Schedule 1 Form 1040 Additional Income and Adjustments to Income 2024

What is the Schedule 1 Form 1040 Additional Income And Adjustments To Income

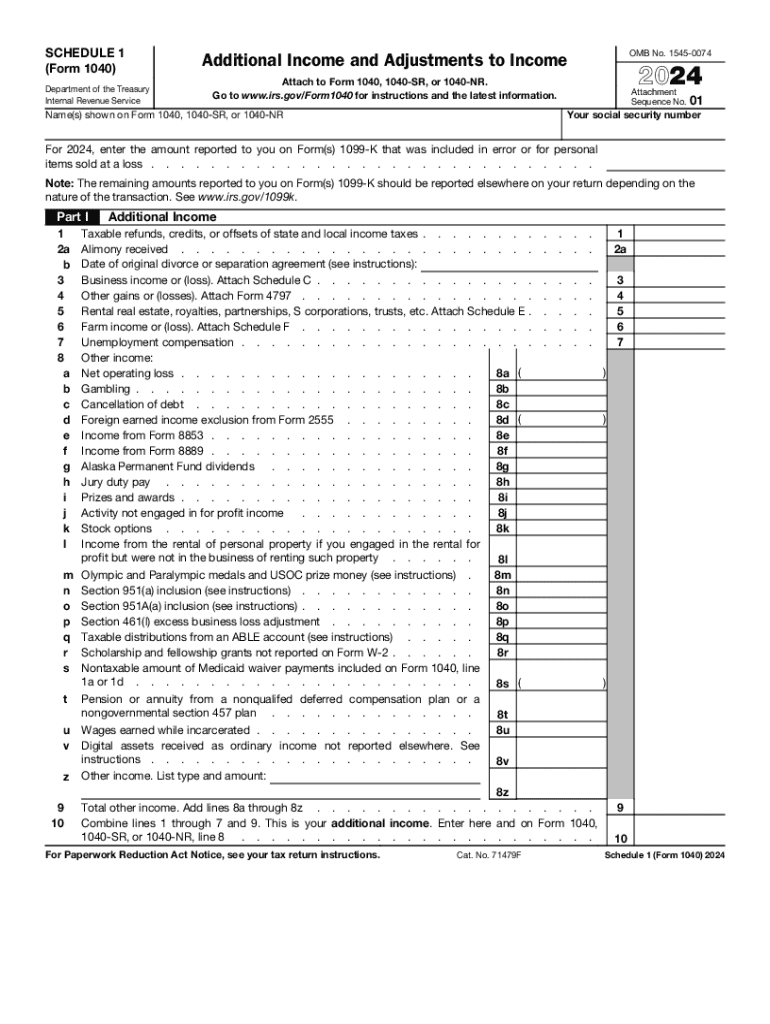

The Schedule 1 tax form for 2021, officially known as the Schedule 1 (Form 1040), is used to report additional income and adjustments to income that are not included directly on the main Form 1040. This form is essential for taxpayers who have specific types of income or deductions that require separate reporting. Examples of additional income include unemployment compensation, prize winnings, or rental income. Adjustments to income may include student loan interest deductions, educator expenses, or contributions to health savings accounts.

How to use the Schedule 1 Form 1040 Additional Income And Adjustments To Income

To effectively use the Schedule 1 form, start by gathering all necessary documentation related to your additional income and adjustments. This may include W-2 forms, 1099 forms, and receipts for deductible expenses. Fill out the form by entering the total amounts for each category of income and adjustments as specified in the instructions. Once completed, attach Schedule 1 to your Form 1040 when filing your federal tax return. Ensure that all figures are accurate to avoid potential issues with the IRS.

Steps to complete the Schedule 1 Form 1040 Additional Income And Adjustments To Income

Completing the Schedule 1 form involves several key steps:

- Gather all relevant documents, including income statements and receipts for adjustments.

- Begin filling out the form by entering your additional income in the designated sections.

- List any adjustments to income, ensuring you have the necessary documentation to support each claim.

- Review the completed form for accuracy and completeness.

- Attach Schedule 1 to your Form 1040 before submitting your tax return.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Schedule 1 tax form. It is crucial to follow these guidelines to ensure compliance and avoid penalties. The instructions detail how to report various types of income and adjustments, including eligibility criteria for each. Taxpayers should refer to the IRS website or the official instructions booklet for the most up-to-date information and any changes for the tax year.

Filing Deadlines / Important Dates

The deadline for filing the 2021 Schedule 1 tax form aligns with the standard tax filing deadline for Form 1040, which is typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any changes to deadlines and plan accordingly to avoid late fees or penalties.

Required Documents

When completing the Schedule 1 form, certain documents are required to accurately report additional income and adjustments. These may include:

- W-2 forms for wages and salaries.

- 1099 forms for various types of income, such as freelance work or interest income.

- Receipts for deductible expenses related to adjustments, like student loan interest or educator expenses.

- Any relevant tax documents that support your claims on the form.

Handy tips for filling out Schedule 1 Form 1040 Additional Income And Adjustments To Income online

Quick steps to complete and e-sign Schedule 1 Form 1040 Additional Income And Adjustments To Income online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant solution for maximum simpleness. Use signNow to electronically sign and share Schedule 1 Form 1040 Additional Income And Adjustments To Income for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct schedule 1 form 1040 additional income and adjustments to income 770308767

Create this form in 5 minutes!

How to create an eSignature for the schedule 1 form 1040 additional income and adjustments to income 770308767

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the schedule 1 tax form 2021?

The schedule 1 tax form 2021 is used to report additional income and adjustments to income that are not listed directly on the main tax form. This includes items like unemployment compensation, prize winnings, and certain deductions. Understanding how to fill out this form correctly is crucial for accurate tax filing.

-

How can airSlate SignNow help with the schedule 1 tax form 2021?

airSlate SignNow provides an efficient platform for electronically signing and sending the schedule 1 tax form 2021. With our user-friendly interface, you can easily manage your tax documents, ensuring they are completed and submitted on time. This streamlines the process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the schedule 1 tax form 2021?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, ensuring you get the best value while managing your schedule 1 tax form 2021 and other documents. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the schedule 1 tax form 2021?

airSlate SignNow includes features such as document templates, real-time tracking, and secure cloud storage, making it easier to manage the schedule 1 tax form 2021. These features enhance collaboration and ensure that all parties can access and sign documents efficiently. Additionally, our platform is designed for ease of use.

-

Can I integrate airSlate SignNow with other software for the schedule 1 tax form 2021?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the schedule 1 tax form 2021. Whether you use accounting software or CRM systems, our integrations help you manage your documents seamlessly.

-

What are the benefits of using airSlate SignNow for the schedule 1 tax form 2021?

Using airSlate SignNow for the schedule 1 tax form 2021 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to sign documents electronically, which saves time and minimizes the risk of losing important paperwork. Additionally, your data is protected with advanced security measures.

-

How do I get started with airSlate SignNow for the schedule 1 tax form 2021?

Getting started with airSlate SignNow for the schedule 1 tax form 2021 is simple. You can sign up for a free trial on our website, explore our features, and start uploading your documents. Our user-friendly interface will guide you through the process of preparing and sending your tax forms.

Get more for Schedule 1 Form 1040 Additional Income And Adjustments To Income

Find out other Schedule 1 Form 1040 Additional Income And Adjustments To Income

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document