Form 4720 Return of Certain Excise Taxes under Chapters 41 and 42 of the Internal Revenue Code 2024-2026

Understanding the Form 4720 Return of Certain Excise Taxes

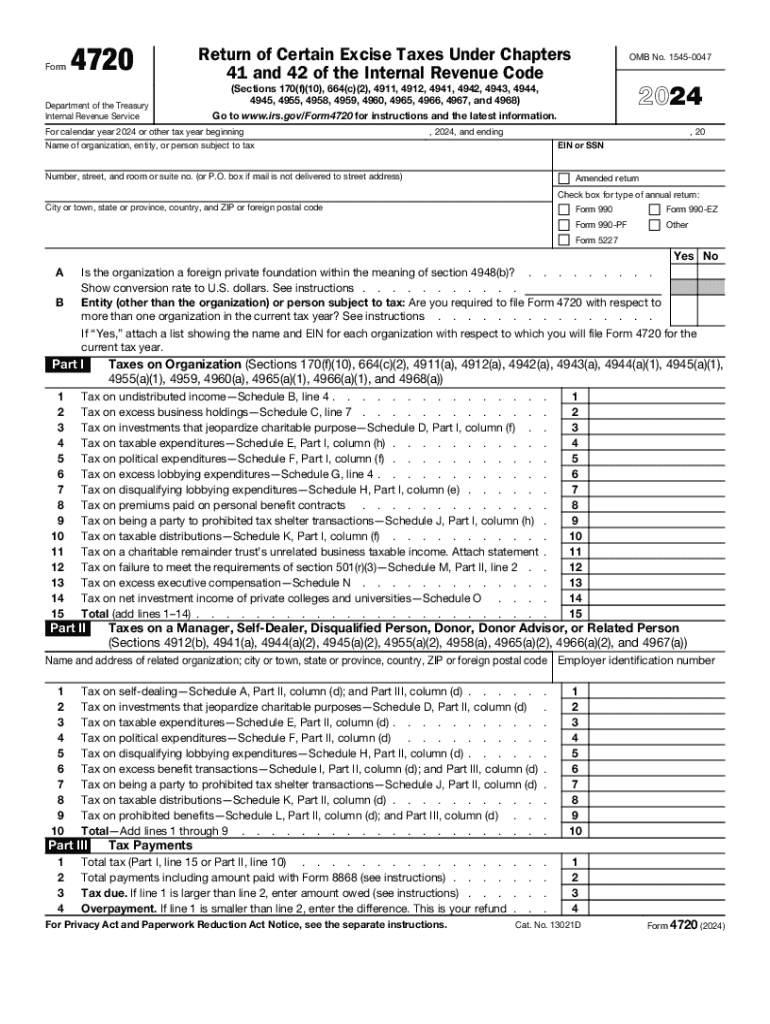

The Form 4720 is a crucial document used to report specific excise taxes under Chapters 41 and 42 of the Internal Revenue Code. This form is primarily utilized by organizations that are subject to certain excise taxes, including those related to excess benefits transactions, certain private foundation excise taxes, and other related tax obligations. Understanding the purpose of this form is essential for compliance with federal tax regulations.

Steps to Complete the Form 4720

Completing the Form 4720 involves several key steps to ensure accurate reporting of excise taxes. Begin by gathering all necessary financial documents and records related to the transactions subject to excise tax. Next, fill out the form by providing detailed information about the organization, the nature of the transactions, and the calculated excise taxes owed. It is important to review the instructions carefully to ensure that all required fields are completed accurately. Finally, double-check your entries for errors before submission.

Obtaining the Form 4720

The Form 4720 can be easily obtained from the Internal Revenue Service (IRS) website. It is available as a downloadable PDF file that can be printed for completion. Additionally, tax professionals and accountants may have access to the form through their software platforms. Ensuring you have the most current version of the form is vital, as tax regulations can change, affecting the requirements for reporting excise taxes.

Filing Deadlines for Form 4720

Timely filing of the Form 4720 is essential to avoid penalties. The form is typically due on the fifteenth day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this means the form is due by May 15. It is advisable to mark your calendar with this deadline and to allow sufficient time for preparation to ensure compliance.

Legal Use of the Form 4720

The Form 4720 serves a legal purpose in reporting excise taxes imposed on certain transactions. Organizations must file this form to comply with IRS regulations, and failure to do so can result in significant penalties. Understanding the legal implications of this form is crucial for organizations to maintain compliance and avoid any potential legal issues related to tax reporting.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form 4720 can lead to severe penalties. The IRS imposes fines based on the amount of excise tax owed, and additional penalties may apply for failure to file the form on time. Organizations should be aware of these consequences and take proactive steps to ensure that they meet all filing requirements to avoid unnecessary financial burdens.

Create this form in 5 minutes or less

Find and fill out the correct form 4720 return of certain excise taxes under chapters 41 and 42 of the internal revenue code 770493553

Create this form in 5 minutes!

How to create an eSignature for the form 4720 return of certain excise taxes under chapters 41 and 42 of the internal revenue code 770493553

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code?

The Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code is a tax form used by organizations to report and pay certain excise taxes. This form is essential for compliance with IRS regulations and helps ensure that organizations fulfill their tax obligations accurately.

-

How can airSlate SignNow assist with the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code?

airSlate SignNow provides a streamlined solution for preparing and submitting the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code. Our platform allows users to easily fill out, eSign, and send the form, ensuring a hassle-free experience.

-

What are the pricing options for using airSlate SignNow for the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are a small business or a large organization, you can choose a plan that fits your budget while ensuring you have the necessary tools to manage the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code efficiently.

-

What features does airSlate SignNow offer for managing the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all designed to simplify the process of handling the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code. These features enhance efficiency and ensure compliance with tax regulations.

-

Can airSlate SignNow integrate with other software for filing the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code?

Yes, airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code. This seamless integration helps streamline your workflow and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code?

Using airSlate SignNow for the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code offers numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform empowers businesses to manage their tax forms efficiently while reducing the risk of errors.

-

Is airSlate SignNow user-friendly for filing the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate the process of filing the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code. Our intuitive interface ensures that users can complete their tasks quickly and efficiently.

Get more for Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

- Petline insurance claim form

- High risk pregnancy letter from doctor form

- Annexure xii form

- Braden scale 101220187 form

- Www uslegalforms comform library464507 newnew zealand darts council transfer form fill and sign

- Bond lodgement form 615489891

- Sim card agreement data only arrowhead alarm products form

- Branch use only form

Find out other Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself