Form 1042 S Foreign Person's U S Source Income

What is the Form 1042-S: Foreign Person's U.S. Source Income

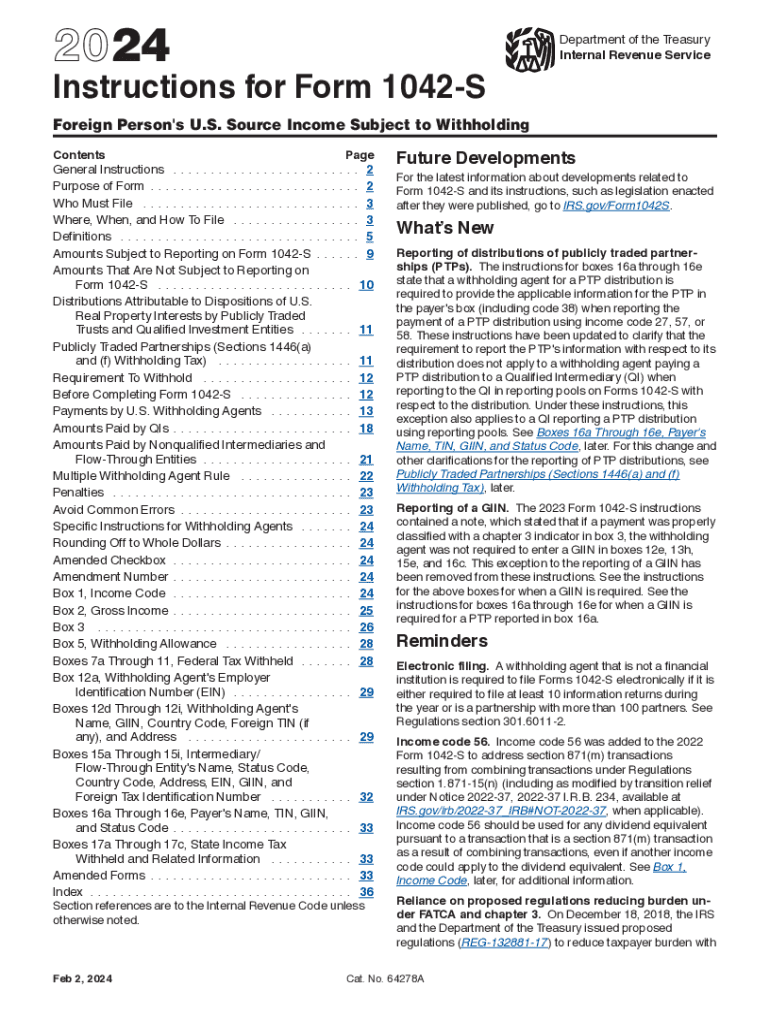

The Form 1042-S is a tax document used to report income paid to foreign persons from U.S. sources. This form is essential for withholding agents to report payments such as interest, dividends, rents, royalties, and certain compensation for services. It ensures compliance with U.S. tax laws regarding non-resident aliens (NRAs) and foreign entities. The form includes details about the income, the recipient, and the amount withheld for tax purposes, making it a crucial part of U.S. tax reporting for foreign income.

Steps to Complete the Form 1042-S

Completing the Form 1042-S involves several steps to ensure accurate reporting. First, gather all necessary information about the foreign recipient, including their name, address, and taxpayer identification number (TIN) if available. Next, identify the type of income being reported and the applicable withholding rate. Fill out the form by entering the income amounts and any taxes withheld. Finally, review the completed form for accuracy before submitting it to the IRS and providing a copy to the recipient. Following these steps helps avoid errors and ensures compliance with IRS regulations.

How to Obtain the Form 1042-S

The Form 1042-S can be obtained directly from the IRS website. It is available for download in PDF format, allowing users to print and fill it out manually. Additionally, many tax software programs include the Form 1042-S as part of their offerings, enabling electronic filing. Users should ensure they are using the most current version of the form to comply with IRS requirements.

IRS Guidelines for Form 1042-S Reporting

The IRS provides specific guidelines for completing and filing the Form 1042-S. These guidelines include instructions on who must file the form, the types of income that must be reported, and the deadlines for submission. It is important for withholding agents to familiarize themselves with these guidelines to avoid penalties for non-compliance. The IRS also outlines the requirements for providing copies of the form to recipients and maintaining records of the information reported.

Filing Deadlines for Form 1042-S

The filing deadlines for the Form 1042-S are critical for compliance. Generally, the form must be filed with the IRS by March 15 of the year following the calendar year in which the income was paid. Additionally, copies of the form must be provided to the recipients by the same date. It is essential to adhere to these deadlines to avoid potential penalties and ensure proper reporting of foreign income.

Penalties for Non-Compliance with Form 1042-S

Failure to comply with the requirements for filing the Form 1042-S can result in significant penalties. The IRS imposes fines for late filings, incorrect information, and failure to provide copies to recipients. These penalties can accumulate quickly, making it essential for withholding agents to understand their obligations and ensure timely and accurate reporting. Being aware of the potential consequences can help motivate compliance and reduce the risk of financial penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1042 s foreign persons u s source income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1042 s form and why is it important?

The 1042 s form is used to report income paid to non-resident aliens and foreign entities. It is crucial for compliance with U.S. tax regulations, ensuring that the correct amount of tax is withheld and reported. Using airSlate SignNow, you can easily eSign and send your 1042 s forms securely and efficiently.

-

How does airSlate SignNow simplify the process of handling 1042 s forms?

airSlate SignNow streamlines the management of 1042 s forms by providing an intuitive platform for eSigning and sending documents. With features like templates and automated workflows, you can reduce the time spent on paperwork and focus on your core business activities. This makes handling 1042 s forms easier and more efficient.

-

What are the pricing options for using airSlate SignNow for 1042 s forms?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose a plan that fits your needs, whether you are sending a few 1042 s forms or managing a high volume of documents. Each plan includes essential features to help you manage your 1042 s forms effectively.

-

Can I integrate airSlate SignNow with other software for managing 1042 s forms?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage 1042 s forms. Whether you use CRM systems, accounting software, or other tools, these integrations help streamline your workflow and ensure that your 1042 s forms are processed efficiently.

-

What security measures does airSlate SignNow have for 1042 s forms?

airSlate SignNow prioritizes the security of your documents, including 1042 s forms. The platform employs advanced encryption and secure access protocols to protect sensitive information. You can confidently eSign and send your 1042 s forms, knowing that your data is safe.

-

Is there a mobile app for managing 1042 s forms with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to manage your 1042 s forms on the go. You can eSign documents, send forms, and track their status from your smartphone or tablet. This flexibility ensures that you can handle your 1042 s forms anytime, anywhere.

-

What are the benefits of using airSlate SignNow for 1042 s forms?

Using airSlate SignNow for your 1042 s forms provides numerous benefits, including time savings, improved accuracy, and enhanced compliance. The platform's user-friendly interface makes it easy to eSign and send documents, while automated features reduce the risk of errors. This ultimately leads to a more efficient process for managing your 1042 s forms.

Get more for Form 1042 S Foreign Person's U S Source Income

Find out other Form 1042 S Foreign Person's U S Source Income

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien