Www Irs Govpubirs Prior2019 Schedule M Form 990 IRS Tax Forms 2022

Understanding the 2018 IRS M Form

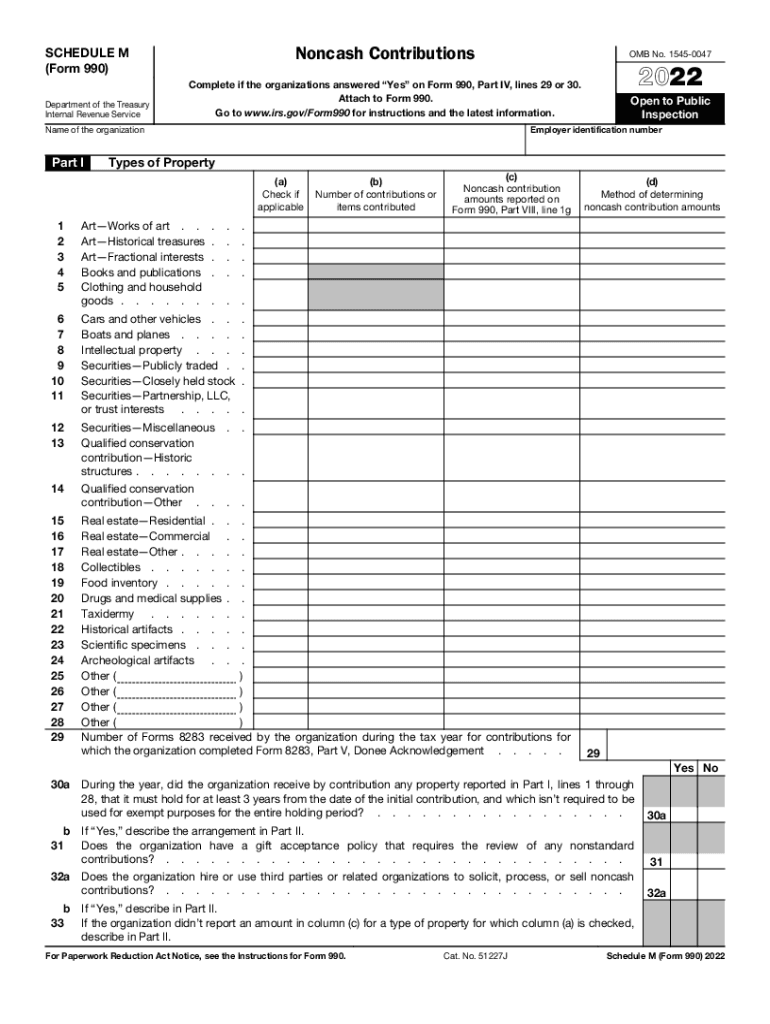

The 2018 IRS M Form, officially known as the 2018 Schedule M, is a crucial document for tax-exempt organizations. It is used to report contributions received and to provide details about the organization’s activities. This form is essential for ensuring compliance with IRS regulations and helps organizations maintain their tax-exempt status. Understanding its purpose and requirements is vital for accurate reporting.

Steps to Complete the 2018 Schedule M Form

Completing the 2018 Schedule M Form involves several key steps:

- Gather necessary financial documents, including records of contributions and expenses.

- Fill out the form accurately, ensuring all sections are completed, particularly those detailing contributions and activities.

- Review the completed form for any errors or omissions.

- Sign and date the form, ensuring that the signature is from an authorized individual within the organization.

- Submit the form by the appropriate deadline to avoid penalties.

Legal Use of the 2018 Schedule M Form

The legal use of the 2018 Schedule M Form is governed by IRS regulations. Organizations must use this form to report contributions accurately to maintain transparency and compliance with federal tax laws. Failure to file or inaccuracies can lead to penalties, including loss of tax-exempt status. It is crucial for organizations to understand their legal obligations when completing this form.

Filing Deadlines for the 2018 Schedule M Form

Filing deadlines for the 2018 Schedule M Form typically align with the overall deadline for Form 990 submissions. Organizations must file their Form 990, including the Schedule M, by the fifteenth day of the fifth month after the end of their fiscal year. Extensions may be available, but it is essential to file on time to avoid penalties.

Required Documents for Filing the 2018 Schedule M Form

To successfully file the 2018 Schedule M Form, organizations need to prepare several documents:

- Financial statements detailing contributions received during the year.

- Records of any grants or other funding sources.

- Documentation supporting the activities reported on the form.

- Previous year's tax filings for reference.

Examples of Using the 2018 Schedule M Form

Organizations may use the 2018 Schedule M Form in various scenarios:

- A nonprofit organization reporting donations received from fundraising events.

- A charitable foundation detailing grants provided to other organizations.

- A religious institution documenting contributions from its congregation.

Quick guide on how to complete wwwirsgovpubirs prior2019 schedule m form 990 irs tax forms

Effortlessly Prepare Www irs govpubirs prior2019 Schedule M Form 990 IRS Tax Forms on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Www irs govpubirs prior2019 Schedule M Form 990 IRS Tax Forms on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and eSign Www irs govpubirs prior2019 Schedule M Form 990 IRS Tax Forms with Ease

- Obtain Www irs govpubirs prior2019 Schedule M Form 990 IRS Tax Forms and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign Www irs govpubirs prior2019 Schedule M Form 990 IRS Tax Forms to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs prior2019 schedule m form 990 irs tax forms

Create this form in 5 minutes!

People also ask

-

What is the 2018 IRS M and why is it important?

The 2018 IRS M refers to the IRS guidelines and forms that taxpayers must adhere to for that tax year. Understanding the 2018 IRS M is crucial for compliance and accurate tax reporting. airSlate SignNow allows users to electronically sign and manage necessary documents related to the 2018 IRS M efficiently.

-

How can airSlate SignNow help with the 2018 IRS M documentation?

airSlate SignNow streamlines the process of managing documentation needed for the 2018 IRS M, allowing users to easily send, sign, and store important forms. With a user-friendly interface, businesses can ensure they meet IRS requirements promptly and reduce the risk of errors in documentation.

-

What are the pricing plans for airSlate SignNow that support 2018 IRS M filing?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses, ensuring efficient management of 2018 IRS M filings. These plans are cost-effective and designed to provide the necessary features without breaking the bank. You can choose a plan that best fits your document management requirements.

-

What features does airSlate SignNow include for managing 2018 IRS M forms?

airSlate SignNow includes features such as customizable templates, electronic signatures, and secure document storage specifically for handling 2018 IRS M forms. These tools help users efficiently prepare and send their IRS documents while ensuring data security and compliance with IRS regulations.

-

Can airSlate SignNow integrate with accounting software for 2018 IRS M reporting?

Yes, airSlate SignNow integrates seamlessly with numerous accounting software programs that assist with 2018 IRS M reporting. By leveraging these integrations, users can streamline their document workflow and ensure that their financial information aligns with IRS requirements.

-

What benefits does airSlate SignNow offer for businesses dealing with 2018 IRS M?

The benefits of using airSlate SignNow for managing 2018 IRS M documents include enhanced productivity, reduced paper waste, and improved compliance. Businesses can also enjoy the convenience of signing documents electronically, signNowly speeding up the filing process. This helps in ensuring timely submissions to the IRS.

-

Is airSlate SignNow secure for handling sensitive 2018 IRS M information?

Absolutely, airSlate SignNow prioritizes security through encryption and compliance with industry standards, making it ideal for handling sensitive 2018 IRS M information. Users can trust that their documents are stored securely and shared only with authorized parties. This safeguards against data bsignNowes and unauthorized access.

Get more for Www irs govpubirs prior2019 Schedule M Form 990 IRS Tax Forms

- Sample stock certificate template form

- Minutes a corporation form

- New resident guide nevada form

- Full reconveyance form pdf

- Nevada reconveyance deed form

- Partial release of property from deed of trust for corporation nevada form

- Partial release of property from deed of trust for individual nevada form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy nevada form

Find out other Www irs govpubirs prior2019 Schedule M Form 990 IRS Tax Forms

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast