W 7 Coa 2011

What is the W-7 COA?

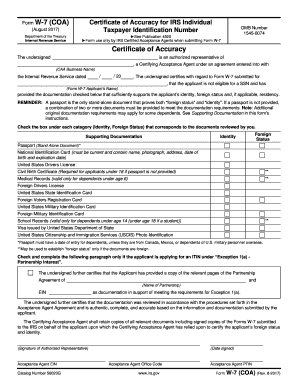

The W-7 COA, or Certificate of Accuracy, is a form used by individuals who need to verify their identity and foreign status when applying for an Individual Taxpayer Identification Number (ITIN). This form is primarily utilized by non-resident aliens who are not eligible for a Social Security Number but require a taxpayer identification number for U.S. tax purposes. The W-7 COA serves as a crucial document to ensure compliance with IRS regulations, enabling individuals to fulfill their tax obligations accurately.

How to use the W-7 COA

To use the W-7 COA effectively, individuals must first complete the form accurately, providing all required personal information, including name, address, and reason for needing an ITIN. Once completed, the form must be submitted along with supporting documents that establish identity and foreign status. These documents may include a passport, national identification card, or other government-issued identification. It is essential to follow IRS guidelines closely to ensure that the application is processed smoothly.

Steps to complete the W-7 COA

Completing the W-7 COA involves several key steps:

- Obtain the W-7 COA form from the IRS website or authorized sources.

- Fill out the form with accurate personal information, ensuring all fields are completed.

- Gather necessary supporting documents that verify your identity and foreign status.

- Submit the completed form along with the supporting documents to the IRS.

- Await confirmation from the IRS regarding your application status.

Legal use of the W-7 COA

The W-7 COA is legally binding when filled out correctly and submitted according to IRS regulations. It is essential for individuals to understand that providing false information can lead to penalties or denial of the application. The form must be used solely for its intended purpose, which is to obtain an ITIN for tax reporting purposes. Compliance with IRS guidelines ensures that the form remains valid and legally recognized.

Required Documents

When submitting the W-7 COA, it is crucial to include specific documents that support your application. Required documents typically include:

- A valid passport or other government-issued identification.

- Birth certificate, if applicable.

- Any documents that confirm your foreign status and identity.

These documents must be original or certified copies to ensure authenticity and compliance with IRS requirements.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the W-7 COA is essential for timely processing. Generally, applications should be submitted as soon as the need for an ITIN arises, especially if it is related to a tax return. The IRS recommends submitting the W-7 COA at least a few weeks before tax deadlines to allow for processing time. Keeping track of important dates, such as tax return submission deadlines, ensures compliance and avoids potential penalties.

Quick guide on how to complete w 7 coa

Prepare W 7 Coa effortlessly on any device

Digital document management has become widely adopted by businesses and individuals. It serves as an excellent environmentally friendly substitute for conventional printed and signed papers, as you can obtain the appropriate format and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, alter, and electronically sign your documents swiftly without any holdups. Handle W 7 Coa on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The easiest method to modify and electronically sign W 7 Coa seamlessly

- Locate W 7 Coa and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign W 7 Coa and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 7 coa

Create this form in 5 minutes!

People also ask

-

What is w7coa and how does it work with airSlate SignNow?

W7coa is a key feature of airSlate SignNow that streamlines the document signing process. With w7coa, users can easily send and eSign documents in a few clicks, enhancing workflow efficiency. This ensures that all your important documents are signed securely and promptly.

-

How much does airSlate SignNow with w7coa cost?

The pricing for airSlate SignNow featuring w7coa varies based on the subscription plan you choose. We offer several tiers to accommodate different business sizes and needs, ensuring you only pay for what you require. For detailed pricing, please visit our website.

-

What are the primary benefits of using w7coa in airSlate SignNow?

W7coa simplifies the eSigning process, allowing for faster document turnaround and improved productivity. By using w7coa, businesses can reduce paper usage and enhance their professional image with streamlined electronic signatures. Additionally, it provides a secure environment for signing sensitive documents.

-

Which integrations does airSlate SignNow offer with w7coa?

airSlate SignNow with w7coa integrates seamlessly with various applications like Google Drive, Dropbox, and CRM systems. These integrations allow users to enhance their existing workflows without disruption. To see a full list of integrations, please check our integration page.

-

Is it easy to get started with w7coa on airSlate SignNow?

Absolutely! Getting started with w7coa on airSlate SignNow is straightforward and user-friendly. Once you sign up for an account, our intuitive interface guides you through setting up your first document for eSigning. You can be up and running in minutes.

-

What types of documents can I sign using w7coa in airSlate SignNow?

With w7coa in airSlate SignNow, you can sign a variety of document types, including contracts, agreements, and forms. The platform supports multiple file formats, ensuring you can manage all your document signing needs in one place. This versatility makes it ideal for businesses of all sectors.

-

Can I track the status of my documents signed with w7coa?

Yes, airSlate SignNow provides tracking capabilities for documents signed using w7coa. You'll receive notifications at each stage of the signing process, allowing you to stay updated. This feature ensures you never miss a step and can manage your documents efficiently.

Get more for W 7 Coa

- Warranty deed from two individuals to husband and wife utah form

- Ut llc company 497427395 form

- Utah disclaimer 497427396 form

- Cancellation of lien by individual utah form

- Quitclaim deed by two individuals to llc utah form

- Warranty deed from two individuals to llc utah form

- Utah lien 497427401 form

- Renunciation and disclaimer of property received by intestate succession utah form

Find out other W 7 Coa

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now