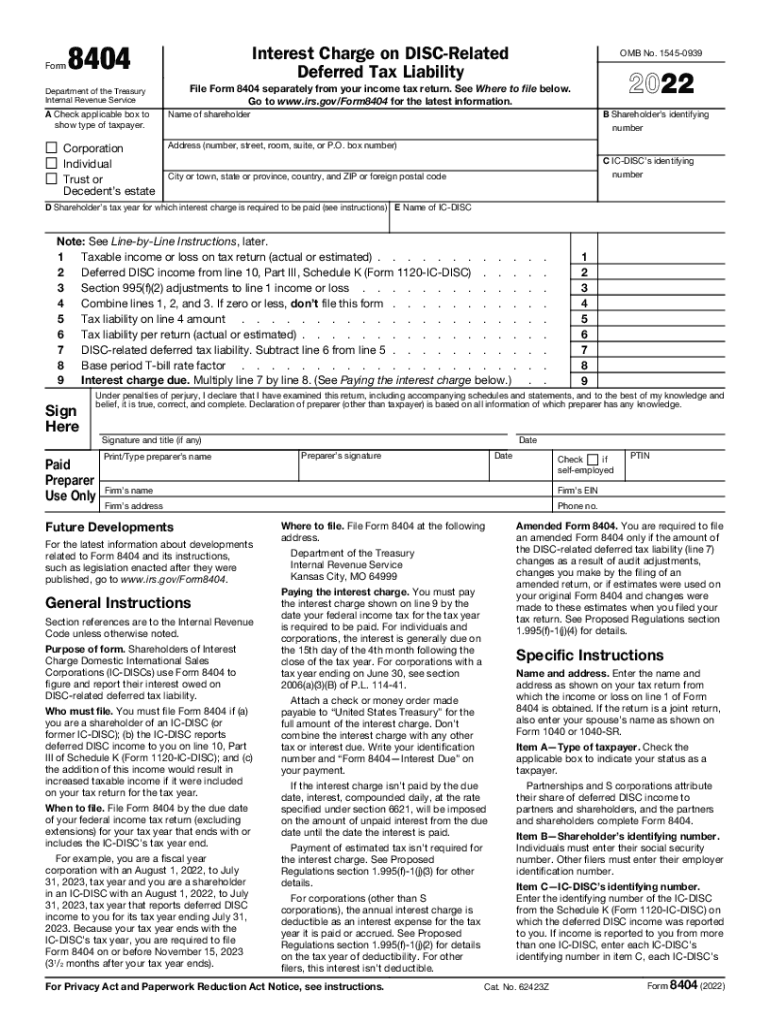

Form 8404 Interest Charge on DISC Related Deferred Tax Liability 2022

Understanding Form 8404 and Its Purpose

The Form 8404 is used to calculate the interest charge on deferred tax liabilities related to a Domestic International Sales Corporation (DISC). This form is crucial for businesses that utilize DISC structures to defer taxes on certain income. Understanding the purpose of Form 8404 helps taxpayers ensure compliance with IRS regulations while managing their tax liabilities effectively.

Steps to Complete Form 8404

Completing Form 8404 requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including income statements and tax returns.

- Calculate the deferred tax liability associated with your DISC.

- Determine the applicable interest rate for the deferred tax liability.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the completed form for any errors before submission.

Filing Deadlines for Form 8404

Timely submission of Form 8404 is essential to avoid penalties. The form must be filed with your tax return for the year in which the deferred tax liability occurred. Be mindful of the IRS deadlines for filing your income tax return to ensure that Form 8404 is submitted on time.

Legal Use of Form 8404

Form 8404 is legally binding when filled out correctly and submitted to the IRS. It is essential to ensure that all information provided is accurate and complete, as inaccuracies can lead to penalties or audits. Understanding the legal implications of submitting this form helps businesses maintain compliance with tax laws.

IRS Guidelines for Form 8404

The IRS provides specific guidelines for completing and submitting Form 8404. These guidelines include instructions on calculating deferred tax liabilities, determining interest rates, and filing procedures. Familiarizing yourself with these guidelines can help ensure that your form is completed correctly and submitted in compliance with IRS requirements.

Penalties for Non-Compliance with Form 8404

Failing to file Form 8404 or submitting incorrect information can result in significant penalties. The IRS may impose fines for late submissions or inaccuracies, which can increase your overall tax liability. Understanding these penalties emphasizes the importance of accurate and timely filing.

Quick guide on how to complete 2022 form 8404 interest charge on disc related deferred tax liability

Complete Form 8404 Interest Charge On DISC Related Deferred Tax Liability effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form 8404 Interest Charge On DISC Related Deferred Tax Liability on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign Form 8404 Interest Charge On DISC Related Deferred Tax Liability with ease

- Find Form 8404 Interest Charge On DISC Related Deferred Tax Liability and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Underline pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or inaccuracies that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Alter and eSign Form 8404 Interest Charge On DISC Related Deferred Tax Liability and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 8404 interest charge on disc related deferred tax liability

Create this form in 5 minutes!

People also ask

-

What is an income tax estimator and how does it work?

An income tax estimator is a tool designed to help you calculate your expected tax liability for the year. By inputting your income, deductions, and credits, the income tax estimator provides an estimate of what you might owe or receive as a refund, making tax planning much easier.

-

How can I use the income tax estimator effectively?

To use the income tax estimator effectively, gather your financial documents, including W-2s and 1099s. Input your income, deductions, and other relevant information accurately to get a reliable estimate of your income tax obligations. This can help you make informed decisions about withholding and potential savings.

-

Is the income tax estimator free to use?

Yes, our income tax estimator is available free of charge. You can access it online without any subscription or payment, allowing you to assess your tax responsibilities conveniently and easily.

-

Can I rely on the income tax estimator for my business taxes?

While the income tax estimator is primarily tailored for personal income taxes, it can also provide a general estimate for small business taxes. However, for a comprehensive evaluation, it’s recommended to consult with a tax professional who can consider your business specifics.

-

What features does the income tax estimator offer?

Our income tax estimator offers user-friendly input forms, real-time calculations, and customizable fields for different income sources and deductions. It simplifies the process of estimating your taxes, allowing you to focus on planning rather than worrying over calculations.

-

Does the income tax estimator integrate with other tools?

Yes, the income tax estimator can be integrated with popular accounting and tax software tools for a seamless experience. This allows for better data management and more accurate estimates based on your actual financial records.

-

What benefits does using an income tax estimator provide?

Using an income tax estimator helps you forecast your tax liabilities, manage your finances better, and avoid surprises during tax season. It empowers you with valuable insights into possible deductions and credits, ultimately helping you to maximize your refund or minimize your tax bill.

Get more for Form 8404 Interest Charge On DISC Related Deferred Tax Liability

- Security contractor package nevada form

- Insulation contractor package nevada form

- Paving contractor package nevada form

- Site work contractor package nevada form

- Siding contractor package nevada form

- Refrigeration contractor package nevada form

- Drainage contractor package nevada form

- Tax free exchange package nevada form

Find out other Form 8404 Interest Charge On DISC Related Deferred Tax Liability

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed