Irs W 7 Coa 2019

What is the IRS W-7 Certificate of Accuracy (COA)?

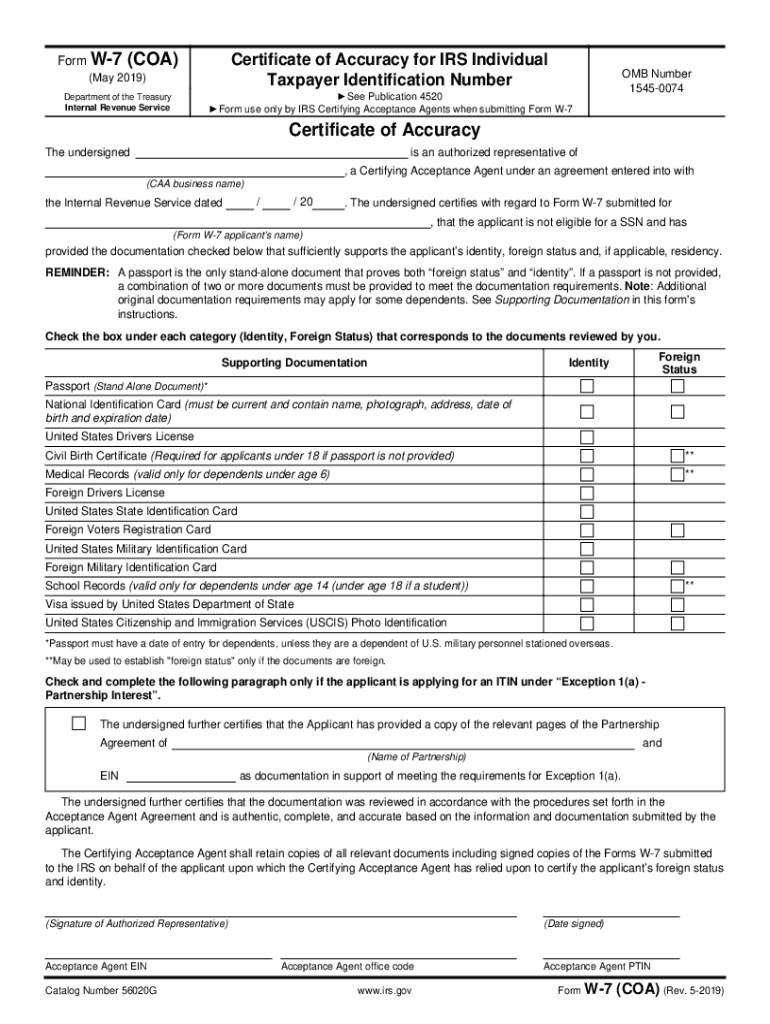

The IRS Form W-7 is used by individuals who are not eligible for a Social Security Number (SSN) but need to obtain an Individual Taxpayer Identification Number (ITIN). The W-7 COA, or Certificate of Accuracy, verifies the information provided on the W-7 form. This certificate is essential for non-resident aliens, their spouses, and dependents who need to file U.S. tax returns or claim tax benefits. The COA ensures that the information submitted is accurate and complete, which helps in processing tax returns efficiently.

Steps to Complete the IRS W-7 COA

Completing the IRS W-7 COA involves several key steps to ensure accuracy and compliance. Begin by gathering the necessary documentation, including proof of identity and foreign status. Next, fill out the W-7 form carefully, ensuring that all information is correct. After completing the form, attach the required documents, such as a copy of your passport or other identification. Finally, submit the W-7 COA along with your tax return to the IRS. It's important to double-check all entries to prevent delays in processing.

Legal Use of the IRS W-7 COA

The IRS W-7 COA serves a legal purpose in the context of U.S. tax law. It is used to validate the identity of individuals who are not eligible for an SSN but need to fulfill their tax obligations. The COA ensures that the information provided is accurate, which is crucial for compliance with IRS regulations. Using the W-7 COA correctly can help avoid potential legal issues related to tax filings and ensure that individuals can access tax benefits they may be entitled to.

Required Documents for the IRS W-7 COA

To successfully complete the IRS W-7 COA, specific documents must be submitted alongside the form. These typically include:

- A valid passport or government-issued ID with a photo

- A birth certificate, if applicable

- Any additional documentation that verifies your foreign status

- Proof of residency, such as utility bills or bank statements

Having these documents ready will streamline the application process and help ensure that your W-7 COA is processed without unnecessary delays.

How to Obtain the IRS W-7 COA

Obtaining the IRS W-7 COA is straightforward. You can download the form directly from the IRS website or request a physical copy through mail. Once you have the form, complete it with accurate information and gather the necessary supporting documents. After ensuring everything is in order, submit the W-7 COA along with your tax return to the IRS. It is advisable to keep copies of all submitted documents for your records.

Filing Deadlines for the IRS W-7 COA

Filing deadlines for the IRS W-7 COA align with the tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If you are filing for an extension, be sure to submit your W-7 COA by the extended deadline to avoid penalties. It is important to stay informed about any changes in tax laws or deadlines that may affect your filing requirements.

Quick guide on how to complete irs w 7 coa

Complete Irs W 7 Coa effortlessly on any device

Web-based document management has become increasingly popular among enterprises and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage Irs W 7 Coa on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign Irs W 7 Coa with no hassle

- Find Irs W 7 Coa and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your adjustments.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Irs W 7 Coa to ensure seamless communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs w 7 coa

Create this form in 5 minutes!

People also ask

-

What is the IRS Form W 7 and when do I need it?

The IRS Form W 7 is used to apply for an Individual Taxpayer Identification Number (ITIN) for individuals who are not eligible for a Social Security number. You need to submit this form if you're required to file a U.S. tax return but do not have a valid SSN. Properly filling out the IRS Form W 7 is crucial to avoid delays in your tax processing.

-

How can airSlate SignNow assist with IRS Form W 7 submissions?

With airSlate SignNow, you can easily create, send, and eSign IRS Form W 7 in a user-friendly digital environment. Our platform simplifies the process, ensuring that all necessary parties can sign off quickly and securely. Utilizing airSlate SignNow can reduce the time and effort needed to submit your IRS Form W 7.

-

What are the pricing options for using airSlate SignNow for IRS Form W 7?

airSlate SignNow offers various pricing plans to fit your business needs, all of which provide access to our powerful features for handling IRS Form W 7 and other documents. Whether you're a small business or a large enterprise, our plans are designed to be cost-effective while ensuring you have the tools needed for seamless document management.

-

Does airSlate SignNow offer any integrations for managing IRS Form W 7?

Yes, airSlate SignNow integrates with numerous applications including CRM systems, cloud storage services, and productivity tools. These integrations can help you manage the entire process of filling out and submitting IRS Form W 7 more efficiently, allowing for a smoother workflow across your platforms.

-

What security measures does airSlate SignNow implement for IRS Form W 7?

airSlate SignNow prioritizes your security, employing encryption and other robust security measures to protect sensitive information on IRS Form W 7. Our platform complies with industry standards to ensure that your documents are safe from unauthorized access and bsignNowes.

-

How does airSlate SignNow improve the signing process for IRS Form W 7?

airSlate SignNow streamlines the signing process for IRS Form W 7 by allowing multiple signers to review and sign the document electronically. This reduces the turnaround time signNowly and helps ensure that your documents are completed accurately and promptly, catering to busy schedules and deadlines.

-

Can I track the status of my IRS Form W 7 with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that enable you to monitor the status of your IRS Form W 7 as it moves through the signing process. You’ll receive notifications and updates, ensuring you are always informed about where your document stands.

Get more for Irs W 7 Coa

- Waiver and release from liability for minor child for go cart track form

- Waiver and release from liability for adult for observatory or arboretum form

- Release minor child form 497427123

- Liability adult form

- Waiver and release from liability for minor child for scuba diving and skin diving form

- Release adult 497427126 form

- Waiver and release from liability for minor child for cultural or ethnic events form

- Waiver petting zoo 497427128 form

Find out other Irs W 7 Coa

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form