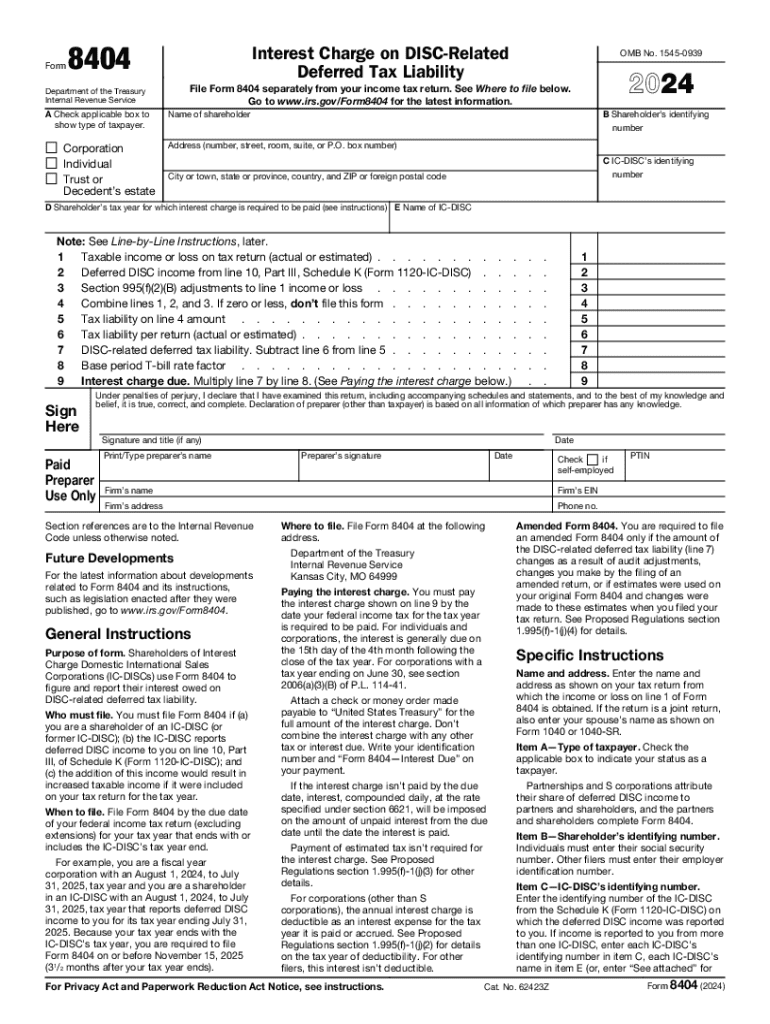

About Form 8404, Interest Charge on DISC Related 2024-2026

IRS Guidelines

The IRS provides comprehensive guidelines for taxpayers to understand their obligations and rights concerning federal income tax. These guidelines include information on how to calculate taxable income, available deductions, and credits. For the 2024 tax year, taxpayers should familiarize themselves with updates in tax laws that may affect their filing. It is crucial to consult the IRS website or official publications for the most accurate and current information.

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines to ensure timely filing and avoid penalties. For the 2024 tax year, the standard deadline for filing individual tax returns is typically April 15. However, if this date falls on a weekend or holiday, the deadline may shift to the next business day. Additionally, extensions can be requested, but it is important to note that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

When preparing to use the 2024 tax calculator, gather all necessary documentation to ensure accurate calculations. Essential documents include W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income. Additionally, receipts for deductible expenses, such as medical costs, mortgage interest, and educational expenses, should be collected. Having these documents ready will streamline the process and improve the accuracy of your tax calculations.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting their tax returns. The most common method is electronic filing (e-filing), which is quick and often results in faster refunds. Alternatively, taxpayers can file by mail, sending their completed forms to the appropriate IRS address based on their location. In-person filing is also an option at designated IRS offices, although this may require an appointment. Each method has its own processing times and requirements, so it is essential to choose the one that best fits your needs.

Penalties for Non-Compliance

Failure to comply with tax obligations can lead to significant penalties. The IRS imposes penalties for late filing, late payment, and underpayment of taxes. For instance, the late filing penalty can be as high as five percent of the unpaid tax for each month the return is late. Understanding these penalties can help taxpayers avoid costly mistakes and encourage timely compliance with tax laws.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios can significantly affect tax calculations and obligations. Self-employed individuals must account for self-employment taxes and may be eligible for various deductions related to business expenses. Retirees may have different income sources, such as pensions or Social Security, which can impact their tax situation. Students often qualify for education-related tax credits. Understanding these scenarios allows taxpayers to use the 2024 tax calculator more effectively and tailor their filings to their specific situations.

Create this form in 5 minutes or less

Find and fill out the correct about form 8404 interest charge on disc related

Create this form in 5 minutes!

How to create an eSignature for the about form 8404 interest charge on disc related

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 tax calculator and how does it work?

The 2024 tax calculator is a tool designed to help individuals and businesses estimate their tax liabilities for the upcoming tax year. By inputting your income, deductions, and credits, the calculator provides an estimate of your tax obligations, making it easier to plan your finances.

-

Is the 2024 tax calculator free to use?

Yes, the 2024 tax calculator is available for free, allowing users to access essential tax estimation tools without any cost. This makes it an ideal solution for those looking to manage their finances effectively without incurring additional expenses.

-

What features does the 2024 tax calculator offer?

The 2024 tax calculator includes features such as income input fields, deduction options, and credit calculations. It also provides a user-friendly interface that simplifies the tax estimation process, ensuring that users can easily navigate and understand their potential tax liabilities.

-

How accurate is the 2024 tax calculator?

The 2024 tax calculator is designed to provide accurate estimates based on the latest tax laws and regulations. While it offers a reliable approximation, users should consult a tax professional for personalized advice and to ensure compliance with all tax obligations.

-

Can I integrate the 2024 tax calculator with other financial tools?

Yes, the 2024 tax calculator can be integrated with various financial tools and software, enhancing its functionality. This allows users to streamline their financial planning and tax preparation processes, making it a versatile addition to your financial toolkit.

-

What are the benefits of using the 2024 tax calculator?

Using the 2024 tax calculator helps users gain a clearer understanding of their tax situation, enabling better financial planning. It saves time and reduces stress by providing quick estimates, allowing users to focus on other important aspects of their financial health.

-

Who can benefit from the 2024 tax calculator?

The 2024 tax calculator is beneficial for individuals, freelancers, and small business owners looking to estimate their tax liabilities. It caters to a wide audience, making it an essential tool for anyone wanting to stay informed about their tax responsibilities.

Get more for About Form 8404, Interest Charge On DISC Related

- 54th street application form

- Growth in a bacterial population worksheet answers form

- Vehicle loaner agreement pdf form

- V55 5 form

- Tell tale heart quiz form

- Hqphlf063 membership status verification slip hqphlf063 membership status verification slip branch branch date filed date filed form

- Geriatric depression scale form

- Standardized traffic control training bccsastandardized traffic control training bccsabccsa traffic control person exambccsa form

Find out other About Form 8404, Interest Charge On DISC Related

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free