Schedule M TG PDF SCHEDULE MForm 990 OMB No 1545 0047 2021

What is the Schedule M Form?

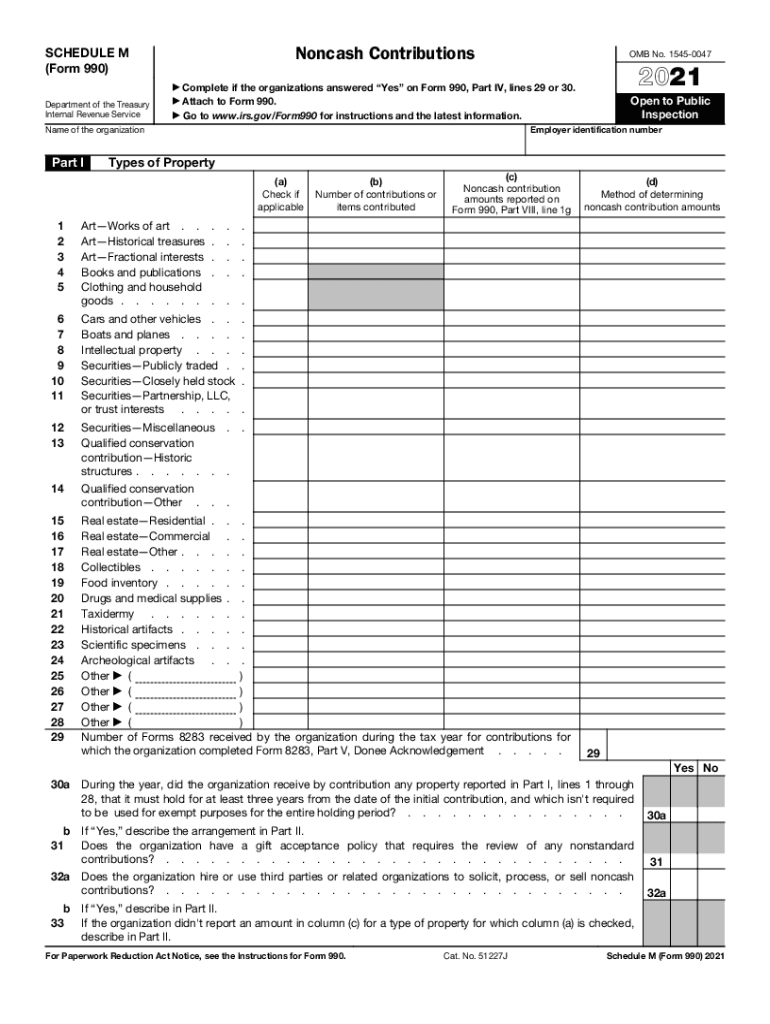

The Schedule M form, officially known as the IRS Schedule M Form 990, is a document used by tax-exempt organizations to report their activities and financial information. This form is essential for organizations that need to disclose their non-cash contributions and provide a detailed account of their income sources. The Schedule M helps ensure transparency and compliance with IRS regulations, making it a vital component of the annual Form 990 filing process.

Key Elements of the Schedule M Form

The Schedule M form includes several key elements that organizations must complete accurately. These elements typically consist of:

- Non-Cash Contributions: Organizations must report the value of non-cash contributions received during the fiscal year.

- Income Sources: A detailed breakdown of income sources, including grants, donations, and fundraising activities.

- Program Services: Information about the organization's program services and how they align with its mission.

- Financial Statements: A summary of the organization's financial statements, including balance sheets and income statements.

Steps to Complete the Schedule M Form

Completing the Schedule M form involves several steps to ensure accuracy and compliance. Here is a general outline of the process:

- Gather Documentation: Collect all necessary financial records and documentation related to contributions and income sources.

- Fill Out the Form: Input the required information into the Schedule M form, ensuring all sections are completed accurately.

- Review for Accuracy: Double-check all entries for accuracy and completeness to avoid potential issues with the IRS.

- Submit the Form: File the completed Schedule M form along with the annual Form 990 by the designated deadline.

Legal Use of the Schedule M Form

The Schedule M form is legally binding and must be completed in accordance with IRS guidelines. Accurate reporting is crucial, as discrepancies can lead to penalties or loss of tax-exempt status. Organizations should ensure that they adhere to all relevant laws and regulations when completing the form, including maintaining proper documentation to support the reported figures.

Filing Deadlines and Important Dates

Organizations must be aware of specific filing deadlines for the Schedule M form. Generally, the Schedule M is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this typically means a May 15 deadline. It is essential to stay informed about any changes to these deadlines to avoid late filing penalties.

Examples of Using the Schedule M Form

Organizations may encounter various scenarios when using the Schedule M form. For instance, a nonprofit organization that receives a significant amount of non-cash donations, such as clothing or food, must accurately report these contributions on the Schedule M. Another example includes a charity that conducts fundraising events and needs to disclose the income generated from these activities. Each scenario requires careful documentation and reporting to ensure compliance with IRS regulations.

Quick guide on how to complete schedule m tg pdf schedule mform 990 omb no 1545 0047

Effortlessly prepare Schedule M TG pdf SCHEDULE MForm 990 OMB No 1545 0047 on any device

The management of online documents has gained popularity among both businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to swiftly create, edit, and eSign your documents without complications. Handle Schedule M TG pdf SCHEDULE MForm 990 OMB No 1545 0047 on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign Schedule M TG pdf SCHEDULE MForm 990 OMB No 1545 0047 seamlessly

- Locate Schedule M TG pdf SCHEDULE MForm 990 OMB No 1545 0047 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Craft your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from the device of your choice. Modify and eSign Schedule M TG pdf SCHEDULE MForm 990 OMB No 1545 0047 to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule m tg pdf schedule mform 990 omb no 1545 0047

Create this form in 5 minutes!

How to create an eSignature for the schedule m tg pdf schedule mform 990 omb no 1545 0047

How to create an e-signature for a PDF online

How to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

How to generate an e-signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is the cost of using airSlate SignNow to schedule m services?

The pricing for airSlate SignNow varies based on the plan you choose. For businesses looking to schedule m services, we provide competitive rates that cater to different needs. You can opt for monthly or annual subscriptions, which include features tailored to eSigning and document management.

-

How can I schedule m documents using airSlate SignNow?

To schedule m documents with airSlate SignNow, simply upload your files, specify the recipients, and set the signing order. The platform allows you to easily manage your documentation workflow, ensuring that all parties can effortlessly sign and return documents on time.

-

What features does airSlate SignNow offer for scheduling m?

airSlate SignNow offers a robust set of features for scheduling m, including templates, automated workflows, and reminders. These tools help streamline your document management process and make it easier to keep track of all signatures and approvals in one place.

-

Can I integrate airSlate SignNow with other applications for schedule m functionalities?

Yes, airSlate SignNow provides seamless integration with a variety of applications, including CRM systems and cloud storage solutions. By integrating these tools, you can enhance your schedule m capabilities and ensure a smooth, efficient workflow across your business processes.

-

Is there a mobile app for airSlate SignNow to manage schedule m tasks?

Absolutely! airSlate SignNow offers a mobile app that allows you to manage your schedule m tasks on the go. You can send documents, request signatures, and track progress from your mobile device, making it easy to stay productive wherever you are.

-

What are the benefits of using airSlate SignNow for schedule m?

Using airSlate SignNow for schedule m brings numerous benefits including time savings, cost-effectiveness, and enhanced security. The platform simplifies the document signing process and ensures that all transactions comply with legal standards, providing peace of mind for businesses.

-

How does airSlate SignNow ensure the security of my schedule m documents?

airSlate SignNow prioritizes security by employing advanced encryption methods and compliance with various regulatory standards. All schedule m documents are stored securely, ensuring that your sensitive information remains protected throughout the signing process.

Get more for Schedule M TG pdf SCHEDULE MForm 990 OMB No 1545 0047

- Chapter 13 plan analysis delaware form

- Verification of creditors matrix delaware form

- Delaware civil procedure form

- Optional form for creditors seeking a deficiency default judgment delaware

- Delaware judgment 497302294 form

- Revive judgment form

- Delaware writ possession form

- Request for a constable sale delaware form

Find out other Schedule M TG pdf SCHEDULE MForm 990 OMB No 1545 0047

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document