Form W 7 COA Rev 7 Certificate of Accuracy for IRS Individual Taxpayer Identification Number 2023-2026

What is the Form W-7 COA Rev 7 Certificate of Accuracy for IRS Individual Taxpayer Identification Number

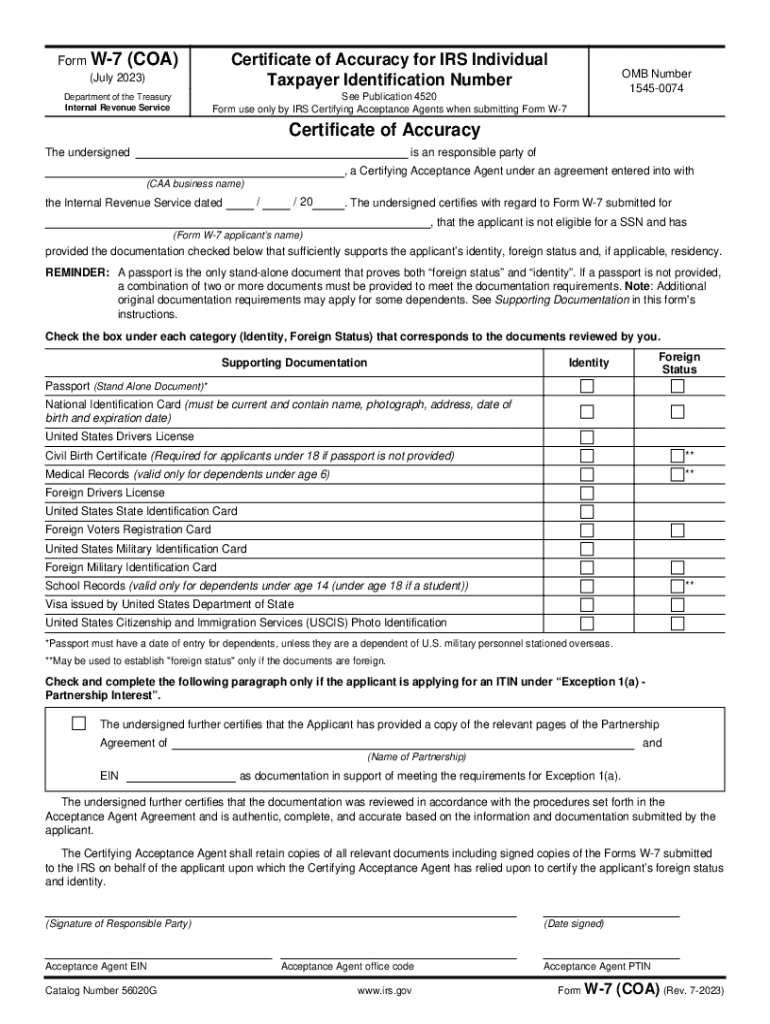

The Form W-7 COA Rev 7, or Certificate of Accuracy, is a document used by individuals applying for an Individual Taxpayer Identification Number (ITIN) from the Internal Revenue Service (IRS). This form serves to certify the accuracy of the information provided on the Form W-7 application. It is essential for individuals who do not qualify for a Social Security number but need to fulfill tax obligations in the United States. The certificate helps ensure that the IRS can accurately process tax returns and other related documents.

How to Use the Form W-7 COA Rev 7 Certificate of Accuracy

To use the Form W-7 COA Rev 7, individuals must complete it alongside their Form W-7 application. This form requires the applicant to provide personal information, including their name, address, and the reason for needing an ITIN. Once completed, the W-7 COA must be submitted to the IRS, typically along with the W-7 application and any required supporting documents. This process helps establish the applicant's eligibility for an ITIN and ensures that all information is verified and accurate.

Steps to Complete the Form W-7 COA Rev 7 Certificate of Accuracy

Completing the Form W-7 COA Rev 7 involves several steps:

- Gather necessary documents, including identification and tax-related paperwork.

- Fill out the Form W-7 application, ensuring all required fields are completed.

- Complete the Form W-7 COA by providing accurate details about your identity and the purpose of the ITIN request.

- Review both forms for accuracy and completeness.

- Submit the forms along with any required documentation to the IRS.

Legal Use of the Form W-7 COA Rev 7 Certificate of Accuracy

The Form W-7 COA Rev 7 is legally recognized by the IRS as a means to validate the information provided by applicants for an ITIN. It is crucial for compliance with U.S. tax laws, especially for individuals who may not have a Social Security number. Proper use of this form ensures that applicants can meet their tax obligations while protecting their rights as taxpayers. Failure to provide accurate information may lead to delays or denial of the ITIN application.

Required Documents for the Form W-7 COA Rev 7 Certificate of Accuracy

When submitting the Form W-7 COA Rev 7, applicants must include several key documents:

- A completed Form W-7 application.

- Proof of identity and foreign status, such as a passport or national identification card.

- Any additional documentation that supports the reason for needing an ITIN.

Having these documents ready can streamline the application process and reduce the likelihood of errors or omissions.

Eligibility Criteria for the Form W-7 COA Rev 7 Certificate of Accuracy

Eligibility for using the Form W-7 COA Rev 7 is primarily based on the need for an ITIN. Individuals who do not qualify for a Social Security number but need to file a tax return or are required to provide a taxpayer identification number for other reasons can apply. This includes non-resident aliens, foreign nationals, and dependents of U.S. citizens or residents. Each applicant must demonstrate their need for an ITIN and provide the necessary documentation to support their request.

Create this form in 5 minutes or less

Find and fill out the correct form w 7 coa rev 7 certificate of accuracy for irs individual taxpayer identification number

Create this form in 5 minutes!

How to create an eSignature for the form w 7 coa rev 7 certificate of accuracy for irs individual taxpayer identification number

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the w7 coa feature in airSlate SignNow?

The w7 coa feature in airSlate SignNow allows users to easily manage and sign documents electronically. This feature streamlines the signing process, making it faster and more efficient for businesses. With w7 coa, you can ensure that all your documents are securely signed and stored.

-

How does airSlate SignNow's w7 coa pricing work?

airSlate SignNow offers competitive pricing for its w7 coa feature, making it accessible for businesses of all sizes. Pricing plans are designed to fit various needs, whether you are a small business or a large enterprise. You can choose a plan that best suits your document signing requirements.

-

What are the benefits of using w7 coa in airSlate SignNow?

Using the w7 coa feature in airSlate SignNow provides numerous benefits, including increased efficiency and reduced turnaround times for document signing. It also enhances security by ensuring that all signatures are legally binding and tamper-proof. Additionally, w7 coa helps in reducing paper usage, contributing to a more sustainable business practice.

-

Can I integrate w7 coa with other applications?

Yes, airSlate SignNow's w7 coa feature can be easily integrated with various applications, enhancing your workflow. This integration allows you to connect with popular tools like Google Drive, Salesforce, and more. By integrating w7 coa, you can streamline your document management processes across different platforms.

-

Is the w7 coa feature user-friendly?

Absolutely! The w7 coa feature in airSlate SignNow is designed with user-friendliness in mind. Its intuitive interface allows users to navigate the document signing process with ease, regardless of their technical expertise. This ensures that everyone in your organization can utilize the w7 coa feature effectively.

-

What types of documents can I sign using w7 coa?

With the w7 coa feature in airSlate SignNow, you can sign a wide variety of documents, including contracts, agreements, and forms. This versatility makes it an ideal solution for businesses across different industries. Whether you need to sign legal documents or internal memos, w7 coa has you covered.

-

How secure is the w7 coa feature?

The w7 coa feature in airSlate SignNow prioritizes security, ensuring that all signed documents are protected. It employs advanced encryption methods and complies with industry standards for electronic signatures. This means you can trust that your documents are safe and legally valid when using w7 coa.

Get more for Form W 7 COA Rev 7 Certificate Of Accuracy For IRS Individual Taxpayer Identification Number

- Character reference sheet template form

- Foster home fire drill report miracle hill miraclehill form

- Tc 656 instructions form

- Matching gift form template

- Discover direct deposit form

- Beneficiary elected transfer form

- Form 8915 f rev january

- Schedule lep form 1040 sp december request for change in language preference spanish version

Find out other Form W 7 COA Rev 7 Certificate Of Accuracy For IRS Individual Taxpayer Identification Number

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy