ME MileageReimbursementTripLog Form 2021-2026

What is the ME Mileage Reimbursement Trip Log Form

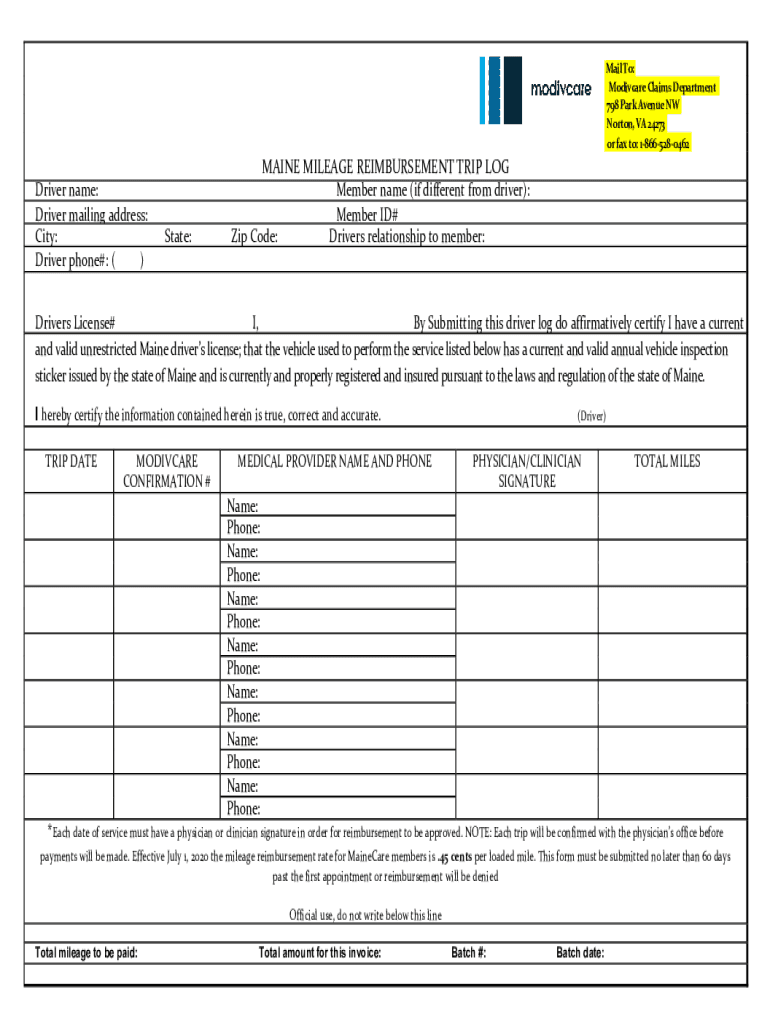

The ME Mileage Reimbursement Trip Log Form is a document used by individuals and businesses in Maine to record travel expenses for reimbursement purposes. This form is essential for accurately tracking miles driven for work-related activities, ensuring that employees or contractors can claim the appropriate reimbursement based on the Maine mileage reimbursement rate for 2023. It typically includes sections for the date of travel, purpose of the trip, starting and ending locations, total miles driven, and any additional notes relevant to the trip.

How to use the ME Mileage Reimbursement Trip Log Form

To effectively use the ME Mileage Reimbursement Trip Log Form, begin by filling in your personal or business information at the top of the form. Next, for each trip, enter the date, purpose, starting point, destination, and total mileage. It is important to maintain accurate records, as this information will be used to calculate your reimbursement based on the current mileage rate. Once completed, submit the form to your employer or the relevant department for processing.

Steps to complete the ME Mileage Reimbursement Trip Log Form

Completing the ME Mileage Reimbursement Trip Log Form involves several straightforward steps:

- Gather necessary information, including dates and destinations of your trips.

- Fill in your personal or business details at the top of the form.

- For each trip, document the date, purpose, starting and ending locations, and total miles driven.

- Double-check your entries for accuracy to ensure proper reimbursement.

- Submit the completed form to the appropriate authority within your organization.

Key elements of the ME Mileage Reimbursement Trip Log Form

The key elements of the ME Mileage Reimbursement Trip Log Form include:

- Date: The specific date of each trip.

- Purpose: A brief description of why the trip was made.

- Starting Location: The address or location where the trip began.

- Ending Location: The address or location where the trip concluded.

- Total Miles Driven: The total distance traveled during the trip.

State-specific rules for the ME Mileage Reimbursement Trip Log Form

Maine has specific rules regarding mileage reimbursement that must be followed when using the ME Mileage Reimbursement Trip Log Form. Employers are required to reimburse employees for business-related travel at the state-approved mileage rate. It is essential to keep accurate records, as discrepancies may lead to delays or denials in reimbursement. Additionally, the reimbursement rate may change annually, so it is important to stay informed about the current rate for 2023.

IRS Guidelines

While the ME Mileage Reimbursement Trip Log Form is specific to Maine, it is also important to adhere to IRS guidelines regarding mileage reimbursement. The IRS allows businesses to deduct mileage expenses for business-related travel, and maintaining a detailed log is crucial for substantiating these deductions. Familiarizing yourself with IRS rules can help ensure compliance and maximize your eligible reimbursements.

Create this form in 5 minutes or less

Find and fill out the correct me mileagereimbursementtriplog form

Create this form in 5 minutes!

How to create an eSignature for the me mileagereimbursementtriplog form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maine mileage reimbursement rate for 2023?

The Maine mileage reimbursement rate for 2023 is set by the state government and is typically updated annually. It is important for businesses to stay informed about this rate to ensure compliance and proper reimbursement for employees using personal vehicles for work-related travel.

-

How can airSlate SignNow help with mileage reimbursement documentation?

airSlate SignNow provides an efficient way to create, send, and eSign mileage reimbursement forms. By utilizing our platform, businesses can streamline the process of documenting mileage claims, ensuring that employees are reimbursed accurately according to the Maine mileage reimbursement rate for 2023.

-

What features does airSlate SignNow offer for managing mileage reimbursements?

Our platform includes features such as customizable templates for mileage reimbursement forms, electronic signatures, and secure document storage. These features help businesses manage their reimbursement processes effectively while adhering to the Maine mileage reimbursement rate for 2023.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. With competitive pricing plans, small businesses can easily manage their document signing and mileage reimbursement needs without exceeding their budgets, especially when considering the Maine mileage reimbursement rate for 2023.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow offers integrations with various accounting and financial software, making it easier to manage mileage reimbursements alongside other financial processes. This ensures that businesses can keep track of expenses in line with the Maine mileage reimbursement rate for 2023.

-

How does airSlate SignNow ensure compliance with state reimbursement rates?

airSlate SignNow allows businesses to customize their reimbursement forms to reflect the current Maine mileage reimbursement rate for 2023. By keeping these forms updated, companies can ensure compliance with state regulations and avoid potential issues with employee reimbursements.

-

What are the benefits of using airSlate SignNow for mileage reimbursement?

Using airSlate SignNow for mileage reimbursement simplifies the process, reduces paperwork, and enhances accuracy. Employees can easily submit their mileage claims, and managers can review and approve them quickly, all while adhering to the Maine mileage reimbursement rate for 2023.

Get more for ME MileageReimbursementTripLog Form

- Gsa form 1655 ampquotpre exit clearance checklistampquot templateroller

- Fillable online department of justice bureau of alcohol form

- United kingdom dental confidential form

- How to file a motion in the special civil part form

- Wwwlacourtorg forms pdfcivil case cover sheet addendum and statement of location

- Order appointing court approved reporter as official reporter pro form

- Cbp form 3229

- Application form for renew driver license

Find out other ME MileageReimbursementTripLog Form

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer