Form 8404 Interest Charge on DISC Related Deferred Tax Liability 2012

What is the Form 8404 Interest Charge On DISC Related Deferred Tax Liability

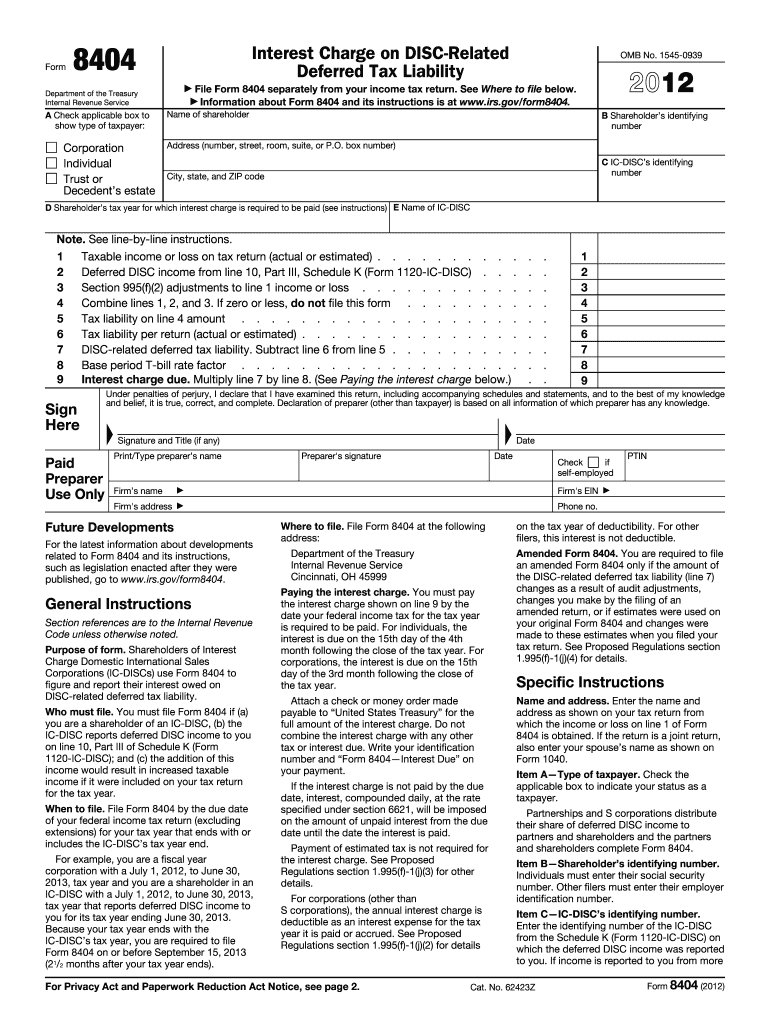

The Form 8404 is utilized to report the interest charge on deferred tax liabilities related to a Domestic International Sales Corporation (DISC). This form is significant for businesses that have elected to be treated as a DISC for tax purposes. It helps in calculating the interest that accrues on deferred tax liabilities, which can arise from the timing differences between financial reporting and tax reporting. Understanding this form is essential for ensuring compliance with IRS regulations and accurately reflecting tax obligations.

How to use the Form 8404 Interest Charge On DISC Related Deferred Tax Liability

Using Form 8404 involves several key steps. First, businesses must determine their DISC status and the applicable deferred tax liabilities. The form requires detailed calculations of interest charges based on the tax deferral period. Accurate completion is crucial, as errors can lead to penalties or incorrect tax filings. Once completed, the form should be submitted along with the business's tax return to the IRS, ensuring that all relevant schedules and documentation are included to support the reported figures.

Steps to complete the Form 8404 Interest Charge On DISC Related Deferred Tax Liability

Completing Form 8404 involves a systematic approach:

- Gather necessary financial records and tax documents related to DISC activities.

- Calculate deferred tax liabilities based on the differences between book income and taxable income.

- Determine the interest charge using the prescribed IRS rates for the relevant tax year.

- Fill out the form accurately, ensuring all calculations are double-checked for accuracy.

- Attach the completed form to your tax return and retain copies for your records.

Legal use of the Form 8404 Interest Charge On DISC Related Deferred Tax Liability

The legal use of Form 8404 is governed by IRS regulations concerning DISC entities. It is essential for businesses to adhere to these regulations to maintain compliance and avoid penalties. The form serves as a formal declaration of the interest charge on deferred tax liabilities, and its accuracy is critical for legal and financial accountability. Businesses should ensure that they understand the implications of the form and seek professional advice if needed to navigate complex tax laws.

Filing Deadlines / Important Dates

Filing deadlines for Form 8404 coincide with the business's tax return due dates. Typically, corporations must file their tax returns by the fifteenth day of the fourth month following the end of their tax year. For most businesses operating on a calendar year, this means the deadline is April 15. It is important to mark these dates on your calendar to ensure timely filing and avoid late penalties.

Examples of using the Form 8404 Interest Charge On DISC Related Deferred Tax Liability

Examples of using Form 8404 include scenarios where a business has significant deferred tax liabilities due to timing differences in revenue recognition. For instance, a company that exports goods through its DISC may defer taxes on income until the goods are sold. In such cases, the interest charge calculated on the deferred tax liability must be reported using Form 8404. Accurate reporting ensures that the business meets its tax obligations while taking advantage of the benefits associated with DISC status.

Quick guide on how to complete 2012 form 8404 interest charge on disc related deferred tax liability

Complete Form 8404 Interest Charge On DISC Related Deferred Tax Liability effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent sustainable substitute for traditional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow supplies all the resources you require to create, adjust, and electronically sign your documents swiftly without delays. Handle Form 8404 Interest Charge On DISC Related Deferred Tax Liability on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest method to alter and electronically sign Form 8404 Interest Charge On DISC Related Deferred Tax Liability without difficulty

- Obtain Form 8404 Interest Charge On DISC Related Deferred Tax Liability and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or redact sensitive information with tools specifically available from airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form: via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, burdensome form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your documentation management needs in just a few clicks from any device of your preference. Adjust and electronically sign Form 8404 Interest Charge On DISC Related Deferred Tax Liability to ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 8404 interest charge on disc related deferred tax liability

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 8404 interest charge on disc related deferred tax liability

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What is Form 8404 Interest Charge On DISC Related Deferred Tax Liability?

Form 8404 is used by corporations to calculate the interest charge on deferred tax liabilities related to the Domestic International Sales Corporation (DISC). This form is vital for businesses who want to ensure compliance with IRS regulations regarding these liabilities. Understanding how this form functions can help businesses manage their tax obligations effectively.

-

How can airSlate SignNow help with Form 8404?

airSlate SignNow offers a streamlined way to send, eSign, and manage necessary documents, including Form 8404 Interest Charge On DISC Related Deferred Tax Liability. Our platform simplifies the signing process, ensuring you can focus on your business while we handle the paperwork. With airSlate, you get reliable document management tailored for compliance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. We provide options that give you access to all features, including eSigning documents like the Form 8404 Interest Charge On DISC Related Deferred Tax Liability, for a reasonable monthly fee. Feel free to check our website for detailed pricing information.

-

What features does airSlate SignNow offer?

Our platform includes features such as secure eSigning, document tracking, and automated workflows to enhance efficiency. With airSlate SignNow, you can easily create and manage forms like the Form 8404 Interest Charge On DISC Related Deferred Tax Liability, making your operations smoother. Plus, we ensure data security and compliance at every step.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority at airSlate SignNow. We use encryption technology and compliant data storage to protect documents and sensitive information. When dealing with important forms like Form 8404 Interest Charge On DISC Related Deferred Tax Liability, you can have peace of mind knowing your data is secured.

-

Can I integrate airSlate SignNow with other tools?

Yes, airSlate SignNow offers various integrations with popular business tools, enhancing workflow efficiency. This means you can easily incorporate eSigning and document management for forms, such as Form 8404 Interest Charge On DISC Related Deferred Tax Liability, into your existing processes. Check out our integration page for a full list.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow enables your team to save time and reduce costs associated with traditional paperwork. Our platform simplifies the process of signing important documents, such as Form 8404 Interest Charge On DISC Related Deferred Tax Liability, making it quick and user-friendly. Additionally, you can track document flow in real-time.

Get more for Form 8404 Interest Charge On DISC Related Deferred Tax Liability

- General durable power of attorney for property and finances or financial effective upon disability iowa form

- Essential legal life documents for baby boomers iowa form

- General durable power of attorney for property and finances or financial effective immediately iowa form

- Revocation of general durable power of attorney iowa form

- Essential legal life documents for newlyweds iowa form

- Iowa legal documents form

- Essential legal life documents for new parents iowa form

- Iowa power attorney 497305184 form

Find out other Form 8404 Interest Charge On DISC Related Deferred Tax Liability

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online