Schedule 1 Form 1040 Additional Income and Adjustments to Income 2022

What is the Schedule 1 Form 1040 Additional Income and Adjustments to Income

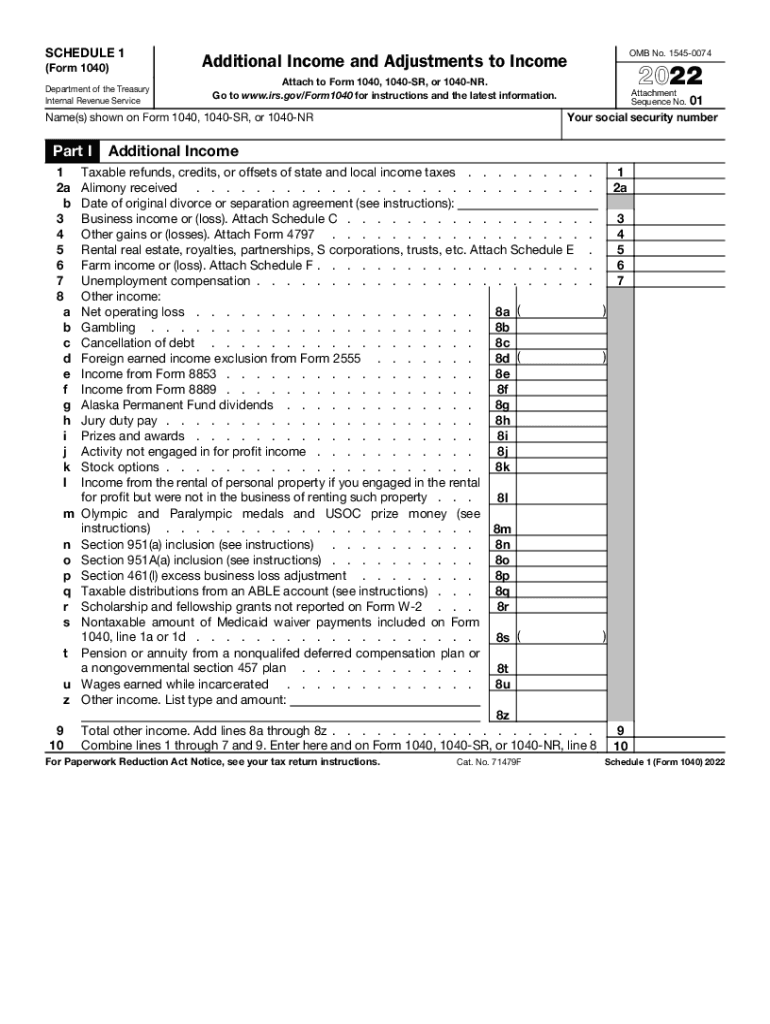

The Schedule 1 Form 1040 is an essential tax document used by individuals in the United States to report additional income and adjustments to income that are not included directly on the main Form 1040. This form allows taxpayers to disclose various types of income, such as unemployment compensation, rental income, and certain business income. Additionally, it provides a space for adjustments like educator expenses, student loan interest deductions, and contributions to retirement accounts. Understanding the Schedule 1 is crucial for accurate tax reporting and ensuring compliance with IRS regulations.

How to use the Schedule 1 Form 1040 Additional Income and Adjustments to Income

Using the Schedule 1 Form 1040 involves several straightforward steps. First, gather all necessary financial documents, including W-2s, 1099s, and records of any additional income. Next, identify the specific types of income you need to report, such as capital gains or unemployment benefits, and fill out the corresponding sections of the form. For adjustments, calculate the amounts you are eligible to claim and enter them in the designated areas. Finally, ensure that you attach Schedule 1 to your Form 1040 when submitting your tax return, whether electronically or by mail.

Steps to complete the Schedule 1 Form 1040 Additional Income and Adjustments to Income

Completing the Schedule 1 Form 1040 requires careful attention to detail. Follow these steps:

- Begin by entering your name and Social Security number at the top of the form.

- In Part I, list any additional income sources. Be thorough and accurate to avoid discrepancies.

- In Part II, detail any adjustments to your income. Ensure you have documentation to support each adjustment you claim.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Attach the Schedule 1 to your Form 1040 before submission.

IRS Guidelines for the Schedule 1 Form 1040

The IRS provides specific guidelines regarding the use of the Schedule 1 Form 1040. It is essential to refer to the latest IRS instructions for the Schedule 1 to understand the requirements fully. These guidelines include eligibility criteria for reporting additional income and the types of adjustments that can be claimed. Additionally, the IRS outlines common mistakes to avoid, such as failing to report all income or miscalculating adjustments. Staying informed about these guidelines helps ensure compliance and minimizes the risk of audits or penalties.

Filing Deadlines / Important Dates for the Schedule 1 Form 1040

Filing deadlines for the Schedule 1 Form 1040 align with the overall tax return deadlines set by the IRS. Typically, the deadline for submitting your federal tax return, including Schedule 1, is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay aware of any changes to these deadlines, especially during tax season, to avoid late filing penalties. Additionally, taxpayers may request an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Key elements of the Schedule 1 Form 1040 Additional Income and Adjustments to Income

The key elements of the Schedule 1 Form 1040 include sections for reporting additional income and adjustments to income. Part I focuses on various types of income that need to be reported, such as business income, unemployment compensation, and other non-standard income sources. Part II addresses adjustments, allowing taxpayers to reduce their taxable income through eligible deductions, such as educator expenses and student loan interest. Understanding these key elements is vital for accurately completing the form and optimizing your tax return.

Quick guide on how to complete 2022 schedule 1 form 1040 additional income and adjustments to income

Complete Schedule 1 Form 1040 Additional Income And Adjustments To Income seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Schedule 1 Form 1040 Additional Income And Adjustments To Income on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to edit and electronically sign Schedule 1 Form 1040 Additional Income And Adjustments To Income effortlessly

- Locate Schedule 1 Form 1040 Additional Income And Adjustments To Income and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Review all details and then click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors requiring new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Schedule 1 Form 1040 Additional Income And Adjustments To Income to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 schedule 1 form 1040 additional income and adjustments to income

Create this form in 5 minutes!

People also ask

-

What is the significance of schedule 1 2022 in eSigning?

Schedule 1 2022 refers to a specific tax form and understanding its relation to eSigning is crucial for businesses. Utilizing airSlate SignNow, you can securely eSign the schedule 1 2022 form, making the filing process more efficient. This ensures that you meet all regulatory requirements promptly.

-

How can airSlate SignNow help me with schedule 1 2022 submissions?

With airSlate SignNow, you can seamlessly prepare and eSign your schedule 1 2022 submissions, minimizing delays and errors. The platform's intuitive interface aids in quickly uploading and sending the necessary forms for signing. This ease of use ensures a smoother submission process.

-

What are the pricing plans for airSlate SignNow for handling schedule 1 2022?

AirSlate SignNow offers various pricing plans that cater to different business needs, especially for managing documents like schedule 1 2022. Each plan includes essential features for eSigning and document management, helping you choose a cost-effective solution. It's designed to provide value regardless of your business size.

-

What features does airSlate SignNow offer for schedule 1 2022 document management?

AirSlate SignNow provides features such as customizable templates, real-time status tracking, and secure cloud storage for schedule 1 2022 documents. These features facilitate efficient document handling and ensure that you can easily access and manage your forms at any time. This helps streamline your workflow.

-

Can I integrate airSlate SignNow with other tools for schedule 1 2022 preparation?

Yes, airSlate SignNow integrates seamlessly with various business tools and software, enhancing your workflow for schedule 1 2022 preparation. This integration allows you to connect with CRMs, email services, and document management systems effortlessly. It simplifies the process and increases efficiency.

-

What are the benefits of using airSlate SignNow for eSigning schedule 1 2022?

Using airSlate SignNow for eSigning schedule 1 2022 provides benefits such as enhanced security, time-saving capabilities, and reduced paper usage. The platform ensures that your documents are protected while offering a fast signing process. This promotes sustainability and efficiency in your business operations.

-

Is airSlate SignNow suitable for small businesses needing to eSign schedule 1 2022?

Absolutely! AirSlate SignNow is designed to be user-friendly and cost-effective, making it ideal for small businesses handling schedule 1 2022 documents. The platform's affordability and essential features cater specifically to smaller operations that require reliable eSigning solutions. It helps you stay organized without overwhelming your budget.

Get more for Schedule 1 Form 1040 Additional Income And Adjustments To Income

Find out other Schedule 1 Form 1040 Additional Income And Adjustments To Income

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation