Form or 20 INS, Oregon Insurance Excise Tax Return 2023-2026

What is the Form OR 20 INS, Oregon Insurance Excise Tax Return

The Form OR 20 INS is the official document used for reporting and paying the Oregon Insurance Excise Tax. This tax applies to insurance companies operating within the state of Oregon, and the form is essential for compliance with state tax regulations. The excise tax is calculated based on the premiums collected by the insurer, and the form must be submitted annually to ensure accurate tax reporting.

Steps to complete the Form OR 20 INS, Oregon Insurance Excise Tax Return

Completing the Form OR 20 INS involves several key steps:

- Gather necessary financial documents, including premium statements and prior year tax returns.

- Calculate the total premiums collected during the tax year.

- Determine the applicable excise tax rate based on the type of insurance provided.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the completed form for any errors or omissions.

- Submit the form by the designated filing deadline.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form OR 20 INS. Typically, the form is due on the fifteenth day of the fourth month following the end of the tax year. For example, if the tax year ends on December 31, the form must be filed by April 15 of the following year. Late submissions may result in penalties, so timely filing is essential.

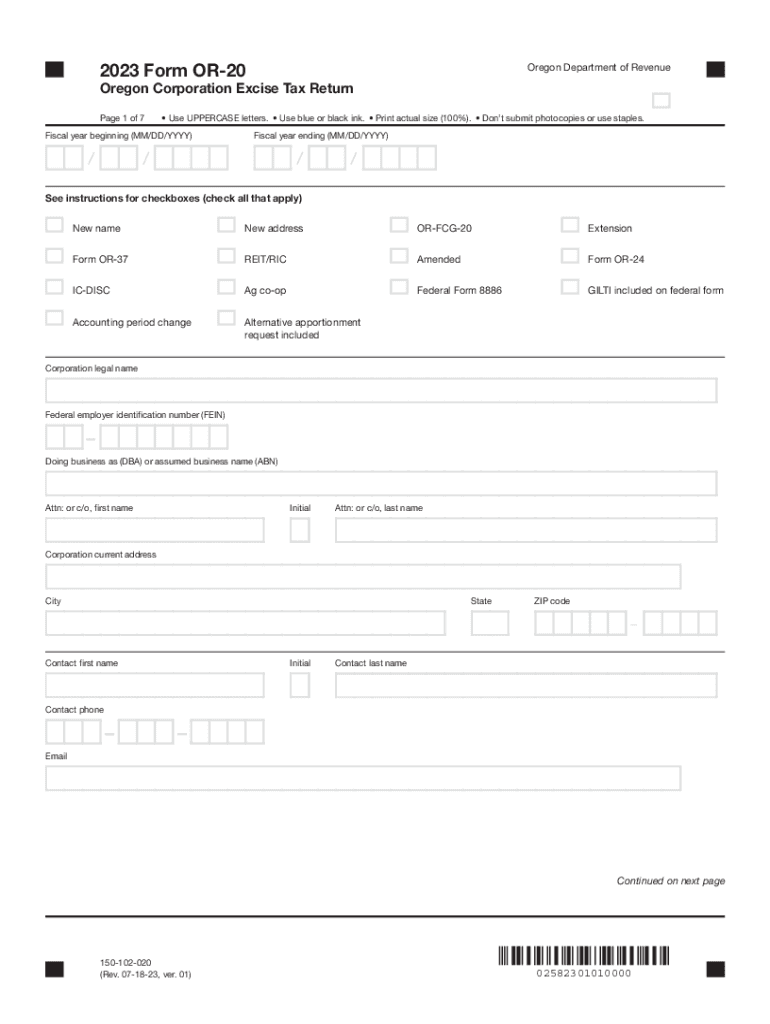

How to obtain the Form OR 20 INS, Oregon Insurance Excise Tax Return

The Form OR 20 INS can be obtained through the Oregon Department of Revenue's official website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, the form may also be available through tax preparation software that supports Oregon tax filings. Ensure you have the most current version of the form to avoid any compliance issues.

Required Documents

When preparing to complete the Form OR 20 INS, certain documents are needed to ensure accuracy:

- Premium statements for the tax year.

- Prior year tax returns for reference.

- Any relevant financial statements that detail income and expenses.

- Documentation of any exemptions or deductions that may apply.

Legal use of the Form OR 20 INS, Oregon Insurance Excise Tax Return

The Form OR 20 INS serves a legal purpose in the state of Oregon as it is required for compliance with state tax laws governing insurance companies. Accurate completion and timely submission of this form are necessary to avoid legal repercussions, including fines or penalties. It is important for insurers to understand their obligations under Oregon law to maintain good standing.

Create this form in 5 minutes or less

Find and fill out the correct form or 20 ins oregon insurance excise tax return

Create this form in 5 minutes!

How to create an eSignature for the form or 20 ins oregon insurance excise tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2020 Oregon 20 and how does it work?

The 2020 Oregon 20 is a comprehensive document management solution that allows businesses to send and eSign documents seamlessly. With airSlate SignNow, users can easily create, send, and track documents, ensuring a smooth workflow. This tool is designed to enhance productivity and streamline the signing process for all types of documents.

-

What are the pricing options for the 2020 Oregon 20?

The pricing for the 2020 Oregon 20 varies based on the features and number of users. airSlate SignNow offers flexible plans that cater to different business needs, ensuring that you only pay for what you use. You can choose from monthly or annual subscriptions, making it a cost-effective solution for businesses of all sizes.

-

What features are included in the 2020 Oregon 20?

The 2020 Oregon 20 includes a variety of features such as customizable templates, real-time tracking, and secure cloud storage. Additionally, it offers advanced eSignature capabilities that comply with legal standards, ensuring that your documents are both secure and valid. These features make it an ideal choice for businesses looking to enhance their document management processes.

-

How can the 2020 Oregon 20 benefit my business?

The 2020 Oregon 20 can signNowly benefit your business by reducing the time spent on document management and increasing efficiency. With its user-friendly interface, employees can quickly send and sign documents, leading to faster turnaround times. This not only improves productivity but also enhances customer satisfaction by providing a seamless experience.

-

Does the 2020 Oregon 20 integrate with other software?

Yes, the 2020 Oregon 20 integrates with various software applications, including CRM systems, cloud storage services, and productivity tools. This integration capability allows businesses to streamline their workflows and maintain a cohesive digital environment. By connecting with other tools, you can enhance the functionality of airSlate SignNow and improve overall efficiency.

-

Is the 2020 Oregon 20 secure for sensitive documents?

Absolutely, the 2020 Oregon 20 prioritizes security and compliance, ensuring that your sensitive documents are protected. airSlate SignNow employs advanced encryption methods and follows industry standards to safeguard your data. This commitment to security makes it a reliable choice for businesses handling confidential information.

-

Can I customize documents using the 2020 Oregon 20?

Yes, the 2020 Oregon 20 allows users to customize documents easily. You can create templates tailored to your specific needs, adding fields for signatures, dates, and other necessary information. This customization feature helps streamline the document creation process and ensures that all necessary details are included.

Get more for Form OR 20 INS, Oregon Insurance Excise Tax Return

- Mass m3 form

- Bursary application form

- Adhd checklist child printable form

- Subtraction grid worksheet form

- Advocate medical records release form

- The corrected and updated anarchist cookbook pdf form

- Application for the purpose of residence of 39highly skilled migrant39 ind form

- Scientific researcher recognised form

Find out other Form OR 20 INS, Oregon Insurance Excise Tax Return

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later