Schedule M Form 990 Noncash Contributions 2020

What is the Schedule M Form 990 Noncash Contributions

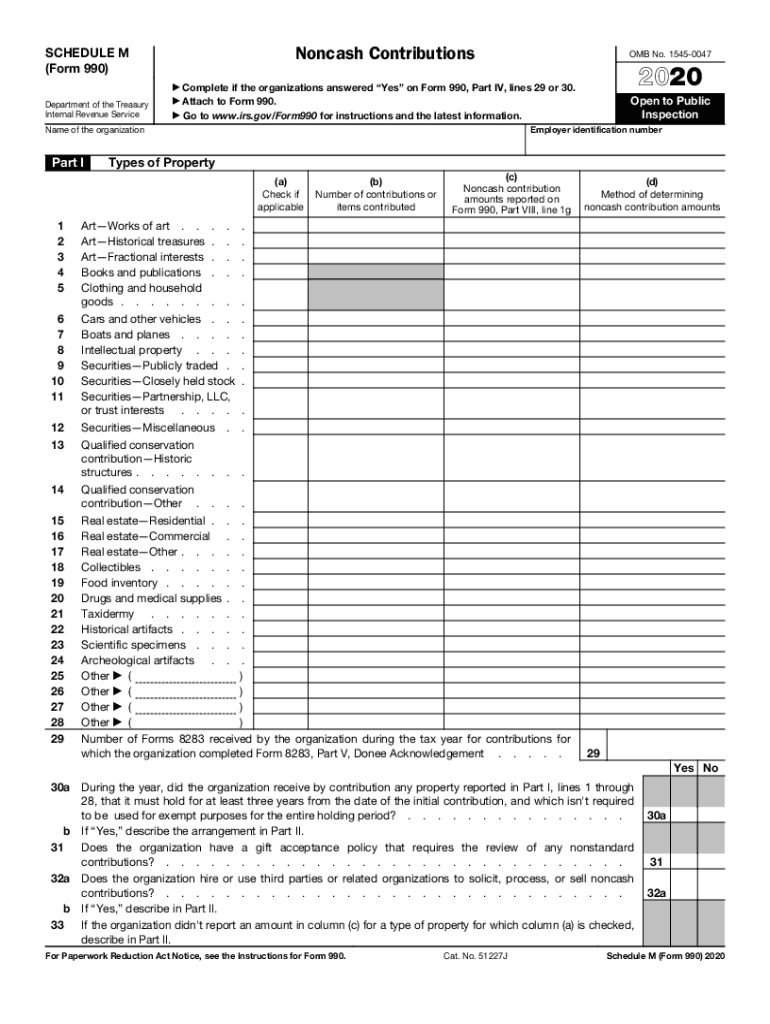

The Schedule M Form 990 is specifically designed for organizations to report noncash contributions received during the tax year. This form provides a detailed account of the types of noncash donations, including property, goods, and services, that a tax-exempt organization has received. It is essential for organizations to accurately document these contributions, as they may affect the overall financial reporting and tax obligations of the entity. The Schedule M helps ensure transparency and compliance with IRS regulations regarding charitable contributions.

How to use the Schedule M Form 990 Noncash Contributions

Using the Schedule M Form 990 involves several key steps. First, organizations must gather all relevant information regarding noncash contributions received. This includes details such as the description of the items, their fair market value, and the date of receipt. Next, the organization should accurately fill out the form, ensuring that all required fields are completed. It is important to categorize contributions appropriately, as this impacts the reporting process. Once completed, the form should be submitted along with the main Form 990 to the IRS.

Steps to complete the Schedule M Form 990 Noncash Contributions

Completing the Schedule M Form 990 requires careful attention to detail. Follow these steps for accurate completion:

- Gather documentation for all noncash contributions received, including appraisals or receipts.

- Identify the fair market value of each noncash item at the time of donation.

- Fill out the Schedule M form, providing descriptions and values for each contribution.

- Review the form for accuracy and completeness before submission.

- Submit the Schedule M along with the Form 990 by the designated deadline.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule M Form 990. Organizations must adhere to these guidelines to ensure compliance and avoid penalties. Key points include:

- Accurate reporting of fair market values is crucial; organizations may need to obtain appraisals for items valued over a certain threshold.

- Documentation must be maintained to support the reported values, including receipts and donor acknowledgments.

- Failure to comply with IRS guidelines can result in penalties or loss of tax-exempt status.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Schedule M Form 990. Typically, the Form 990, including Schedule M, is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. For organizations operating on a calendar year, this means the deadline is May fifteenth. Extensions may be available, but it is essential to file the necessary forms to avoid penalties.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Schedule M Form 990 can lead to significant penalties. Organizations may face fines for failure to file or for filing inaccurate information. The IRS may impose penalties based on the size of the organization and the length of the delay. Additionally, repeated non-compliance can jeopardize the organization’s tax-exempt status, leading to further financial repercussions.

Quick guide on how to complete 2020 schedule m form 990 noncash contributions

Effortlessly prepare Schedule M Form 990 Noncash Contributions on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Schedule M Form 990 Noncash Contributions on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

How to edit and electronically sign Schedule M Form 990 Noncash Contributions with ease

- Find Schedule M Form 990 Noncash Contributions and click Get Form to begin.

- Make use of the features we provide to fill out your document.

- Emphasize pertinent sections of your documents or hide sensitive data with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal standing as a traditional handwritten signature.

- Verify the information and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form retrieval, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Schedule M Form 990 Noncash Contributions and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule m form 990 noncash contributions

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule m form 990 noncash contributions

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the 2017 990 schedule m and why is it important?

The 2017 990 schedule m is crucial for tax-exempt organizations as it provides detailed reporting of non-cash contributions. Understanding how to fill out this schedule accurately is essential for compliance. By using airSlate SignNow, organizations can easily compile and eSign their necessary documents related to the 2017 990 schedule m.

-

How can airSlate SignNow assist with filling out the 2017 990 schedule m?

airSlate SignNow offers a user-friendly platform that allows you to streamline the process of filling out the 2017 990 schedule m. You can easily create templates and collaborate with team members to ensure all necessary information is included. Our platform ensures that your documents are completed accurately and securely.

-

Is there a cost associated with using airSlate SignNow for the 2017 990 schedule m?

Yes, there are various pricing plans for airSlate SignNow that cater to different business needs. Each plan offers features that simplify document signing and management for forms like the 2017 990 schedule m. We recommend checking our pricing page for detailed information and selecting the plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other software to manage the 2017 990 schedule m?

Absolutely! airSlate SignNow supports integrations with various accounting and document management systems. This enables users to import data directly into the 2017 990 schedule m, streamlining the filing process and ensuring accuracy in reporting.

-

What are the benefits of using airSlate SignNow for the 2017 990 schedule m?

Using airSlate SignNow for the 2017 990 schedule m offers signNow benefits, including enhanced document security and easy collaboration. Our platform allows for quick eSigning and storage of documents, which helps ensure compliance and saves time on administrative tasks. Plus, it reduces the risk of errors in important filings.

-

How secure is the use of airSlate SignNow for managing sensitive documents like the 2017 990 schedule m?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and complies with industry standards to protect sensitive documents such as the 2017 990 schedule m. Users can trust that their information is safe while using our services.

-

Can I access airSlate SignNow on mobile devices for the 2017 990 schedule m?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to manage the 2017 990 schedule m anytime and anywhere. This mobile accessibility facilitates on-the-go signing and document management, ensuring you’re always up to date regardless of your location.

Get more for Schedule M Form 990 Noncash Contributions

- Buyers request for accounting from seller under contract for deed washington form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed washington form

- General notice of default for contract for deed washington form

- Washington seller disclosure form

- Seller disclosure agreement 497429217 form

- Contract for deed sellers annual accounting statement washington form

- Notice of default for past due payments in connection with contract for deed washington form

- Final notice of default for past due payments in connection with contract for deed washington form

Find out other Schedule M Form 990 Noncash Contributions

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation