About Form 4720, Return of Certain Excise Taxes under 2021

Understanding Form 4720: Return of Certain Excise Taxes

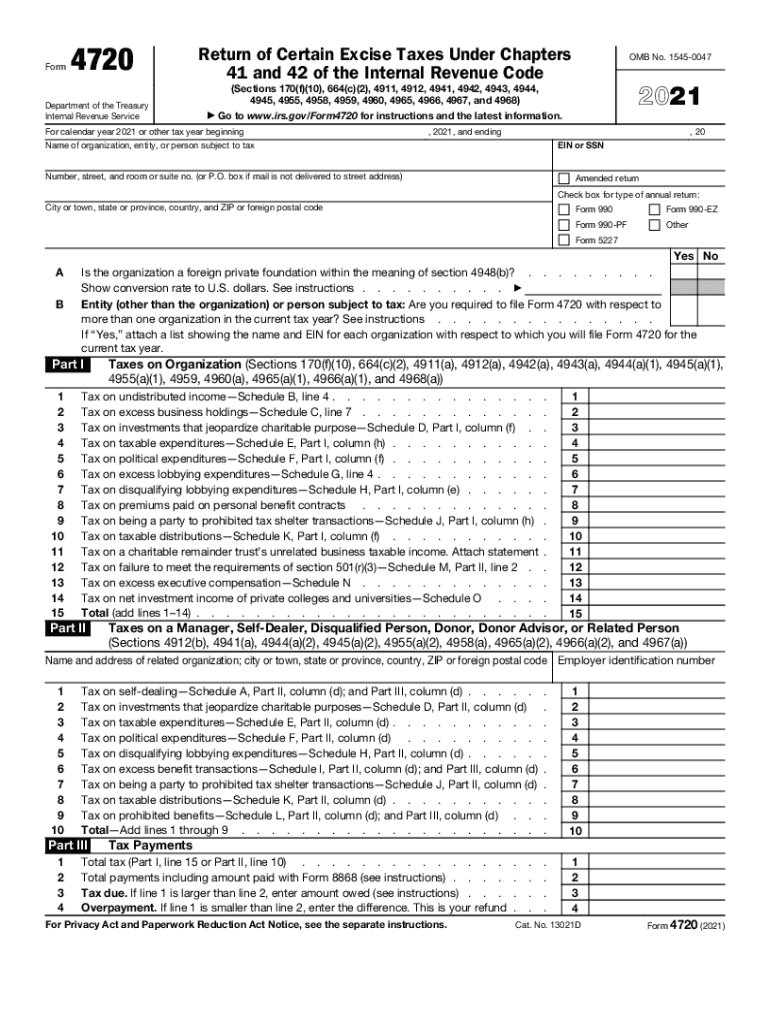

The IRS Form 4720 is essential for reporting specific excise taxes imposed on certain activities and transactions. This form is primarily used by organizations that are subject to excise taxes under various sections of the Internal Revenue Code. It is crucial for ensuring compliance with tax regulations, particularly for non-profit organizations that may be liable for taxes on excess benefits, excess business holdings, and other related transactions. Understanding the purpose and requirements of Form 4720 is vital for accurate tax reporting and avoiding penalties.

Steps to Complete Form 4720

Completing Form 4720 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial information related to the excise taxes applicable to your organization. This includes details about any excess benefit transactions and business holdings. Next, follow these steps:

- Review the IRS instructions for Form 4720 to understand the specific requirements.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the excise taxes owed based on the information provided.

- Double-check your calculations and the information entered for accuracy.

- Submit the completed form to the IRS by the specified deadline.

Filing Deadlines for Form 4720

Timely filing of Form 4720 is crucial to avoid penalties. The deadline for submitting this form typically aligns with the tax return deadline for the organization, which is usually the fifteenth day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this means the form is due on May 15. It is important to keep track of these deadlines to ensure compliance and avoid late fees.

Legal Use of Form 4720

Form 4720 must be used in accordance with IRS regulations to ensure its legal validity. The form is legally binding when completed correctly and submitted on time. Organizations must ensure that they meet all eligibility criteria and adhere to the specific requirements outlined by the IRS. Failure to comply can result in penalties, including excise taxes and interest on unpaid amounts. Proper documentation and record-keeping are essential to support the information reported on Form 4720.

Required Documents for Form 4720

When preparing to file Form 4720, certain documents are necessary to support the information reported. These may include:

- Financial statements detailing income and expenses.

- Records of excess benefit transactions and business holdings.

- Previous tax returns that may be relevant to the current filing.

- Any correspondence with the IRS regarding prior filings.

Gathering these documents in advance can streamline the completion process and ensure accuracy.

Penalties for Non-Compliance with Form 4720

Non-compliance with the requirements of Form 4720 can lead to significant penalties. Organizations may face excise taxes on the amount of the excess benefit or holdings, as well as additional fines for late filing or failure to file altogether. It is essential to understand these potential penalties and take proactive measures to ensure compliance. Regularly reviewing tax obligations and maintaining accurate records can help mitigate the risk of non-compliance.

Quick guide on how to complete about form 4720 return of certain excise taxes under

Complete About Form 4720, Return Of Certain Excise Taxes Under effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage About Form 4720, Return Of Certain Excise Taxes Under on any platform using the airSlate SignNow apps for Android or iOS, and streamline any document-oriented process today.

The easiest method to modify and eSign About Form 4720, Return Of Certain Excise Taxes Under without hassle

- Find About Form 4720, Return Of Certain Excise Taxes Under and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of your documents or black out sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to finalize your changes.

- Choose how you want to send your form, either via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign About Form 4720, Return Of Certain Excise Taxes Under and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 4720 return of certain excise taxes under

Create this form in 5 minutes!

People also ask

-

What is the form 4720 used for?

The form 4720 is used to report excise taxes on certain events in relation to private foundations, including excess benefits transactions and undistributed income. Understanding this form is essential for compliance with IRS regulations for private foundations.

-

How do I fill out the form 4720 using airSlate SignNow?

airSlate SignNow offers user-friendly tools to fill out the form 4720 efficiently. You can easily upload the form, fill in the required fields, and ensure all necessary signatures are captured electronically.

-

Is there a cost associated with using airSlate SignNow to complete form 4720?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs. Each plan ensures that you can complete documents like form 4720 seamlessly, with options for unlimited signing and secure storage.

-

What features does airSlate SignNow offer for form 4720?

airSlate SignNow includes features like document templates, collaboration tools, and secure eSigning functionality specifically beneficial for forms like 4720. These features streamline the process and enhance efficiency for users managing tax-related documents.

-

Can I integrate airSlate SignNow with other software for form 4720 processing?

Absolutely! airSlate SignNow integrates with various popular software solutions, allowing for a smoother workflow when processing documents like form 4720. You can connect it with tools like CRM and accounting software for better document management.

-

How does airSlate SignNow ensure the security of my form 4720 documents?

airSlate SignNow employs robust security measures, including encryption and secure access protocols, to ensure your form 4720 documents are protected. This commitment to security keeps your sensitive information safe throughout the signing process.

-

What benefits does airSlate SignNow provide for submitting form 4720?

Using airSlate SignNow for submitting form 4720 streamlines the process, reduces errors, and ensures compliance with IRS regulations. The ability to sign documents electronically also speeds up the filing process, saving you valuable time.

Get more for About Form 4720, Return Of Certain Excise Taxes Under

- 2022 form ri 1040mu

- 10 10ezr fill out and sign printable pdf templatesignnow form

- 1 wages salaries tips etc from federal form 1040 or 1040 sr line 1z

- 2022 form ri 2210pt

- Form ri w3 ri division of taxation

- Delaware income taxes and de state tax forms efile

- Ri division of taxation welcome form

- Personal income tax formsri division of taxation rigov

Find out other About Form 4720, Return Of Certain Excise Taxes Under

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple