CH 2 Tax Return Schedule 1 Form 1040 PDF SCHEDULE 1 2021

What is the 1040 Schedule 1?

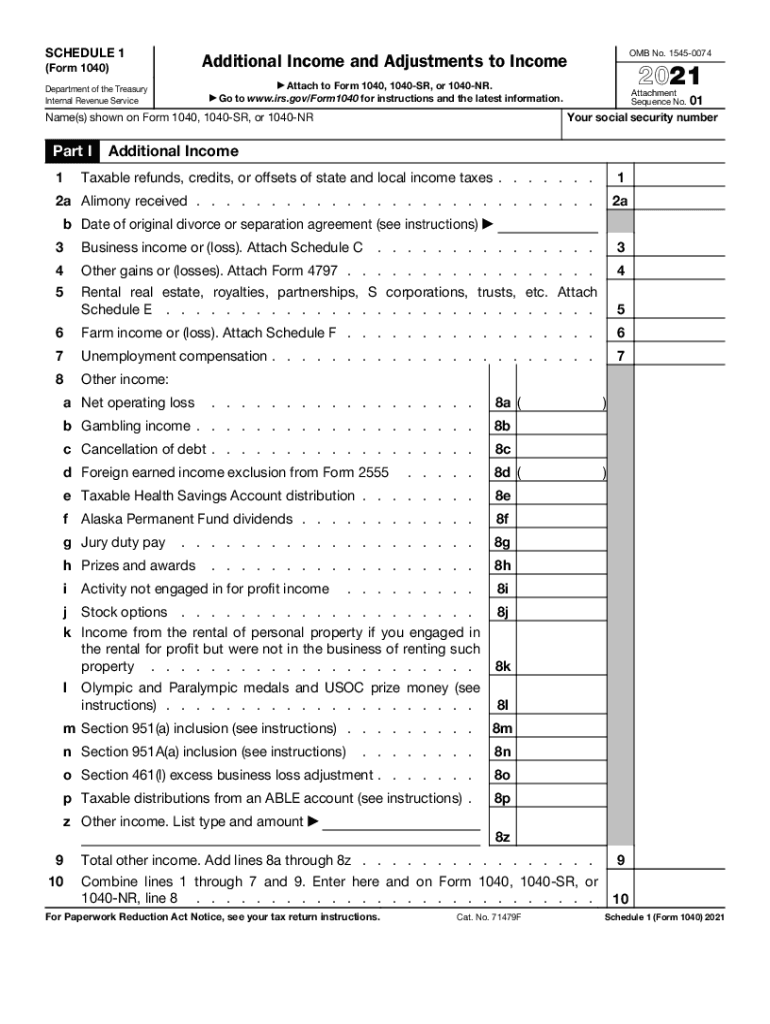

The 1040 Schedule 1 is a supplemental form used by taxpayers in the United States to report additional income and adjustments to income that are not included directly on the main Form 1040. This form is essential for individuals who have specific types of income, such as unemployment compensation, or who wish to claim certain deductions, like educator expenses or the student loan interest deduction. Understanding the purpose of Schedule 1 is crucial for accurate tax reporting and compliance with IRS regulations.

How to obtain the 1040 Schedule 1

Taxpayers can easily obtain the 1040 Schedule 1 by visiting the official IRS website, where the form is available for download in PDF format. Additionally, many tax preparation software programs include this form as part of their offerings, allowing users to fill it out electronically. It is important to ensure that you have the most current version of the form, as tax laws and requirements can change annually.

Steps to complete the 1040 Schedule 1

Completing the 1040 Schedule 1 involves several key steps:

- Begin by entering your personal information at the top of the form, including your name and Social Security number.

- Report any additional income in Part I, which may include unemployment compensation, prize winnings, or other taxable income sources.

- In Part II, list any adjustments to income, such as contributions to a traditional IRA or student loan interest paid.

- Ensure that all entries are accurate and reflect the information from your financial documents.

- Once completed, attach Schedule 1 to your Form 1040 before submission.

Legal use of the 1040 Schedule 1

The 1040 Schedule 1 is legally binding when filled out correctly and submitted to the IRS. It is important to ensure that all information reported is accurate and complete to avoid penalties or issues with your tax return. The form must be signed and dated, affirming that the information provided is true to the best of your knowledge. Utilizing a reliable eSignature solution can help ensure that your submission meets legal requirements.

Filing Deadlines for the 1040 Schedule 1

Taxpayers must be aware of the filing deadlines associated with the 1040 Schedule 1. Generally, the deadline for submitting your federal income tax return, including Schedule 1, is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It's advisable to file as early as possible to avoid any last-minute complications.

Required Documents for the 1040 Schedule 1

To complete the 1040 Schedule 1 accurately, you will need several documents, including:

- Your previous year's tax return for reference.

- Documentation of any additional income sources, such as W-2s or 1099 forms.

- Records of adjustments to income, like receipts for IRA contributions or student loan interest statements.

Having these documents ready will streamline the process and help ensure that your tax return is filed correctly.

Quick guide on how to complete ch 2 tax return schedule 1 form 1040pdf schedule 1

Effortlessly Prepare CH 2 Tax Return Schedule 1 Form 1040 pdf SCHEDULE 1 on Any Device

Online document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and safely store it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents quickly and efficiently. Manage CH 2 Tax Return Schedule 1 Form 1040 pdf SCHEDULE 1 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Effortless Editing and eSigning of CH 2 Tax Return Schedule 1 Form 1040 pdf SCHEDULE 1

- Find CH 2 Tax Return Schedule 1 Form 1040 pdf SCHEDULE 1 and click on Get Form to begin.

- Use the tools available to fill out your document.

- Select pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and has the same legal validity as an ink signature.

- Review the details and click the Done button to save your updates.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign CH 2 Tax Return Schedule 1 Form 1040 pdf SCHEDULE 1 to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ch 2 tax return schedule 1 form 1040pdf schedule 1

Create this form in 5 minutes!

How to create an eSignature for the ch 2 tax return schedule 1 form 1040pdf schedule 1

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

How to generate an e-signature straight from your smartphone

How to make an e-signature for a PDF on iOS

How to generate an e-signature for a PDF document on Android

People also ask

-

What is the 1040 Schedule 1 and why is it important?

The 1040 Schedule 1 is a supplemental form used to report additional income, adjustments, and deductions that are not included on the standard 1040 form. Understanding how to properly complete the 1040 Schedule 1 is crucial for accurate tax reporting and maximizing deductions, as it entails various financial details that could affect your overall tax liability.

-

How does airSlate SignNow help with completing the 1040 Schedule 1?

airSlate SignNow provides a seamless way to electronically sign and send your 1040 Schedule 1 and other tax documents. With user-friendly templates, you can easily fill out and share your forms, ensuring that everything is completed accurately and efficiently, which is vital during tax season.

-

Is there a cost associated with using airSlate SignNow for the 1040 Schedule 1?

Yes, airSlate SignNow offers various pricing plans designed to cater to different business needs. Depending on the features and services you require for managing your 1040 Schedule 1 electronically, you can choose the most cost-effective plan that fits your budget and usage.

-

What benefits does airSlate SignNow provide for filing the 1040 Schedule 1?

Using airSlate SignNow for filing the 1040 Schedule 1 enhances efficiency and reduces the risk of errors. Features like document tracking, reminders, and audit trails ensure that you stay organized throughout the tax filing process, allowing you to focus on other important financial matters.

-

Can I integrate airSlate SignNow with other software for easier management of the 1040 Schedule 1?

Yes, airSlate SignNow offers integration with various third-party applications, making it simple to manage your 1040 Schedule 1 alongside other tools you may be using for accounting and tax preparation. These integrations streamline your workflow and help you maintain all necessary documentation in one place.

-

How secure is airSlate SignNow when handling my 1040 Schedule 1?

AirSlate SignNow prioritizes security and compliance, ensuring that your 1040 Schedule 1 and all related documents are protected. With features like advanced encryption and secure access controls, you can trust that your sensitive tax information remains confidential and secure during the e-signing process.

-

How can I ensure my 1040 Schedule 1 is completed correctly using airSlate SignNow?

To ensure your 1040 Schedule 1 is completed correctly, airSlate SignNow offers helpful templates and a straightforward interface that guides you through each step. By following the built-in prompts and utilizing the review features, you can minimize errors and confidently submit your tax return.

Get more for CH 2 Tax Return Schedule 1 Form 1040 pdf SCHEDULE 1

- Quitclaim deed two individuals to one individual arizona form

- Az special warranty deed form

- Az husband wife 497296972 form

- Warranty trust form

- Transfer on death deed or tod beneficiary deed for husband and wife to four individuals arizona form

- Revocation of transfer on death deed or tod beneficiary deed for husband and wife grantors arizona form

- Warranty deed individual to three individuals arizona form

- Transfer on death deed or tod beneficiary deed for individual to individual arizona form

Find out other CH 2 Tax Return Schedule 1 Form 1040 pdf SCHEDULE 1

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History