Form 207F EXT, Application for Extension of Time to File 2023-2026

What is the Form 207F EXT, Application For Extension Of Time To File

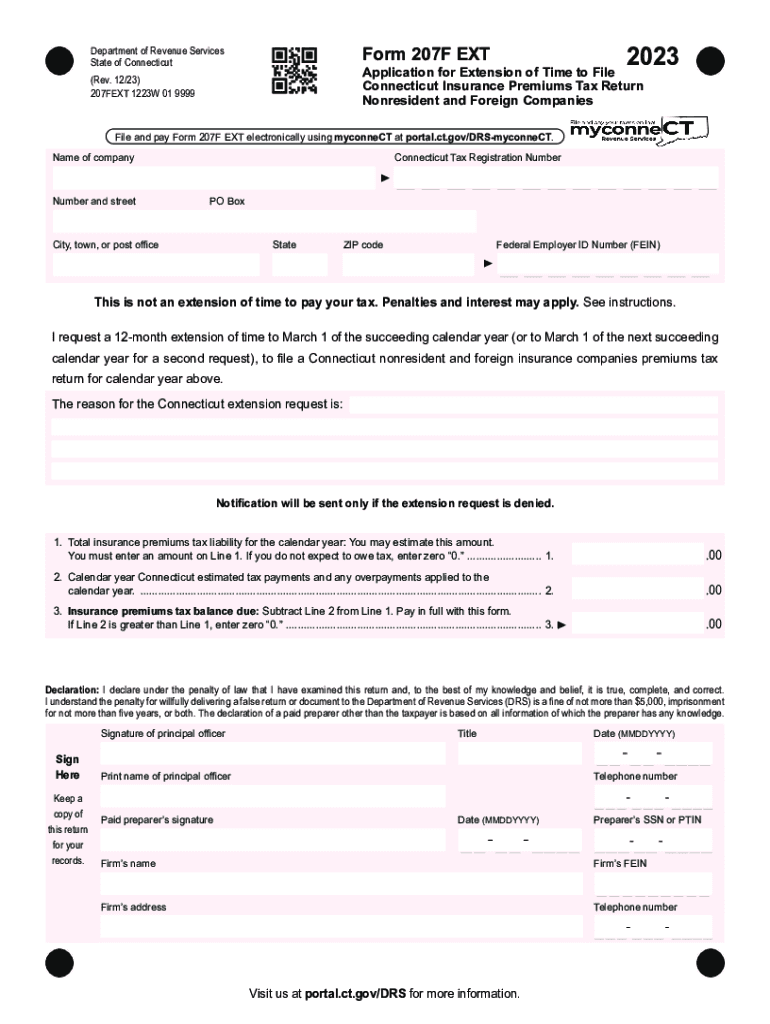

The Form 207F EXT, also known as the Application For Extension Of Time To File, is a crucial document for individuals and businesses seeking additional time to submit their tax returns. This form is typically used when the standard filing deadline is approaching, and the taxpayer requires more time to prepare their return accurately. By submitting this form, taxpayers can avoid penalties associated with late filing while ensuring they have sufficient time to gather necessary financial information.

How to use the Form 207F EXT, Application For Extension Of Time To File

Using the Form 207F EXT involves a few straightforward steps. First, taxpayers must accurately fill out the required information, including personal details and the reason for requesting an extension. After completing the form, it should be submitted to the appropriate tax authority, either electronically or via mail, depending on the specific requirements of the jurisdiction. It is essential to keep a copy of the submitted form for personal records and to confirm the extension has been granted.

Steps to complete the Form 207F EXT, Application For Extension Of Time To File

Completing the Form 207F EXT requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents to support your application.

- Fill in your personal information, including your name, address, and Social Security number or Employer Identification Number.

- Indicate the type of tax return for which you are requesting an extension.

- Provide the reason for the extension request, if applicable.

- Sign and date the form to validate your request.

After completing these steps, submit the form by the specified deadline to ensure compliance with tax regulations.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Form 207F EXT is essential for compliance. Typically, the request for an extension must be submitted by the original tax return due date. For most taxpayers, this date falls on April fifteenth for individual income tax returns. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to check the specific deadlines each year, as they can vary based on individual circumstances and changes in tax law.

Required Documents

When submitting the Form 207F EXT, certain documents may be required to support your request. These can include:

- Personal identification details, such as Social Security number or Employer Identification Number.

- Financial statements or documentation related to income and deductions.

- Any correspondence from the IRS or state tax authorities regarding previous filings.

Having these documents ready can streamline the process and ensure your extension request is processed without delays.

Eligibility Criteria

To be eligible to file the Form 207F EXT, taxpayers must meet specific criteria. Generally, individuals and businesses that are unable to meet the standard tax filing deadline due to extenuating circumstances can apply for an extension. This includes situations such as illness, natural disasters, or other unforeseen events that hinder timely filing. It is important to note that while an extension provides additional time to file, it does not extend the time to pay any taxes owed.

Create this form in 5 minutes or less

Find and fill out the correct form 207f ext application for extension of time to file

Create this form in 5 minutes!

How to create an eSignature for the form 207f ext application for extension of time to file

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 207F EXT, Application For Extension Of Time To File?

The Form 207F EXT, Application For Extension Of Time To File, is a document that allows individuals and businesses to request additional time to file their tax returns. This form is essential for those who may need extra time to gather necessary information or complete their filings accurately.

-

How can airSlate SignNow help with the Form 207F EXT, Application For Extension Of Time To File?

airSlate SignNow simplifies the process of completing and submitting the Form 207F EXT, Application For Extension Of Time To File. Our platform allows users to fill out the form electronically, ensuring accuracy and efficiency while providing secure eSignature options.

-

What are the pricing options for using airSlate SignNow for the Form 207F EXT?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you have access to features that streamline the Form 207F EXT, Application For Extension Of Time To File.

-

Are there any features specifically designed for the Form 207F EXT, Application For Extension Of Time To File?

Yes, airSlate SignNow includes features tailored for the Form 207F EXT, Application For Extension Of Time To File, such as customizable templates, automated reminders, and secure storage. These features enhance the user experience and ensure compliance with filing deadlines.

-

What benefits does airSlate SignNow provide for filing the Form 207F EXT?

Using airSlate SignNow for the Form 207F EXT, Application For Extension Of Time To File, offers numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled efficiently and securely, allowing you to focus on your business.

-

Can I integrate airSlate SignNow with other software for the Form 207F EXT?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage your Form 207F EXT, Application For Extension Of Time To File, alongside your existing tools. This integration helps streamline your workflow and improve overall efficiency.

-

Is it easy to eSign the Form 207F EXT using airSlate SignNow?

Yes, eSigning the Form 207F EXT, Application For Extension Of Time To File, is straightforward with airSlate SignNow. Our user-friendly interface allows you to sign documents electronically in just a few clicks, ensuring a quick and hassle-free experience.

Get more for Form 207F EXT, Application For Extension Of Time To File

Find out other Form 207F EXT, Application For Extension Of Time To File

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer