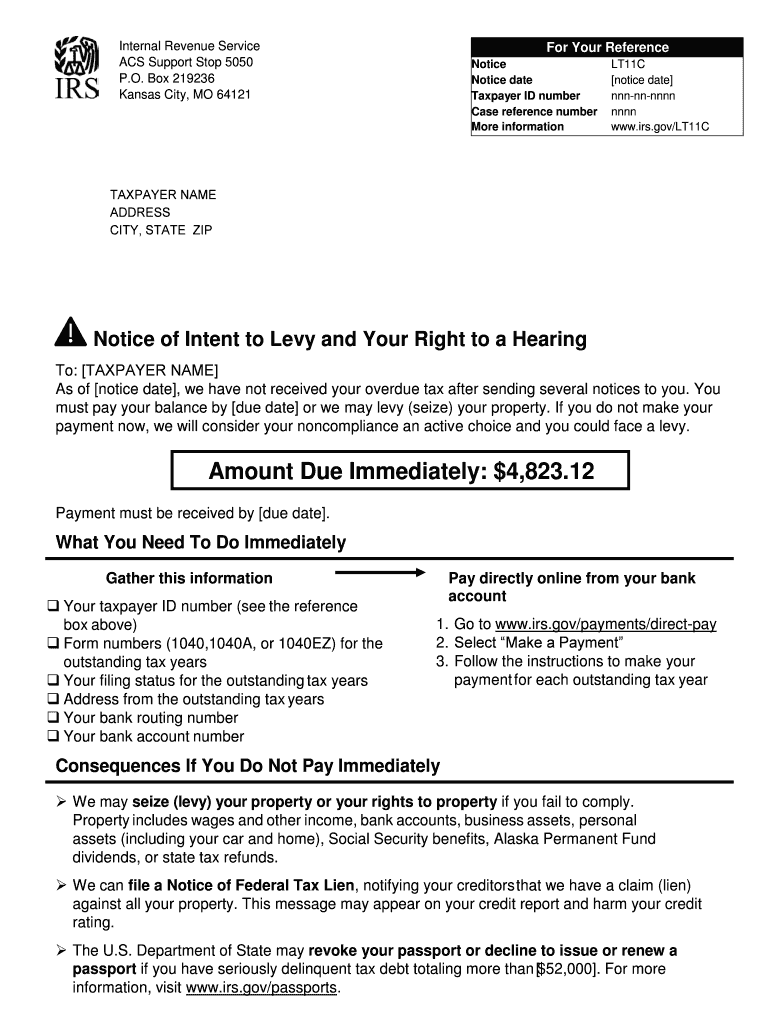

The LT11C Sample is a specific form used primarily for tax-related purposes in the United States. It serves as a critical document for individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax laws and regulations.

How to use the LT11C Sample

Using the LT11C Sample involves filling out the required sections accurately to reflect your financial situation. Begin by gathering all necessary documentation, such as income statements and previous tax returns. Once you have the relevant information, complete the form by entering your details in the designated fields. Ensure that all entries are clear and legible to avoid processing delays.

Steps to complete the LT11C Sample

To successfully complete the LT11C Sample, follow these steps:

- Gather all relevant financial documents.

- Carefully read the instructions provided with the form.

- Fill in your personal information, including your name and Social Security number.

- Report your income and any deductions accurately.

- Review the completed form for errors or omissions.

- Sign and date the form as required.

Legal use of the LT11C Sample

The LT11C Sample must be used in accordance with IRS guidelines to ensure its legal validity. It is important to submit the form by the designated deadlines to avoid penalties. Additionally, maintaining accurate records of your submissions can protect you in case of an audit or inquiry from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the LT11C Sample vary based on the tax year and individual circumstances. Generally, forms must be submitted by April 15 of the following year. It is crucial to stay informed about any changes to deadlines, especially if you are applying for extensions or have specific filing requirements.

Required Documents

When completing the LT11C Sample, you will need several documents to support your claims. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Previous tax returns for reference

Who Issues the Form

The LT11C Sample is issued by the Internal Revenue Service (IRS). This federal agency is responsible for tax collection and enforcement of tax laws in the United States. Understanding the role of the IRS can help you navigate the requirements associated with this form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lt11c sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the LT11C Sample and how can it benefit my business?

The LT11C Sample is a customizable document template designed to streamline your eSigning process. By using the LT11C Sample, businesses can save time and reduce errors in document management, ensuring a more efficient workflow.

-

How much does the LT11C Sample cost?

The LT11C Sample is available through various pricing plans offered by airSlate SignNow. Depending on your business needs, you can choose a plan that includes access to the LT11C Sample along with other features, ensuring you get the best value for your investment.

-

What features are included with the LT11C Sample?

The LT11C Sample includes features such as customizable fields, automated workflows, and secure eSigning capabilities. These features help enhance your document management process, making it easier to collect signatures and manage approvals.

-

Can I integrate the LT11C Sample with other software?

Yes, the LT11C Sample can be easily integrated with various software applications, including CRM and project management tools. This integration allows for seamless document handling and enhances overall productivity within your business.

-

Is the LT11C Sample suitable for all types of businesses?

Absolutely! The LT11C Sample is designed to cater to businesses of all sizes and industries. Whether you are a small startup or a large corporation, the LT11C Sample can be tailored to meet your specific document signing needs.

-

How secure is the LT11C Sample for sensitive documents?

The LT11C Sample is built with robust security features, including encryption and secure access controls. This ensures that your sensitive documents are protected throughout the eSigning process, giving you peace of mind.

-

What support options are available for users of the LT11C Sample?

Users of the LT11C Sample have access to comprehensive support options, including online resources, tutorials, and customer service. This ensures that you can get assistance whenever you need help with the LT11C Sample or any related features.

Get more for LT11C Sample

Find out other LT11C Sample

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate