Form CT 945, Connecticut Annual Reconciliation of 2021

What is the Form CT 945, Connecticut Annual Reconciliation Of

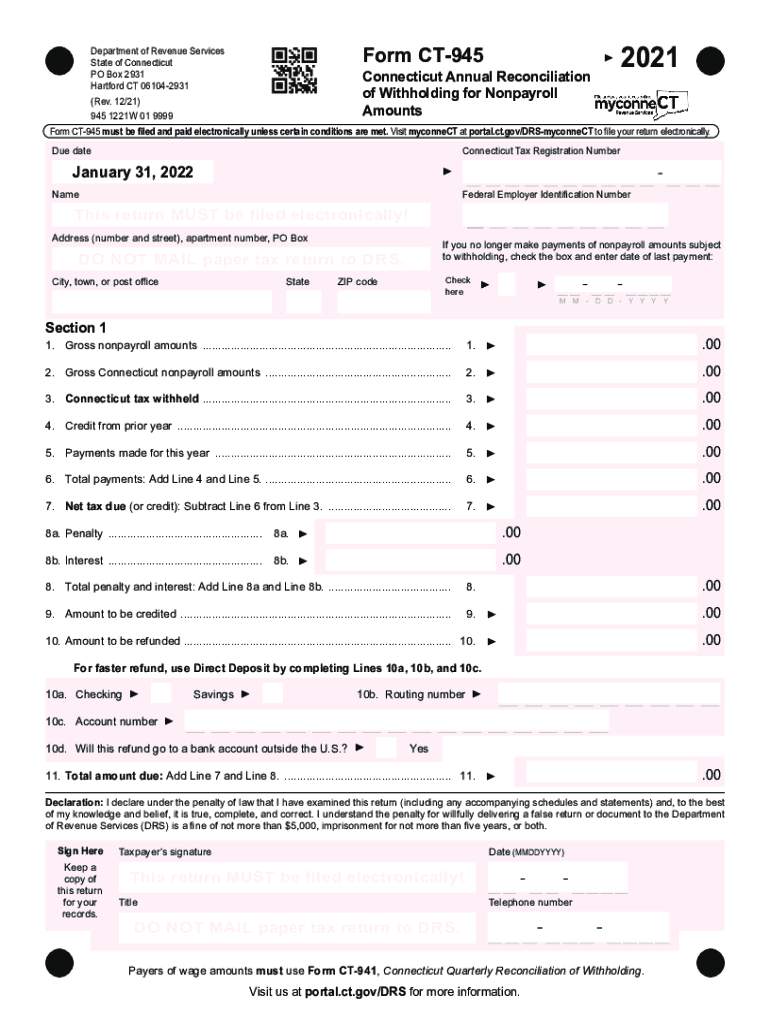

The Form CT 945 is a crucial document used for the annual reconciliation of Connecticut income tax withheld from employee wages. This form is specifically designed for employers to report the total amount of income tax withheld during the year and to reconcile this amount with the payments made to the Connecticut Department of Revenue Services (DRS). By completing this form, employers ensure compliance with state tax regulations and facilitate accurate tax reporting.

Steps to complete the Form CT 945, Connecticut Annual Reconciliation Of

Completing the Form CT 945 involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll records for the year, including total wages paid and taxes withheld. Next, accurately fill in your business information, including your Employer Identification Number (EIN) and the total amount of Connecticut income tax withheld. Ensure that the figures match your payroll records. After completing the form, review it for any errors before submitting it to the Connecticut DRS. Finally, retain a copy of the completed form for your records.

Legal use of the Form CT 945, Connecticut Annual Reconciliation Of

The Form CT 945 is legally binding and must be filed by employers who withhold Connecticut income tax from their employees' wages. This form serves as a declaration of the total tax withheld and reconciles it with the payments made to the state. Failure to file this form accurately and on time can result in penalties and interest charges. Therefore, it is essential for employers to understand their legal obligations regarding the completion and submission of this form.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the Form CT 945 to avoid penalties. The form is typically due by the last day of January following the end of the calendar year. For example, for the tax year ending December 31, the form must be submitted by January 31 of the following year. It is important to stay informed about any changes to these deadlines, as state regulations may vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 945 can be submitted through various methods to accommodate different preferences. Employers have the option to file the form online through the Connecticut DRS website, which offers a streamlined process for electronic submissions. Alternatively, the form can be mailed to the appropriate address provided by the DRS. In-person submissions are also accepted at designated DRS offices. Regardless of the method chosen, ensure that the form is submitted by the deadline to avoid any compliance issues.

Key elements of the Form CT 945, Connecticut Annual Reconciliation Of

Key elements of the Form CT 945 include essential information such as the employer's name, address, and EIN, as well as the total amount of Connecticut income tax withheld. The form also requires a breakdown of the wages paid to employees and the corresponding tax withheld. Additionally, employers must provide a summary of any adjustments made during the year. These elements are crucial for accurate reporting and reconciliation with state tax records.

Quick guide on how to complete form ct 945 2012 connecticut annual reconciliation of

Easily prepare Form CT 945, Connecticut Annual Reconciliation Of on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Form CT 945, Connecticut Annual Reconciliation Of on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric operation today.

The simplest way to modify and electronically sign Form CT 945, Connecticut Annual Reconciliation Of effortlessly

- Locate Form CT 945, Connecticut Annual Reconciliation Of and click on Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize signNow sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or by downloading it to your PC.

Put an end to lost or misplaced documents, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form CT 945, Connecticut Annual Reconciliation Of and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 945 2012 connecticut annual reconciliation of

Create this form in 5 minutes!

How to create an eSignature for the form ct 945 2012 connecticut annual reconciliation of

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is ct 945 and how does it relate to airSlate SignNow?

ct 945 refers to a specific regulatory aspect that businesses must consider when using eSigning solutions. airSlate SignNow complies with all relevant regulations, allowing companies to manage their document processes seamlessly while adhering to ct 945 standards. This ensures that your eSigned documents are legally binding and recognized.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow varies depending on the chosen plan and the number of users. Each plan is designed to provide a cost-effective solution for eSigning needs, allowing businesses to choose the right package that suits their budget while ensuring compliance with regulations like ct 945.

-

What features does airSlate SignNow offer?

airSlate SignNow offers a variety of features including document templates, bulk sending, and secure eSignatures. These features help streamline your document management processes, making it easier to handle compliance measures, including those related to ct 945. The user-friendly interface makes these features accessible to businesses of all sizes.

-

How does airSlate SignNow benefit businesses?

By using airSlate SignNow, businesses can save time and resources with efficient document management and eSigning capabilities. It enhances workflow efficiency while ensuring compliance with ct 945 regulations. This results in faster turnaround times for contracts and agreements, positively impacting your bottom line.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers robust integrations with numerous software applications, including CRMs and document management systems. This flexibility allows you to incorporate eSigning into your existing workflows seamlessly while complying with ct 945 regulations. Integrating these tools can enhance productivity and improve data accuracy.

-

Is airSlate SignNow secure and compliant with industry regulations?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all eSigned documents meet the necessary regulations, including ct 945. With features like encryption, two-factor authentication, and audit trails, you can trust that your documents are safe and legally valid.

-

How can I start using airSlate SignNow for my eSignature needs?

Getting started with airSlate SignNow is easy. You can sign up for a free trial to explore its features and benefits for eSigning documents. This allows you to evaluate how it can help your business stay compliant with ct 945 regulations before committing to a paid plan.

Get more for Form CT 945, Connecticut Annual Reconciliation Of

- Motion and order to refix louisiana form

- Motion release bond 497309022 form

- Louisiana drug test form

- Release obligation form

- Order defendant form

- Louisiana bond 497309026 form

- Motion to remand amount in controversy not in excess of 75000 exclusive of interest and costs louisiana form

- Louisiana succession form

Find out other Form CT 945, Connecticut Annual Reconciliation Of

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors