Establishing secure connection…Loading editor…Preparing document…

We are not affiliated with any brand or entity on this form.

Instructions for Form it 204 IP New York Partner's Schedule K

Key elements of the Instructions For Form IT 204 IP New York Partner's Schedule K

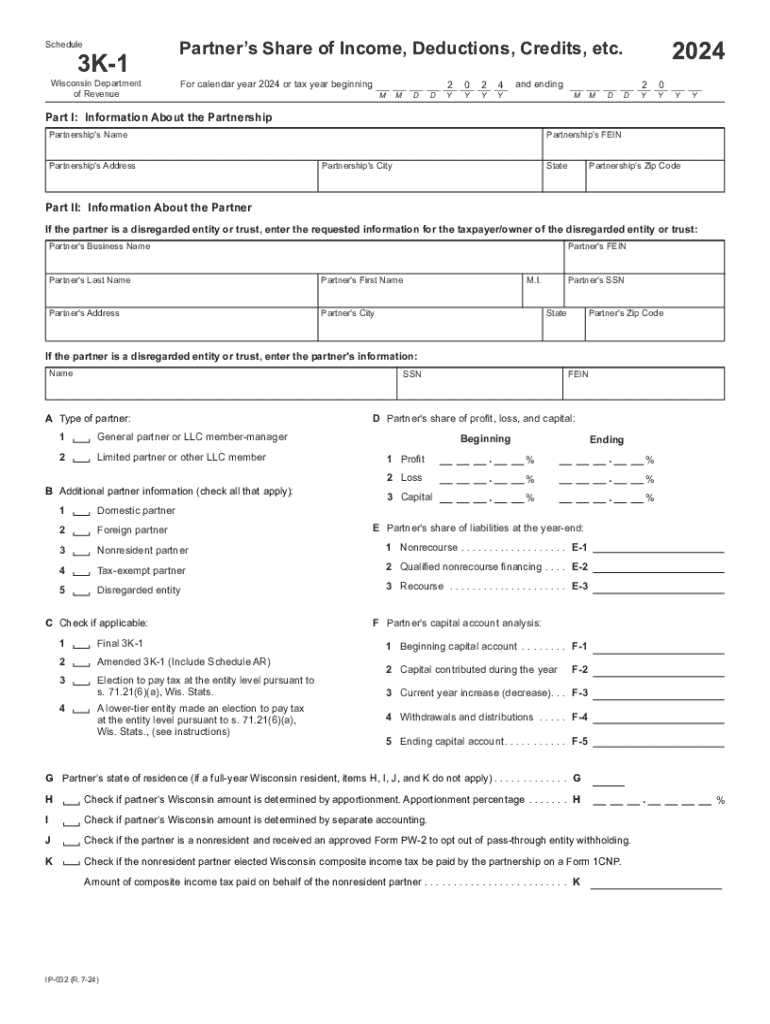

The Instructions for Form IT 204 IP New York Partner's Schedule K provide essential guidance for partners in a partnership to report income, deductions, and credits. Key elements include:

- Identification Information: Partners must provide their name, address, and taxpayer identification number.

- Income Reporting: Detailed instructions on how to report various types of income, including ordinary income and capital gains.

- Deductions and Credits: Guidelines on eligible deductions and credits that partners can claim based on their share of partnership income.

- Filing Requirements: Information on what forms must be filed and the deadlines for submission.

- State-Specific Guidelines: Any additional rules that apply specifically to New York state filings.

Steps to complete the Instructions For Form IT 204 IP New York Partner's Schedule K

Completing the Instructions for Form IT 204 IP involves several detailed steps to ensure accurate reporting:

- Gather all necessary documents, including partnership agreements and prior year tax returns.

- Fill out the identification section with accurate partner information.

- Report all income from the partnership, ensuring to categorize it correctly.

- Include any deductions or credits applicable to your share of the partnership.

- Review the form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for compliance. For Form IT 204 IP, the following dates are important:

- Annual Filing Deadline: Typically due on the fifteenth day of the fourth month following the end of the tax year.

- Extension Requests: If more time is needed, partners can request an extension, which usually provides an additional six months.

Required Documents

When preparing to file Form IT 204 IP, partners should have the following documents ready:

- Partnership agreement detailing profit-sharing arrangements.

- Prior year tax returns for reference.

- Records of income received from the partnership.

- Documentation for any deductions or credits being claimed.

IRS Guidelines

Partners must adhere to IRS guidelines when completing Form IT 204 IP. Key points include:

- Ensure all income is reported accurately to avoid discrepancies.

- Follow the specific instructions provided for each section of the form.

- Maintain records of all submitted forms and supporting documents for at least three years.

Penalties for Non-Compliance

Failure to comply with filing requirements can result in penalties. Important considerations include:

- Late Filing Penalties: Partners may incur fees for submitting the form after the deadline.

- Accuracy-Related Penalties: Incorrect reporting can lead to additional fines or interest on unpaid taxes.

be ready to get more

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 204 ip new york partners schedule k

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How does airSlate SignNow simplify the income tax document signing process?

airSlate SignNow streamlines the income tax document signing process by allowing users to send and eSign documents electronically. This eliminates the need for physical signatures, saving time and reducing errors. With its user-friendly interface, businesses can easily manage their income tax documents from anywhere.

-

What features does airSlate SignNow offer for managing income tax forms?

airSlate SignNow offers a variety of features tailored for managing income tax forms, including customizable templates, automated workflows, and secure cloud storage. These features help ensure that all income tax documents are organized and easily accessible. Additionally, users can track the status of their documents in real-time.

-

Is airSlate SignNow cost-effective for small businesses handling income tax?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing income tax documents. With flexible pricing plans, businesses can choose a package that fits their budget while still accessing essential features. This affordability makes it easier for small businesses to comply with income tax regulations without overspending.

-

Can airSlate SignNow integrate with accounting software for income tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to prepare and file income tax returns. This integration allows users to import data directly from their accounting systems, reducing manual entry and minimizing errors. It enhances the overall efficiency of the income tax preparation process.

-

What are the security measures in place for income tax documents on airSlate SignNow?

airSlate SignNow prioritizes the security of your income tax documents with advanced encryption and secure cloud storage. All documents are protected during transmission and at rest, ensuring that sensitive information remains confidential. Additionally, the platform complies with industry standards to safeguard your data.

-

How can airSlate SignNow help with compliance for income tax regulations?

airSlate SignNow assists businesses in maintaining compliance with income tax regulations by providing audit trails and secure document storage. Users can easily track who signed documents and when, which is crucial for compliance purposes. This transparency helps businesses avoid potential penalties related to income tax filings.

-

What support options are available for users dealing with income tax documents?

airSlate SignNow offers comprehensive support options for users managing income tax documents, including live chat, email support, and an extensive knowledge base. This ensures that users can get assistance whenever they encounter issues or have questions about their income tax processes. The support team is dedicated to helping users maximize their experience.

Get more for Instructions For Form IT 204 IP New York Partner's Schedule K

- Law of reflection worksheet form

- Iowa dot bill of sale form

- Weekly math review q3 2 answer key form

- Leaders building leaders adding value to individuals and organizations name date the wheel of life zig ziglar physical form

- Retirement for sss form

- Physical features of europe worksheet answers form

- E jansampark chandigarh form

- Recording ampamp supporting grant expenditures form

Find out other Instructions For Form IT 204 IP New York Partner's Schedule K

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile

be ready to get more

Get this form now!

If you believe that this page should be taken down, please follow our DMCA take down process here.