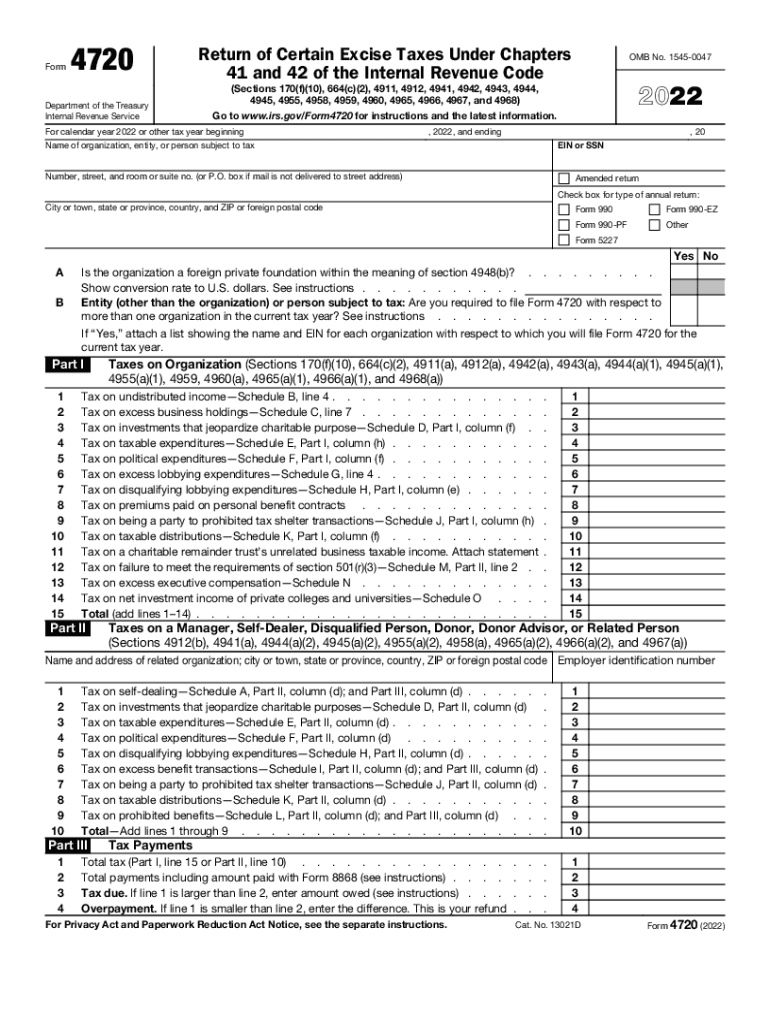

Form 4720Internal Revenue Service IRS Tax Forms 2022

What is the 4720 excise form?

The 4720 excise form is an Internal Revenue Service (IRS) tax document used by certain organizations to report and pay excise taxes. This form is primarily associated with the reporting of excess benefit transactions, which occur when a tax-exempt organization provides a benefit to a disqualified person that exceeds the fair market value. The IRS 4720 is crucial for maintaining compliance with tax regulations and ensuring that organizations adhere to the rules governing tax-exempt status.

Steps to complete the 4720 excise form

Completing the 4720 excise form involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the transactions that require reporting. This includes details about the disqualified persons involved and the benefits provided. Next, accurately fill out each section of the form, ensuring that all figures are correct and supported by appropriate documentation. After completing the form, review it for any errors before submission. Finally, submit the form to the IRS by the designated deadline to avoid penalties.

Legal use of the 4720 excise form

The legal use of the 4720 excise form is essential for organizations to fulfill their tax obligations. It serves as a formal declaration of any excess benefit transactions and demonstrates the organization's commitment to compliance with IRS regulations. Proper filing of the form can help protect the organization from potential penalties and maintain its tax-exempt status. Understanding the legal implications of the form is vital for organizations to navigate the complexities of tax law effectively.

Filing deadlines for the 4720 excise form

Filing deadlines for the 4720 excise form are critical for organizations to avoid penalties. Typically, the form must be filed by the 15th day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this means the form is due by May 15. It is important for organizations to mark their calendars and prepare the necessary documentation ahead of time to ensure timely submission.

Required documents for the 4720 excise form

When preparing to file the 4720 excise form, certain documents are required to support the information reported. These may include financial statements, records of transactions involving disqualified persons, and any correspondence related to excess benefit transactions. Having these documents readily available can facilitate the completion of the form and ensure that all reported figures are accurate and verifiable.

Penalties for non-compliance with the 4720 excise form

Organizations that fail to comply with the requirements of the 4720 excise form may face significant penalties. The IRS can impose excise taxes on the excess benefits provided, which can amount to 25 percent of the excess benefit for each year it remains unreported. Additionally, if the failure to file is deemed willful, further penalties may apply. Understanding these consequences underscores the importance of timely and accurate filing of the form.

Quick guide on how to complete form 4720internal revenue service irs tax forms

Fill out Form 4720Internal Revenue Service IRS Tax Forms efficiently on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the features you require to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Form 4720Internal Revenue Service IRS Tax Forms on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest method to modify and electronically sign Form 4720Internal Revenue Service IRS Tax Forms effortlessly

- Find Form 4720Internal Revenue Service IRS Tax Forms and then click Obtain Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of the documents or conceal sensitive information using the tools provided specifically for this purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Finish button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Alter and electronically sign Form 4720Internal Revenue Service IRS Tax Forms while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4720internal revenue service irs tax forms

Create this form in 5 minutes!

People also ask

-

What is 4720 excise and how does it relate to airSlate SignNow?

The 4720 excise form is used for reporting federal excise taxes, particularly for specific goods and services. airSlate SignNow provides a streamlined solution to manage this documentation efficiently, allowing businesses to eSign and send forms without delay.

-

How does airSlate SignNow help with the 4720 excise reporting process?

airSlate SignNow simplifies the 4720 excise reporting process by enabling quick eSigning and sharing of necessary documents. This ensures compliance and timely submission, helping businesses avoid penalties related to federal excise taxes.

-

What features does airSlate SignNow offer for managing the 4720 excise forms?

With airSlate SignNow, users can easily create, edit, and eSign 4720 excise forms. The platform also offers templates, real-time collaboration, and secure cloud storage, making it a comprehensive tool for managing such tax documents.

-

Is airSlate SignNow a cost-effective solution for handling 4720 excise documentation?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing 4720 excise documentation. Its competitive pricing ensures that even small businesses can access essential eSigning features without breaking the bank.

-

Can airSlate SignNow integrate with other tools for managing 4720 excise tasks?

Absolutely! airSlate SignNow offers integrations with various software, allowing users to seamlessly manage their 4720 excise tasks alongside accounting and tax preparation tools. This enhances workflow efficiency and reduces errors.

-

What benefits does airSlate SignNow provide for businesses handling excise filings?

airSlate SignNow helps businesses handling 4720 excise filings by ensuring documentation is completed accurately and on time. The ease of use, along with compliance features, contributes signNowly to reducing administrative burdens.

-

How can airSlate SignNow improve the efficiency of 4720 excise document workflows?

By using airSlate SignNow, businesses can automate document workflows related to 4720 excise forms. This results in faster processing times, minimized paperwork, and improved accuracy in reporting excise taxes.

Get more for Form 4720Internal Revenue Service IRS Tax Forms

- Trim carpenter contract for contractor new jersey form

- Fencing contract for contractor new jersey form

- Hvac contract for contractor new jersey form

- Landscape contract for contractor new jersey form

- Commercial contract for contractor new jersey form

- Excavator contract for contractor new jersey form

- Renovation contract for contractor new jersey form

- Concrete mason contract for contractor new jersey form

Find out other Form 4720Internal Revenue Service IRS Tax Forms

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free