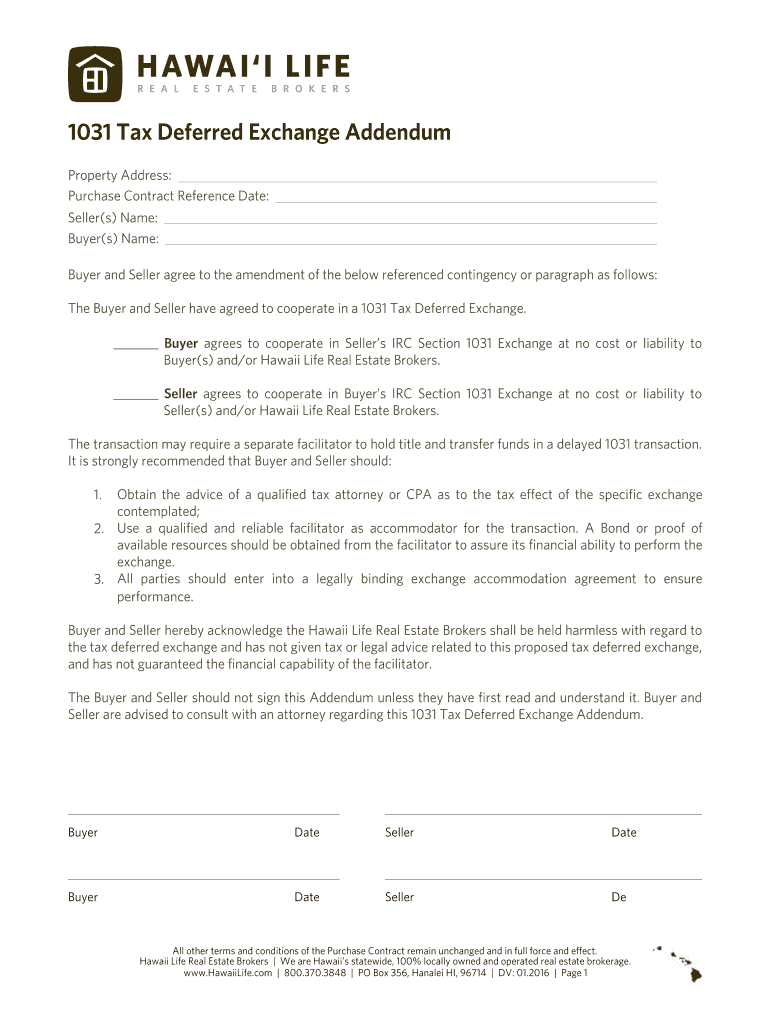

1031 Tax Deferred Exchange Addendum 2016-2026

What is the 1031 Tax Deferred Exchange Addendum

The 1031 Tax Deferred Exchange Addendum is a crucial document in real estate transactions that allows investors to defer capital gains taxes on the sale of a property by reinvesting the proceeds into a similar property. This addendum is part of the Internal Revenue Code Section 1031, which facilitates exchanges of like-kind properties. By utilizing this addendum, investors can enhance their purchasing power and potentially grow their real estate portfolios without immediate tax liabilities.

How to Use the 1031 Tax Deferred Exchange Addendum

Using the 1031 Tax Deferred Exchange Addendum involves several key steps. First, ensure that both the relinquished property and the replacement property qualify as like-kind under IRS guidelines. Next, complete the addendum accurately, detailing the properties involved and the terms of the exchange. It is essential to include all necessary information, such as the identification of the replacement property and timelines for the exchange. Consulting with a qualified intermediary is often recommended to navigate the complexities of the exchange process.

Steps to Complete the 1031 Tax Deferred Exchange Addendum

Completing the 1031 Tax Deferred Exchange Addendum requires careful attention to detail. Follow these steps:

- Identify the relinquished property and the intended replacement property.

- Gather all relevant documentation, including property deeds and valuation reports.

- Fill out the addendum, ensuring all fields are accurate and complete.

- Submit the addendum to your qualified intermediary for review.

- Keep copies of all submitted documents for your records.

Following these steps helps ensure compliance with IRS regulations and smooth processing of the exchange.

Key Elements of the 1031 Tax Deferred Exchange Addendum

Several key elements must be included in the 1031 Tax Deferred Exchange Addendum for it to be valid. These include:

- Identification of the relinquished property and the replacement property.

- Details regarding the parties involved in the exchange.

- Timelines for the identification and acquisition of the replacement property.

- Any contingencies or conditions that must be met for the exchange to proceed.

Incorporating these elements accurately is vital for the successful execution of the exchange and for meeting IRS requirements.

IRS Guidelines

The IRS provides specific guidelines governing the use of the 1031 Tax Deferred Exchange Addendum. These guidelines outline the requirements for qualifying properties, timelines for completing the exchange, and the necessary documentation. It is important to adhere to these guidelines to avoid potential penalties or disqualification of the exchange. Key points include the requirement that both properties must be held for investment or productive use in a trade or business, and the strict timelines for identifying and closing on the replacement property.

Eligibility Criteria

To utilize the 1031 Tax Deferred Exchange Addendum, certain eligibility criteria must be met. The properties involved must be classified as like-kind, meaning they must be of the same nature or character, even if they differ in grade or quality. Additionally, both the relinquished and replacement properties must be held for investment purposes or used in a trade or business. Investors must also adhere to the 45-day identification period and the 180-day closing period to complete the exchange successfully.

Create this form in 5 minutes or less

Find and fill out the correct 1031 tax deferred exchange addendum

Create this form in 5 minutes!

How to create an eSignature for the 1031 tax deferred exchange addendum

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1031 Tax Deferred Exchange Addendum?

A 1031 Tax Deferred Exchange Addendum is a legal document that facilitates the exchange of properties while deferring capital gains taxes. This addendum is essential for investors looking to reinvest in like-kind properties without immediate tax implications. Understanding this addendum can signNowly enhance your investment strategy.

-

How does the 1031 Tax Deferred Exchange Addendum work?

The 1031 Tax Deferred Exchange Addendum allows property owners to defer taxes on the sale of an investment property by reinvesting the proceeds into a similar property. This process must adhere to specific IRS guidelines, ensuring that the transaction qualifies for tax deferral. Utilizing this addendum can lead to substantial tax savings for investors.

-

What are the benefits of using the 1031 Tax Deferred Exchange Addendum?

The primary benefit of the 1031 Tax Deferred Exchange Addendum is the ability to defer capital gains taxes, allowing investors to maximize their investment potential. Additionally, it provides flexibility in property management and investment strategies. By leveraging this addendum, investors can grow their portfolios more effectively.

-

Is there a cost associated with the 1031 Tax Deferred Exchange Addendum?

While the 1031 Tax Deferred Exchange Addendum itself may not have a direct cost, there are associated fees for legal and real estate services. These costs can vary based on the complexity of the exchange and the professionals involved. It's essential to budget for these expenses to ensure a smooth transaction.

-

Can I integrate the 1031 Tax Deferred Exchange Addendum with airSlate SignNow?

Yes, you can easily integrate the 1031 Tax Deferred Exchange Addendum with airSlate SignNow. Our platform allows for seamless eSigning and document management, making it simple to handle all your real estate transactions. This integration enhances efficiency and ensures compliance with legal requirements.

-

What features does airSlate SignNow offer for managing the 1031 Tax Deferred Exchange Addendum?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for the 1031 Tax Deferred Exchange Addendum. These tools streamline the process, ensuring that all parties can easily access and sign documents. Our platform is designed to simplify complex transactions.

-

Who should consider using the 1031 Tax Deferred Exchange Addendum?

Real estate investors, property owners, and anyone looking to defer capital gains taxes should consider using the 1031 Tax Deferred Exchange Addendum. This addendum is particularly beneficial for those involved in investment properties or looking to upgrade their real estate holdings. Understanding its use can lead to signNow financial advantages.

Get more for 1031 Tax Deferred Exchange Addendum

- Wedding decor rental contract template form

- Nyc health daily attendance record form

- Windshield survey template form

- Seminole nation tag agency form

- Jordan visa application form for pakistan pdf

- Mauritius visa application form pdf

- License agreement doc cabq form

- Application request form nevada state board of cosmetology cosmetology nv

Find out other 1031 Tax Deferred Exchange Addendum

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile