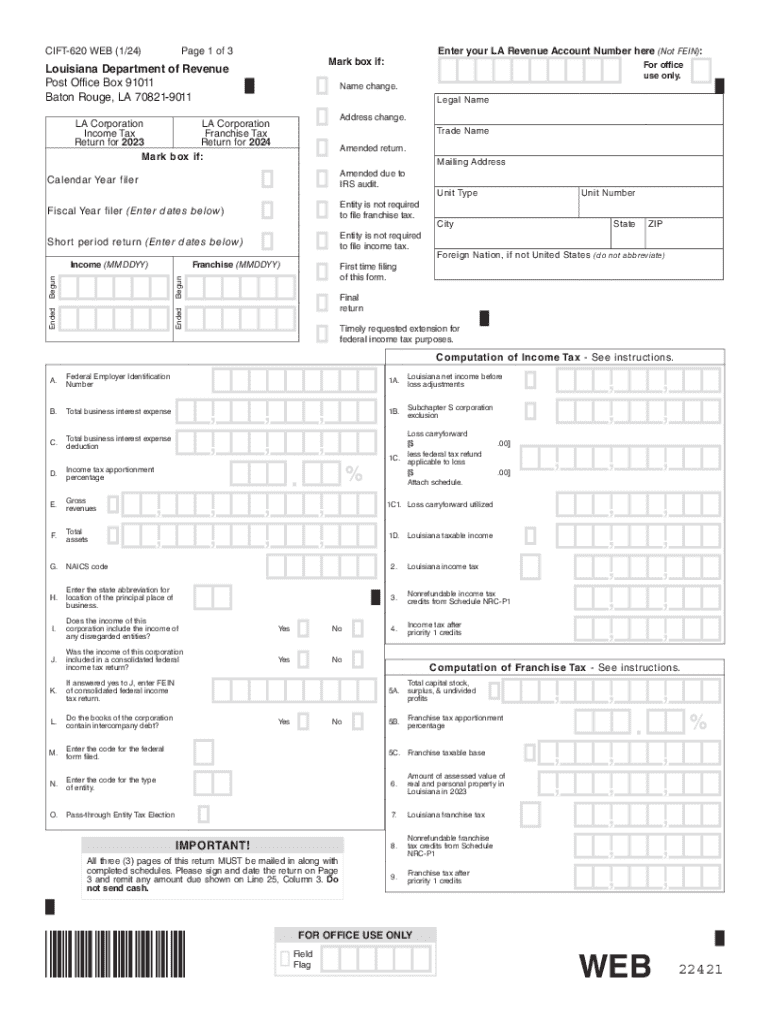

Louisiana Department of Revenue Post Office Box 91011 Baton Form

Filing Deadlines and Important Dates

Understanding the filing deadlines for the 2024 Louisiana income tax form is crucial for timely submission. The state typically sets its own deadlines, which may differ from federal deadlines. For the 2024 tax year, the deadline for filing your Louisiana income tax return is usually April 15, unless it falls on a weekend or holiday, in which case the deadline may be extended. Taxpayers should also be aware of any extensions that can be filed to delay submission, but interest and penalties may apply if taxes owed are not paid by the original deadline.

Required Documents

To accurately complete the 2024 Louisiana income tax form, gather all necessary documents beforehand. Key documents include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Previous year’s tax return for reference

Having these documents ready will streamline the process and help ensure all income and deductions are reported correctly.

Form Submission Methods

Taxpayers have several options for submitting the 2024 Louisiana income tax form. These methods include:

- Online: Filing electronically through the Louisiana Department of Revenue’s website is often the fastest method.

- Mail: You can print the completed form and send it to the appropriate address, which is usually specified on the form itself.

- In-Person: Some taxpayers may prefer to file in person at designated locations, which may offer assistance if needed.

Choosing the right submission method can depend on personal preference and the complexity of your tax situation.

Penalties for Non-Compliance

Failure to comply with Louisiana tax regulations can result in significant penalties. Common penalties include:

- Late filing penalties, which may be a percentage of the unpaid tax amount.

- Interest charges on any unpaid taxes, accruing from the original due date.

- Potential legal actions for persistent non-compliance.

It is important for taxpayers to stay informed about their obligations to avoid these penalties.

Taxpayer Scenarios

Different taxpayer scenarios can affect how you fill out the 2024 Louisiana income tax form. Consider the following situations:

- Self-Employed: Additional forms may be required to report business income and expenses.

- Retired: Income from retirement accounts may have specific reporting requirements.

- Students: Tax credits for education may be available, impacting total tax liability.

Understanding how your specific situation affects your filing can help ensure accurate reporting and maximize potential refunds.

Who Issues the Form

The 2024 Louisiana income tax form is issued by the Louisiana Department of Revenue. This state agency is responsible for collecting taxes and ensuring compliance with tax laws. Taxpayers can access the form and related resources through the department’s official website, which provides guidance on filling out the form and understanding tax obligations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the louisiana department of revenue post office box 91011 baton

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 Louisiana income tax form?

The 2024 Louisiana income tax form is the official document used by residents to report their income and calculate their tax liability for the year. It includes various sections for income, deductions, and credits. Completing this form accurately is essential to ensure compliance with state tax laws.

-

How can airSlate SignNow help with the 2024 Louisiana income tax form?

airSlate SignNow provides a streamlined solution for electronically signing and sending the 2024 Louisiana income tax form. Our platform simplifies the document management process, allowing users to complete and submit their tax forms quickly and securely. This can save time and reduce the stress associated with tax season.

-

Is there a cost associated with using airSlate SignNow for the 2024 Louisiana income tax form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our cost-effective solutions ensure that you can manage your 2024 Louisiana income tax form without breaking the bank. We provide a free trial, allowing you to explore our features before committing to a plan.

-

What features does airSlate SignNow offer for managing the 2024 Louisiana income tax form?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to prepare, sign, and store your 2024 Louisiana income tax form. Additionally, our user-friendly interface ensures that even those unfamiliar with digital forms can navigate the process effortlessly.

-

Can I integrate airSlate SignNow with other software for the 2024 Louisiana income tax form?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage your 2024 Louisiana income tax form. This connectivity allows for seamless data transfer and enhances your overall workflow, ensuring that all your financial documents are in sync.

-

What are the benefits of using airSlate SignNow for the 2024 Louisiana income tax form?

Using airSlate SignNow for your 2024 Louisiana income tax form provides numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. Our platform allows you to complete and sign documents from anywhere, making tax filing more convenient. Additionally, our secure system protects your sensitive information.

-

How secure is airSlate SignNow when handling the 2024 Louisiana income tax form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your 2024 Louisiana income tax form and other sensitive documents. Our compliance with industry standards ensures that your data remains safe throughout the signing and submission process.

Get more for Louisiana Department Of Revenue Post Office Box 91011 Baton

Find out other Louisiana Department Of Revenue Post Office Box 91011 Baton

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online