Form 8404 Interest Charge on DISC Related Deferred Tax Liability 2020

What is the Form 8404 Interest Charge On DISC Related Deferred Tax Liability

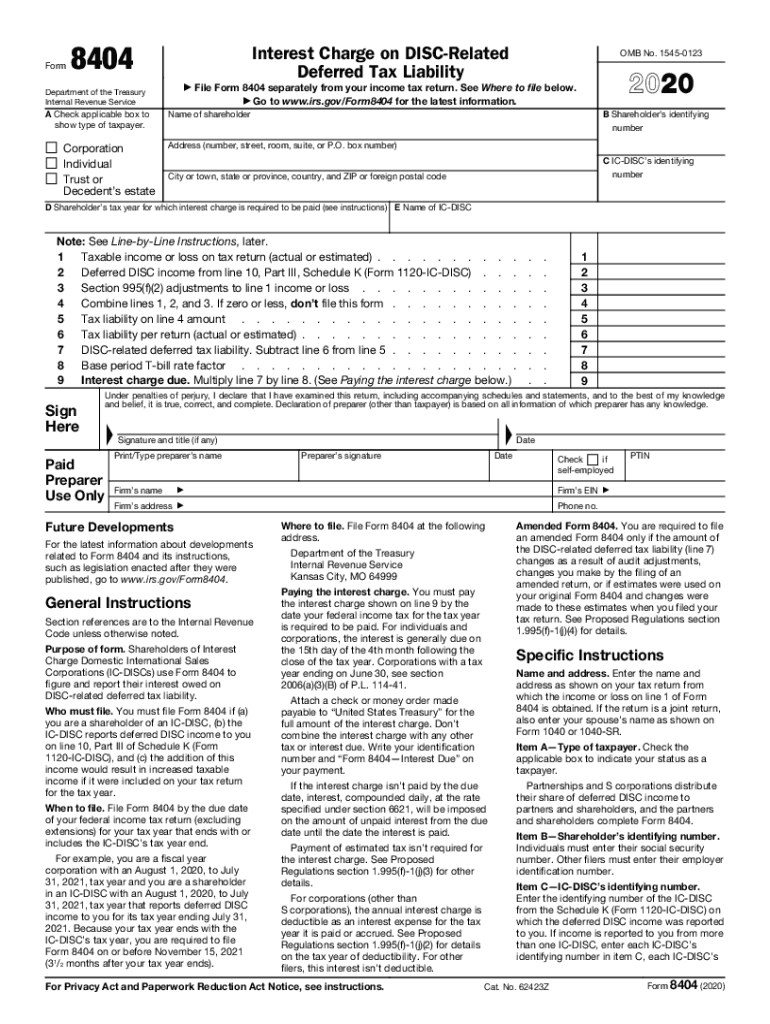

The Form 8404 is used to calculate the interest charge on deferred tax liabilities related to a Domestic International Sales Corporation (DISC). This form is essential for taxpayers who have elected to treat certain income as deferred, allowing them to postpone tax payments on that income until it is distributed. The interest charge is calculated based on the deferred tax liability and is designed to ensure that taxpayers pay a fair amount of interest on the tax that has been deferred. Understanding this form is crucial for compliance with IRS regulations and for accurate tax reporting.

How to use the Form 8404 Interest Charge On DISC Related Deferred Tax Liability

Using the Form 8404 involves several steps to ensure accurate calculations of the interest charge. First, gather all relevant financial information regarding the DISC and the deferred tax liabilities. Next, complete the form by entering the necessary data, including the amount of deferred tax and the applicable interest rates. It is important to follow the IRS guidelines closely to avoid errors. Once the form is completed, it should be attached to your tax return for the applicable year. Keeping a copy for your records is also recommended for future reference.

Steps to complete the Form 8404 Interest Charge On DISC Related Deferred Tax Liability

Completing the Form 8404 requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of Form 8404 from the IRS website or your tax professional.

- Fill in your identifying information, including your name, address, and taxpayer identification number.

- Calculate the total deferred tax liability that applies to the DISC.

- Determine the interest rate applicable for the period of deferral.

- Complete the calculations as outlined in the form's instructions, ensuring accuracy in each step.

- Review the completed form for any errors before submission.

Legal use of the Form 8404 Interest Charge On DISC Related Deferred Tax Liability

The legal use of Form 8404 is governed by IRS regulations, which stipulate that taxpayers must accurately report deferred tax liabilities associated with a DISC. Proper completion of this form ensures compliance with tax laws and avoids potential penalties. It is important to understand that failing to file this form or providing incorrect information can lead to legal repercussions, including fines or audits. Therefore, using the form correctly is not only a matter of compliance but also of maintaining good standing with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for Form 8404 typically align with the annual tax return deadlines. For most taxpayers, this means the form should be filed by April fifteenth of the following year. If you are unable to meet this deadline, you may apply for an extension, but it is crucial to ensure that Form 8404 is submitted on time to avoid any penalties. Keeping track of these important dates is essential for proper tax planning and compliance.

Penalties for Non-Compliance

Failure to file Form 8404 or inaccuracies in the information provided can result in significant penalties. The IRS may impose fines based on the amount of tax that was deferred and the duration of non-compliance. Additionally, interest may accrue on any unpaid taxes, further increasing the financial burden. It is advisable to consult with a tax professional to ensure that all forms are completed correctly and submitted on time to mitigate the risk of penalties.

Quick guide on how to complete 2020 form 8404 interest charge on disc related deferred tax liability

Effortlessly Prepare Form 8404 Interest Charge On DISC Related Deferred Tax Liability on Any Device

The management of online documents has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without disruptions. Manage Form 8404 Interest Charge On DISC Related Deferred Tax Liability on any device with the airSlate SignNow apps for Android or iOS and enhance any document-focused task today.

Your Key to Easily Edit and eSign Form 8404 Interest Charge On DISC Related Deferred Tax Liability

- Find Form 8404 Interest Charge On DISC Related Deferred Tax Liability and click on Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or conceal sensitive information using the specialized tools provided by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to submit your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that require new copies to be printed. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form 8404 Interest Charge On DISC Related Deferred Tax Liability to ensure clear communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 8404 interest charge on disc related deferred tax liability

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 8404 interest charge on disc related deferred tax liability

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What features does airSlate SignNow offer for the 8404 2016 document signing process?

airSlate SignNow provides comprehensive features for the 8404 2016 document signing process, including customizable templates, real-time tracking, and secure cloud storage. These tools help streamline the signature workflow, ensuring documents are signed quickly and efficiently. Additionally, users can integrate with popular applications to enhance their experience.

-

How does airSlate SignNow pricing work for the 8404 2016 solution?

The pricing for airSlate SignNow's 8404 2016 solution is flexible and designed to accommodate businesses of all sizes. Subscriptions can be tailored based on the number of users and required features, providing excellent value for those needing document signing capabilities. You can start with a free trial to see if it suits your needs before committing.

-

What are the benefits of using airSlate SignNow for my 8404 2016 documentation?

Using airSlate SignNow for your 8404 2016 documentation offers numerous benefits, including reduced turnaround time and improved accuracy in document processing. The platform enhances efficiency by reducing the need for paper and manual signatures, ultimately saving time and costs. Additionally, it helps maintain compliance and security with encrypted signatures.

-

Can I integrate airSlate SignNow with other software while working with the 8404 2016 form?

Yes, airSlate SignNow seamlessly integrates with various software solutions, enhancing the functionality of the 8404 2016 form. You can connect it with CRM systems, cloud storage services, and productivity tools to create a unified workflow. This integration capability makes it easier to manage documents and streamline your business processes.

-

Is airSlate SignNow suitable for small businesses handling the 8404 2016 forms?

Absolutely! airSlate SignNow is tailored for small businesses that need efficient document management for 8404 2016 forms. Its user-friendly interface and cost-effective pricing make it accessible for businesses operating on a budget while still providing professional-grade features. Small teams benefit from improved collaboration and faster turnaround times on documents.

-

How secure is airSlate SignNow for signing 8404 2016 documents?

Security is a top priority at airSlate SignNow, especially for sensitive 8404 2016 documents. The platform uses advanced encryption protocols and complies with industry standards to protect your data. Additionally, features like audit trails provide transparency and tracking of document access, ensuring integrity throughout the signing process.

-

What support does airSlate SignNow offer for 8404 2016 users?

airSlate SignNow offers diverse support options for 8404 2016 users, including a dedicated help center, live chat, and email support. Their knowledgeable support team is available to assist with any questions or troubleshooting needs. Additionally, users can access a library of resources, including tutorials and best practice guides.

Get more for Form 8404 Interest Charge On DISC Related Deferred Tax Liability

- Wv separation agreement form

- Commercial sublease west virginia form

- West virginia separation form

- Residential lease renewal agreement west virginia form

- West virginia notice 497431763 form

- Assignment of lease and rent from borrower to lender west virginia form

- Assignment of lease from lessor with notice of assignment west virginia form

- Wv tenant form

Find out other Form 8404 Interest Charge On DISC Related Deferred Tax Liability

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement