State of Connecticut Department of Revenue Services 2022

What is the State of Connecticut Department of Revenue Services?

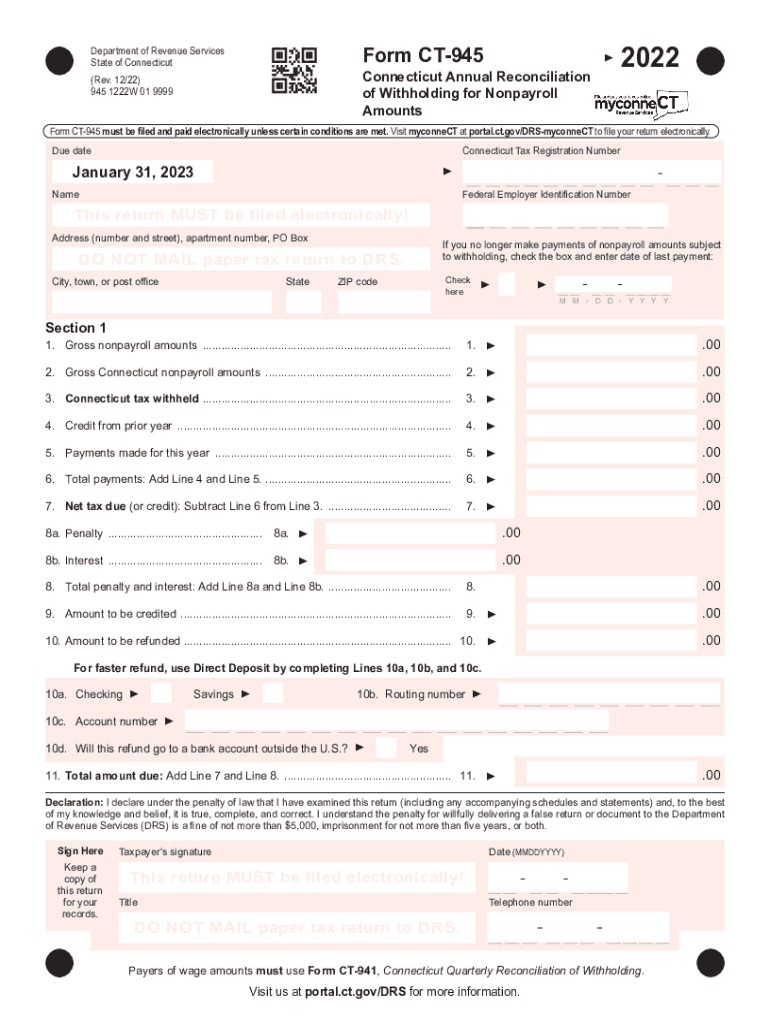

The State of Connecticut Department of Revenue Services (DRS) is the primary agency responsible for administering tax laws and collecting revenue for the state. It oversees various tax programs, including income tax, sales and use tax, and business taxes. The DRS plays a crucial role in ensuring compliance with state tax regulations and providing services to taxpayers, including guidance on forms like the ct 945.

Steps to Complete the State of Connecticut Department of Revenue Services

Filling out forms for the Connecticut Department of Revenue Services, such as the ct 945, involves several key steps:

- Gather necessary information, including income details and tax identification numbers.

- Access the appropriate form, ensuring you have the most current version.

- Carefully fill out the form, following the provided instructions to avoid errors.

- Review the completed form for accuracy before submission.

- Submit the form via your chosen method, ensuring you meet any deadlines.

Form Submission Methods

Submitting the ct 945 can be done through various methods, catering to different preferences:

- Online: Utilize the DRS online portal for quick and efficient submission.

- Mail: Send the completed form to the designated address provided in the form instructions.

- In-Person: Visit a local DRS office to submit your form directly, if preferred.

Required Documents

To complete the ct 945, certain documents may be necessary to support your submission:

- Proof of income, such as W-2 forms or 1099 statements.

- Identification numbers, including Social Security numbers or Employer Identification Numbers (EIN).

- Any prior tax returns that may be relevant to your current filing.

Penalties for Non-Compliance

Failure to comply with the requirements set forth by the Connecticut Department of Revenue Services can result in various penalties:

- Monetary fines based on the amount of tax owed.

- Interest on unpaid taxes, accruing from the due date until payment is made.

- Potential legal action for severe cases of non-compliance.

Eligibility Criteria

Understanding the eligibility criteria for submitting the ct 945 is essential for compliance:

- Taxpayers must have income that is subject to Connecticut income tax.

- Specific thresholds may apply based on filing status and income levels.

- Taxpayers must ensure they meet all residency requirements set by the state.

Quick guide on how to complete state of connecticut department of revenue services

Effortlessly complete State Of Connecticut Department Of Revenue Services on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the correct format and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents rapidly without delays. Handle State Of Connecticut Department Of Revenue Services on any device using the airSlate SignNow applications for Android or iOS and enhance any document-oriented process today.

The simplest way to alter and eSign State Of Connecticut Department Of Revenue Services effortlessly

- Find State Of Connecticut Department Of Revenue Services and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Decide how you wish to share your form, whether via email, SMS, an invitation link, or by downloading it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign State Of Connecticut Department Of Revenue Services and ensure effective communication at any step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of connecticut department of revenue services

Create this form in 5 minutes!

How to create an eSignature for the state of connecticut department of revenue services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 945 in relation to airSlate SignNow?

Ct 945 refers to our comprehensive solution that allows businesses to manage electronic signatures and document workflows. With airSlate SignNow, the ct 945 feature enhances user experience by streamlining processes that require signing, approval, and documentation.

-

How does airSlate SignNow's ct 945 help with document management?

The ct 945 feature within airSlate SignNow provides a seamless way to send, track, and store signed documents. This not only increases efficiency but also ensures security and compliance, making document management straightforward and reliable.

-

What are the pricing options for using ct 945 with airSlate SignNow?

AirSlate SignNow offers various pricing plans tailored to the needs of businesses utilizing the ct 945 feature. These plans are designed to be cost-effective, providing a range of features that suit different organizational requirements without breaking the bank.

-

What features are included with the ct 945 option?

The ct 945 option in airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking of document statuses. These features are essential for businesses looking to enhance their workflow and improve overall productivity.

-

Can I integrate ct 945 with other applications?

Yes, airSlate SignNow's ct 945 can easily integrate with various applications including CRM, storage solutions, and cloud services. This ensures that users can maintain a comprehensive digital ecosystem that boosts workflow efficiency.

-

What are the benefits of using ct 945 for eSigning processes?

Using ct 945 within airSlate SignNow offers numerous benefits including faster turnaround times for document workflows, improved accuracy, and enhanced customer experience. These advantages help businesses to operate more effectively and focus on growth.

-

Is ct 945 secure for handling sensitive documents?

Absolutely, the ct 945 feature in airSlate SignNow incorporates state-of-the-art security measures. These include encryption, authentication, and audit trails that ensure all sensitive documents remain protected throughout the signing process.

Get more for State Of Connecticut Department Of Revenue Services

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts where 497326926 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective 497326927 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497326928 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497326929 form

- Tn corporation form

- Tennessee dissolve llc form

- Living trust for husband and wife with no children tennessee form

- Tn living trust form

Find out other State Of Connecticut Department Of Revenue Services

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document