1031 Exchange Hawaii 2012

What is the 1031 Exchange Hawaii

The 1031 exchange in Hawaii allows real estate investors to defer capital gains taxes on the sale of an investment property by reinvesting the proceeds into a similar property. This tax strategy is named after Section 1031 of the Internal Revenue Code, which provides the framework for like-kind exchanges. It is crucial for investors to understand that both the relinquished property and the replacement property must be held for investment or productive use in a trade or business. The rules surrounding this exchange can be complex, so familiarity with the specifics is essential for successful tax deferral.

Steps to Complete the 1031 Exchange Hawaii

Completing a 1031 exchange in Hawaii involves several key steps that investors must follow to ensure compliance with IRS regulations. The process typically includes:

- Identify the relinquished property: This is the property you are selling.

- Engage a qualified intermediary: A qualified intermediary is necessary to facilitate the exchange and hold the funds during the transaction.

- Identify replacement properties: You must identify potential replacement properties within 45 days of selling the relinquished property.

- Close on the replacement property: The purchase must be completed within 180 days of the sale of the relinquished property.

Each of these steps requires careful planning and execution to ensure that the exchange qualifies under IRS guidelines.

Legal Use of the 1031 Exchange Hawaii

The legal use of the 1031 exchange in Hawaii is governed by both federal and state laws. Investors must adhere to the stipulations set forth by the IRS, including the requirement that properties involved in the exchange be of "like kind." This means that both properties must be investment properties, and personal residences do not qualify. Additionally, all transactions must be properly documented, and it is advisable to work with legal and tax professionals to navigate the complexities of the law and avoid potential pitfalls.

Required Documents

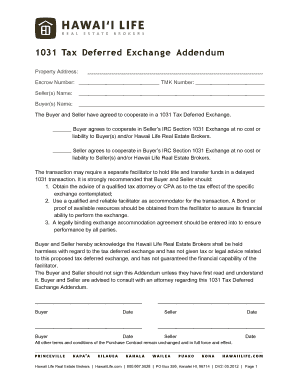

To successfully complete a 1031 exchange in Hawaii, several documents are required. These typically include:

- Purchase and sale agreement: This outlines the terms of the sale of the relinquished property.

- Exchange agreement: A contract with the qualified intermediary detailing the exchange process.

- Identification of replacement properties: Documentation that lists the properties you intend to acquire.

- Closing statements: These provide proof of the sale of the relinquished property and the purchase of the replacement property.

Having these documents prepared and organized can facilitate a smoother transaction process.

IRS Guidelines

The IRS guidelines for a 1031 exchange are critical for ensuring compliance and successful tax deferral. Key points include:

- Both properties must be held for investment or business purposes.

- The exchange must be completed within specific time frames: 45 days to identify replacement properties and 180 days to close on them.

- All proceeds from the sale must be reinvested into the replacement property to avoid tax liability.

Understanding these guidelines helps investors make informed decisions and avoid costly mistakes.

Eligibility Criteria

To qualify for a 1031 exchange in Hawaii, certain eligibility criteria must be met. These include:

- The investor must be a U.S. taxpayer.

- The properties involved must be classified as like-kind.

- Both properties must be used for investment or business purposes.

Meeting these criteria is essential for taking advantage of the tax benefits associated with the 1031 exchange.

Quick guide on how to complete 1031 exchange hawaii

Effortlessly complete 1031 Exchange Hawaii on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage 1031 Exchange Hawaii on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to edit and electronically sign 1031 Exchange Hawaii with ease

- Obtain 1031 Exchange Hawaii and click Get Form to begin.

- Use the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 1031 Exchange Hawaii and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1031 exchange hawaii

Create this form in 5 minutes!

How to create an eSignature for the 1031 exchange hawaii

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1031 exchange in Hawaii?

A 1031 exchange in Hawaii allows investors to defer capital gains taxes by reinvesting the proceeds from the sale of an investment property into a similar property. This tax strategy is particularly beneficial for real estate investors looking to maximize their investment potential while minimizing tax liabilities. Understanding the nuances of a 1031 exchange is crucial when navigating the real estate market in Hawaii.

-

How does airSlate SignNow facilitate the 1031 exchange process in Hawaii?

airSlate SignNow streamlines the 1031 exchange process in Hawaii by providing an easy-to-use platform for electronic signatures and document management. With features like templates and automated workflows, users can efficiently manage necessary paperwork, ensuring compliance and timely submissions. This enhances the overall experience for investors engaging in a 1031 exchange in Hawaii.

-

What are the costs associated with executing a 1031 exchange in Hawaii?

The costs of executing a 1031 exchange in Hawaii can vary depending on multiple factors, including intermediary fees, legal consultation, and documentation expenses. With airSlate SignNow, users can save on documentation costs by utilizing cost-effective eSigning solutions. Effective planning and understanding of these costs can signNowly impact your overall return on investment during a 1031 exchange.

-

What features should I look for in a 1031 exchange service in Hawaii?

When searching for a 1031 exchange service in Hawaii, look for features such as ease of use, compliance with IRS regulations, and document tracking capabilities. airSlate SignNow offers an intuitive platform that meets these needs, ensuring all paperwork is organized and accessible. Choosing a robust service can enhance the efficiency of your 1031 exchange in Hawaii.

-

Can airSlate SignNow integrate with my existing real estate software for 1031 exchanges in Hawaii?

Yes, airSlate SignNow seamlessly integrates with various real estate and financial software, making it easier to manage documents related to your 1031 exchange in Hawaii. This compatibility helps streamline your workflow, ensuring all parties are on the same page without delays. Integrating these tools can signNowly improve your efficiency during the exchange process.

-

What are the benefits of using airSlate SignNow for a 1031 exchange in Hawaii?

The benefits of using airSlate SignNow for a 1031 exchange in Hawaii include reduced paperwork, faster transaction times, and enhanced security for your sensitive documents. This eSigning solution also ensures that all documents are stored securely and can be accessed anytime, which is crucial during the time-sensitive nature of a 1031 exchange. Overall, it simplifies the process and provides peace of mind.

-

How can I ensure compliance during my 1031 exchange in Hawaii?

To ensure compliance during your 1031 exchange in Hawaii, it's essential to work with knowledgeable professionals and use reliable tools like airSlate SignNow. Our platform provides compliance checks and templates designed for 1031 exchanges, helping users adhere to IRS regulations. Staying organized and informed is key to a successful exchange process.

Get more for 1031 Exchange Hawaii

- Royal mail keepsafe application form

- What is the cap for list of allowances in virginia form

- Form pa 1796

- Crossfit monroe ga form

- Mg6 police form

- Department of the army pamphlet 27 50 379 form

- Superior court of washington for state of forms

- Form int 3 savings loan association building loan association tax return

Find out other 1031 Exchange Hawaii

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement

- How To eSignature Massachusetts Quitclaim Deed