Employee's Withholding Exemption CertificateRevised Form

Understanding the Employee's Withholding Exemption Certificate

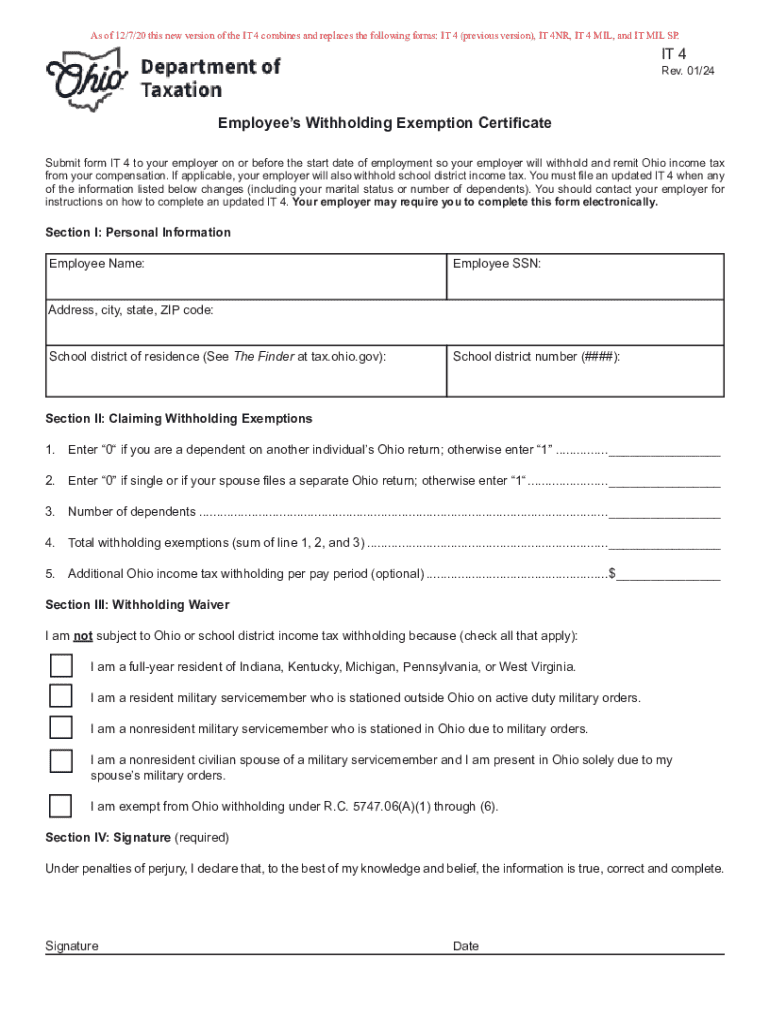

The Ohio IT 4 form, also known as the Employee's Withholding Exemption Certificate, is essential for employees to declare their withholding status. This form allows individuals to claim exemptions from state income tax withholding based on their personal circumstances. Understanding the purpose of this form is crucial for ensuring accurate tax withholding throughout the year.

Steps to Complete the Employee's Withholding Exemption Certificate

Completing the Ohio IT 4 form involves several straightforward steps:

- Provide your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Claim any exemptions you are eligible for by checking the appropriate boxes.

- Sign and date the form to validate your claims.

Ensure that all information is accurate to avoid issues with your tax withholding.

Legal Use of the Employee's Withholding Exemption Certificate

The Ohio IT 4 form is legally recognized for tax purposes in the state of Ohio. It is important to use this form correctly to ensure compliance with state tax laws. Misuse or failure to submit the form can result in incorrect withholding, leading to potential tax liabilities or penalties.

Filing Deadlines and Important Dates

Submitting the Ohio IT 4 form should align with your employer's payroll schedule. Typically, employees should submit this form at the start of employment or whenever their withholding status changes. Keeping track of any changes in your personal situation that affect your withholding is important to maintain compliance.

Eligibility Criteria for the Employee's Withholding Exemption Certificate

To qualify for exemptions on the Ohio IT 4 form, individuals must meet specific criteria. Generally, you may claim exemptions if you had no tax liability in the previous year and expect none in the current year. Additionally, certain personal circumstances, such as being a full-time student or having dependents, may also influence your eligibility.

Examples of Using the Employee's Withholding Exemption Certificate

Consider the following scenarios where the Ohio IT 4 form is applicable:

- A recent graduate starting their first job may claim exemptions if they anticipate low income.

- A married couple with dependents may adjust their withholding to reflect their family situation.

- A seasonal worker may choose to claim exemptions during off-peak months when they expect to earn less.

These examples illustrate how personal circumstances can impact the completion of the form and the resulting tax withholding.

Form Submission Methods

The Ohio IT 4 form can be submitted through various methods, depending on your employer's policies. Common submission methods include:

- Online submission through your employer's payroll system.

- Mailing a physical copy to your employer's human resources department.

- Hand-delivering the form to your workplace.

It is advisable to confirm the preferred submission method with your employer to ensure timely processing.

Handy tips for filling out Employee's Withholding Exemption CertificateRevised online

Quick steps to complete and e-sign Employee's Withholding Exemption CertificateRevised online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a GDPR and HIPAA compliant platform for optimum straightforwardness. Use signNow to e-sign and send Employee's Withholding Exemption CertificateRevised for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employees withholding exemption certificaterevised

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio IT 4 form?

The Ohio IT 4 form is a state tax withholding form that allows employees in Ohio to designate their tax withholding preferences. By completing the Ohio IT 4 form, employees can ensure that the correct amount of state income tax is withheld from their paychecks, helping them avoid underpayment or overpayment of taxes.

-

How can airSlate SignNow help with the Ohio IT 4 form?

airSlate SignNow simplifies the process of completing and submitting the Ohio IT 4 form by providing an easy-to-use electronic signature solution. With airSlate SignNow, users can fill out the form digitally, sign it, and send it securely, ensuring compliance and efficiency in handling tax documents.

-

Is there a cost associated with using airSlate SignNow for the Ohio IT 4 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost of using airSlate SignNow for the Ohio IT 4 form is competitive and provides excellent value, especially considering the time and resources saved by streamlining document management.

-

What features does airSlate SignNow offer for managing the Ohio IT 4 form?

airSlate SignNow provides features such as customizable templates, secure electronic signatures, and document tracking, all of which enhance the management of the Ohio IT 4 form. These features ensure that users can efficiently create, sign, and store their tax documents in one secure platform.

-

Can I integrate airSlate SignNow with other software for the Ohio IT 4 form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing users to seamlessly manage the Ohio IT 4 form alongside their existing tools. This integration capability enhances workflow efficiency and ensures that all necessary documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the Ohio IT 4 form?

Using airSlate SignNow for the Ohio IT 4 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By digitizing the process, businesses can save time and resources while ensuring compliance with state tax regulations.

-

How secure is airSlate SignNow when handling the Ohio IT 4 form?

airSlate SignNow prioritizes security and employs advanced encryption methods to protect sensitive information, including the Ohio IT 4 form. Users can trust that their data is secure throughout the signing and submission process, ensuring peace of mind.

Get more for Employee's Withholding Exemption CertificateRevised

Find out other Employee's Withholding Exemption CertificateRevised

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word