1040 Schedule 1 2019

What is the 1040 Schedule 1

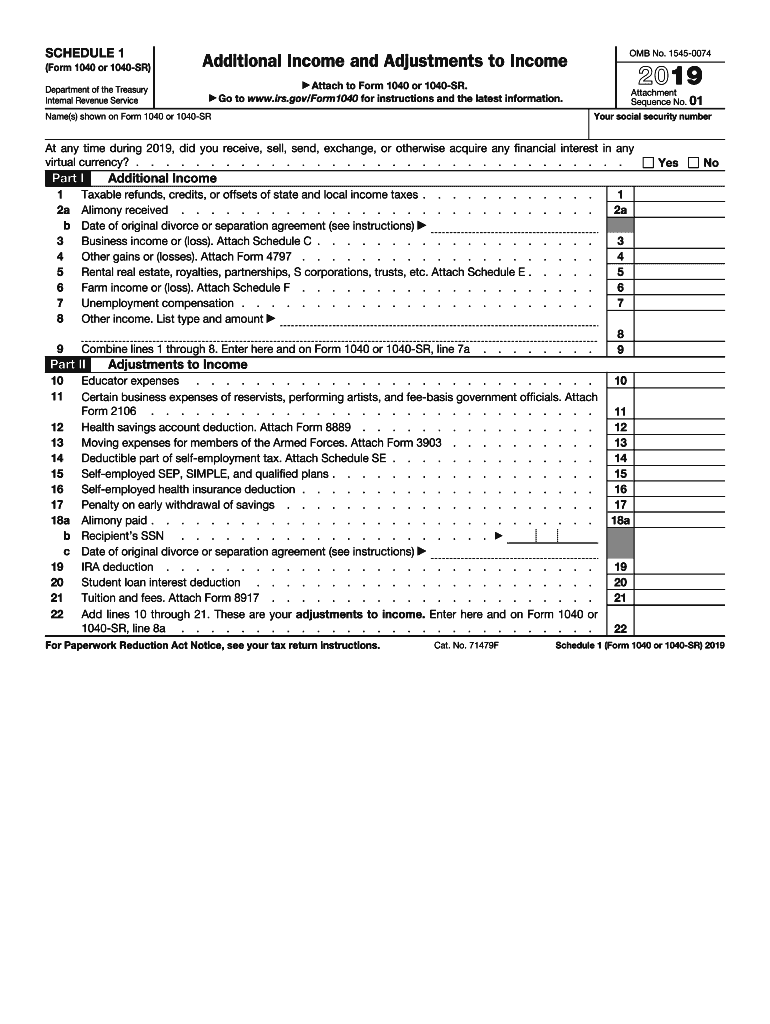

The 1040 Schedule 1 is an essential tax form used by individuals in the United States to report additional income and adjustments to income that are not included directly on the standard IRS Form 1040. This form captures various types of income, such as unemployment compensation, prize winnings, and other less common sources. Additionally, it allows taxpayers to claim certain adjustments, which can reduce their taxable income.

Understanding the 1040 Schedule 1 is crucial for accurately reporting your financial situation to the IRS. By completing this form, you ensure that all relevant income sources and deductions are considered, potentially lowering your overall tax liability.

How to use the 1040 Schedule 1

Using the 1040 Schedule 1 involves filling out the form with specific details regarding your additional income and adjustments. To start, you will need to gather all relevant financial documents that pertain to the income sources you plan to report. This may include W-2 forms, 1099 forms, and records of any other income received during the tax year.

Once you have your documents, you can begin filling out the form. The first section focuses on additional income, where you will list any amounts that apply to you. The second section allows you to report adjustments to income, such as educator expenses or contributions to traditional IRAs. After completing the form, you will attach it to your main Form 1040 when filing your taxes.

Steps to complete the 1040 Schedule 1

Completing the 1040 Schedule 1 involves several straightforward steps:

- Gather documents: Collect all necessary documents, including income statements and records of adjustments.

- Fill in personal information: Enter your name, Social Security number, and other identifying information at the top of the form.

- Report additional income: In Part I, list all applicable additional income sources, ensuring you include the correct amounts.

- Claim adjustments: In Part II, detail any adjustments to income that you qualify for, such as student loan interest or retirement contributions.

- Review and sign: Double-check your entries for accuracy, then sign and date the form before submitting it with your 1040.

Legal use of the 1040 Schedule 1

The legal use of the 1040 Schedule 1 is governed by IRS regulations, which require accurate reporting of all income and adjustments. Failing to complete this form correctly can lead to penalties or audits. It is essential to ensure that all information provided is truthful and supported by documentation.

When used properly, the 1040 Schedule 1 helps maintain compliance with tax laws, allowing taxpayers to benefit from legitimate deductions and accurately report their financial situation. This adherence to legal requirements is crucial for avoiding future complications with the IRS.

IRS Guidelines

The IRS provides specific guidelines for completing the 1040 Schedule 1, which can be found in the instructions accompanying the form. These guidelines outline what constitutes additional income and what adjustments are permissible. It is important to refer to these instructions to ensure compliance with current tax laws.

The IRS also updates these guidelines periodically, so staying informed about any changes is beneficial. Following the IRS guidelines not only helps in accurate reporting but also aids in maximizing potential tax benefits.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 Schedule 1 align with the standard tax filing deadlines set by the IRS. Typically, individual taxpayers must file their tax returns by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day.

It is essential to be aware of any changes to these deadlines, as they can vary each year. Additionally, taxpayers may request an extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete 1040 schedule 1

Accomplish 1040 Schedule 1 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed forms, as you can easily locate the necessary template and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly and without delays. Manage 1040 Schedule 1 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to modify and eSign 1040 Schedule 1 effortlessly

- Find 1040 Schedule 1 and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Mark important parts of the documents or obscure sensitive details using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether via email, text message (SMS), or shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign 1040 Schedule 1 to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040 schedule 1

Create this form in 5 minutes!

How to create an eSignature for the 1040 schedule 1

The best way to generate an electronic signature for your PDF document online

The best way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What are additional income adjustments in airSlate SignNow?

Additional income adjustments in airSlate SignNow refer to modifications made to the income data that may affect your document workflows. This feature allows users to easily amend income-related documents ensuring that all financial information is accurate. Utilizing these adjustments can streamline your eSigning process.

-

How can I benefit from additional income adjustments?

By incorporating additional income adjustments, users can enhance the accuracy of their financial documents. This feature minimizes errors in income reporting and helps maintain compliance with regulations. Ultimately, it promotes efficient workflows and builds trust with stakeholders.

-

Are there any additional costs associated with the additional income adjustments feature?

No, additional income adjustments are included in your airSlate SignNow subscription at no extra cost. This feature adds signNow value by improving the functionality of your document workflows without affecting your budget. It's designed to be a cost-effective solution for businesses.

-

Can I integrate additional income adjustments with other applications?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing for easy implementation of additional income adjustments. Whether you are using CRM systems or accounting software, you can enhance your document management process. This integration boosts overall efficiency.

-

How does airSlate SignNow ensure the security of additional income adjustments?

airSlate SignNow prioritizes security, employing advanced encryption protocols to protect your documents, including those with additional income adjustments. This ensures that sensitive financial information remains confidential and secure. Users can confidently manage their documents without concerns about data bsignNowes.

-

Is training available for using additional income adjustments in airSlate SignNow?

Yes, airSlate SignNow provides comprehensive training resources to help users effectively utilize additional income adjustments. Our tutorials and customer support team will guide you through the features ensuring you can maximize the potential of your documents. This support facilitates a smooth onboarding experience.

-

What types of businesses can benefit from additional income adjustments?

Businesses of all sizes and industries can leverage additional income adjustments in airSlate SignNow. Whether you are a small startup or a large corporation, this feature enhances your document accuracy and efficiency. It's particularly beneficial for those handling financial documents regularly.

Get more for 1040 Schedule 1

Find out other 1040 Schedule 1

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer