Form or 20, Oregon Corporation Excise Tax Return, 150 102 020 2021

What is the Form OR 20, Oregon Corporation Excise Tax Return

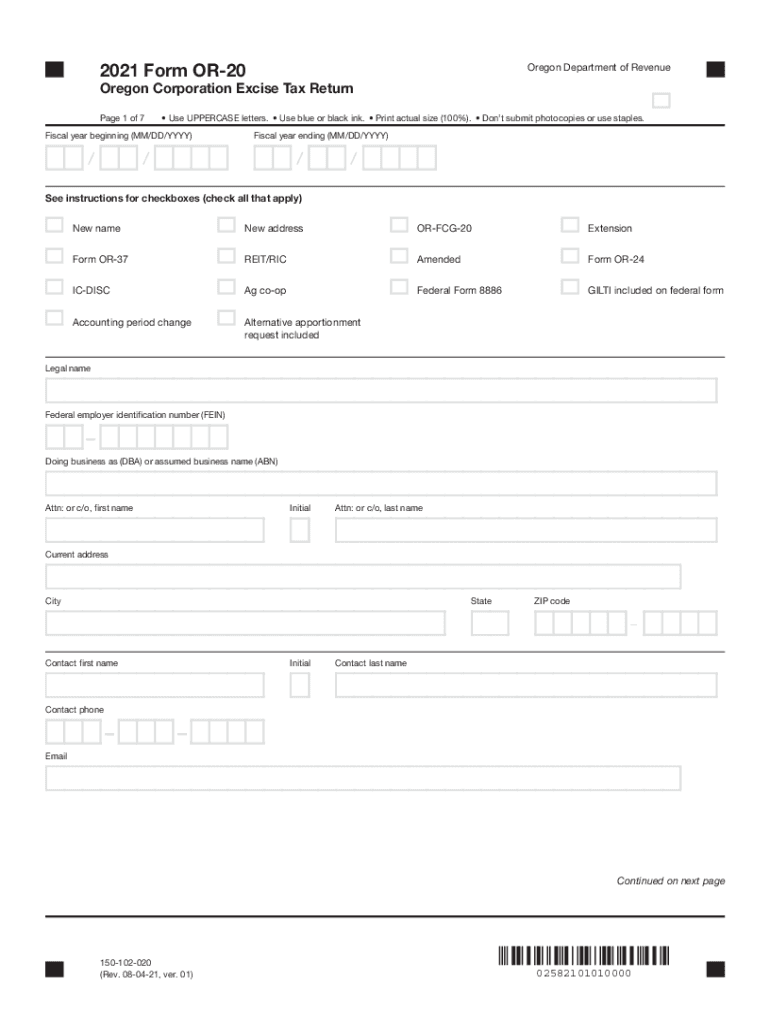

The Form OR 20 is the Oregon Corporation Excise Tax Return, which corporations operating in Oregon must file annually. This form is essential for reporting the corporation's income, deductions, and tax liability to the Oregon Department of Revenue. The OR 20 is specifically designed for corporations, including C corporations and S corporations, that conduct business in the state. Understanding the purpose of this form is crucial for compliance with state tax laws and ensuring that your corporation meets its tax obligations.

Steps to complete the Form OR 20, Oregon Corporation Excise Tax Return

Completing the Form OR 20 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, fill out the form by entering your corporation's gross income, allowable deductions, and calculating the excise tax owed. It's important to double-check all figures for accuracy. After completing the form, sign it and prepare it for submission. Ensure that you keep a copy for your records, as this will be important for future reference and potential audits.

How to use the Form OR 20, Oregon Corporation Excise Tax Return

The Form OR 20 is used to report the income and expenses of your corporation for the tax year. To use the form effectively, begin by entering your corporation's identifying information, including the name, address, and federal employer identification number (EIN). Follow the instructions carefully to report your corporation's total income, including gross receipts and other income sources. Deduct eligible expenses to determine your taxable income. Finally, calculate the excise tax based on the applicable rates and submit the completed form to the Oregon Department of Revenue by the due date.

Filing Deadlines / Important Dates

Filing deadlines for the Form OR 20 are critical for compliance. Corporations must submit their excise tax return by the 15th day of the fourth month following the end of their tax year. For most corporations operating on a calendar year, this means the due date is April 15. It is essential to be aware of any extensions that may apply, as well as any changes to deadlines that could occur due to state regulations. Missing the deadline can result in penalties and interest on unpaid taxes.

Penalties for Non-Compliance

Failure to file the Form OR 20 on time or inaccuracies in reporting can lead to penalties imposed by the Oregon Department of Revenue. These penalties may include a late filing penalty, which is typically a percentage of the unpaid tax amount, and interest on any unpaid taxes. Additionally, corporations that do not comply with disclosure requirements may face further penalties. It is advisable for corporations to ensure timely and accurate filing to avoid these potential repercussions.

Key elements of the Form OR 20, Oregon Corporation Excise Tax Return

The Form OR 20 contains several key elements that are essential for accurate reporting. These include sections for entering the corporation's gross income, allowable deductions, and tax credits. Additionally, the form requires the corporation to provide detailed information about its business activities and any changes in ownership or structure during the tax year. Understanding these elements is crucial for completing the form correctly and ensuring compliance with Oregon tax regulations.

Quick guide on how to complete 2021 form or 20 oregon corporation excise tax return 150 102 020

Effortlessly Prepare Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020 on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to access the correct forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Alter and Electronically Sign Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020 with Ease

- Find Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020 and click on Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Use the available instruments to highlight important sections of your documents or obscure sensitive information with features provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it onto your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks, accessible from your chosen device. Modify and electronically sign Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form or 20 oregon corporation excise tax return 150 102 020

Create this form in 5 minutes!

How to create an eSignature for the 2021 form or 20 oregon corporation excise tax return 150 102 020

The best way to create an e-signature for your PDF document in the online mode

The best way to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an e-signature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an e-signature for a PDF file on Android devices

People also ask

-

What is the airSlate SignNow 2021 form or?

The airSlate SignNow 2021 form or is a comprehensive solution that enables users to send and eSign documents quickly and easily. This platform streamlines the signing process, allowing businesses to manage their paperwork efficiently and securely.

-

What are the pricing options for the 2021 form or?

airSlate SignNow offers flexible pricing plans for the 2021 form or that cater to different business sizes and needs. Whether you're a solo entrepreneur or part of a larger enterprise, you can find a cost-effective solution that suits your budget without sacrificing features.

-

What features does the 2021 form or include?

The 2021 form or includes essential features such as customizable templates, advanced security measures, and real-time tracking of document statuses. These features enhance the user experience, making document management more seamless and efficient.

-

How does the 2021 form or benefit my business?

Using the airSlate SignNow 2021 form or can signNowly enhance productivity by reducing the time spent on paperwork. The ease of sending and signing documents electronically means your team can focus on more important tasks, ultimately driving business growth.

-

Can I integrate the 2021 form or with other software?

Yes, the airSlate SignNow 2021 form or supports integration with various software applications, such as CRMs and project management tools. This flexibility allows users to streamline their workflows and synchronize their operations across multiple platforms.

-

Is the 2021 form or secure for sensitive documents?

Absolutely, the airSlate SignNow 2021 form or prioritizes security with industry-standard encryption and compliance with regulations such as GDPR. This ensures that your sensitive documents are protected throughout the signing process.

-

What industries can benefit from the 2021 form or?

The airSlate SignNow 2021 form or can benefit various industries including healthcare, real estate, finance, and legal sectors. Its versatility makes it an ideal choice for any business that requires efficient document management and electronic signatures.

Get more for Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020

Find out other Form OR 20, Oregon Corporation Excise Tax Return, 150 102 020

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure